Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Priceline presented numbers for their fourth quarter and full year to end December, close of business Monday. For the full year, the group had gross travel bookings (total dollar value, generally inclusive of all taxes and fees, of all travel services purchased by its customers, net of cancellations) of 68.1 billion Dollars, 23.1 percent better than the prior year. Gross profit was 10.3 billion Dollars, 20 percent better than the year prior. Non-GAAP income grew 23 percent to 3.3 billion Dollars, per diluted share, non-GAAP net income was 65.63 Dollars. Yes, per share, there are only 49 million odd shares (13 million too in treasury, what!!) in issue.

Net income per diluted share was 14 percent lower to 42.65 Dollars. Reason being that Priceline took a non-cash charge in the 3rd quarter related to OpenTable, a business they bought for 2.6 billion Dollars in 2014. 941 million Dollars, gulp. Shouldn't have paid that premium!

The stock price is around 1700 Dollars a share. Not surprisingly, the stock is up nearly 3000 percent in ten years. What? Yes, the company now has a market capitalisation in excess of 80 billion Dollars. It may well be the biggest holding company that you have never heard of. In fact, the market cap is bigger than Naspers, quite a lot bigger in fact. The company has delivered compounded gross profit growth rates over the last five years of 35 percent. Incredible.

In case you were wondering who and what this massive business is, you know their Booking.com platform (Michael said he wasn't too familiar with it until he bought the share, I almost fell off my chair), they have multiple others, priceline.com, KAYAK, agoda.com, Rentalcars.com and OpenTable. You may have used some, I have. I couldn't find a rental once, I used priceline.com directly, it worked perfectly. Except I forgot my drivers licence at home, that is another story! This business is very valuable for all the stakeholders in the tourism industry, they have the ability to connect the dots better than ever. Ever old traditional insiders (travel agents) have their own platforms, enabling them to have a wider scope than before.

As per the annual report: "As of December 31, 2016, Booking.com offered accommodation reservation services for over 1,115,000 properties in over 220 countries and territories on its various websites and in over 40 languages, which includes over 568,000 vacation rental properties ... Vacation rentals generally consist of, among others, properties categorized as single-unit and multi-unit villas, apartments, "aparthotels" (which are apartments with a front desk and cleaning service) and chalets which are generally self-catered (i.e., include a kitchen), directly bookable properties."

In other words, people would be willing to advertise on both AirBNB and Booking.com, as far as I understand it, there is no exclusivity. Interestingly, the company lists their competitors as Google, Apple, Alibaba, Tencent, Amazon and Facebook, and then a whole lot more, from TripAdvisor to Marriott International, Hilton and Hyatt Hotels. They also list Lyft, Uber and Didi Chuxing, in the cars space. So there is a lot of seasonality to their business, and there are multiple competitors too. They do own some great brands and try and keep at the forefront of technological advances in travel.

There is another sentence that makes you wonder if humanity is ever going to advance, these are broad based risks that could impact on any business: "In addition, other unforeseen events beyond our control, such as worldwide recession, oil prices, terrorist attacks, unusual or extreme weather or natural disasters such as earthquakes, hurricanes, tsunamis, floods, droughts and volcanic eruptions, travel-related health concerns including pandemics and epidemics such as Ebola, Zika, Influenza H1N1, avian bird flu, SARS and MERS, political instability, regional hostilities, imposition of taxes or surcharges by regulatory authorities, changes in trade or immigration policies or travel-related accidents, can disrupt travel or otherwise result in declines in travel demand."

Wow. Reach for the pills.

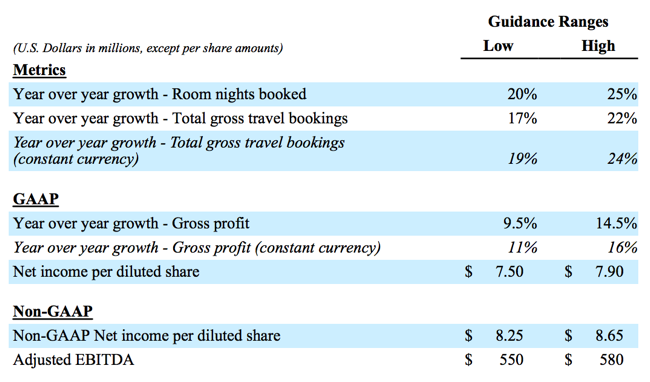

The company stuck out a guidance that seems to have been below the market expectations, remembering that this is the 1st quarter. In other words, not the holiday season, that comes in the second half of the year, July through to December:

The stock rallied hard, up over five percent to another all time high of 1725 Dollars a share. The stock trades on 40 times earnings, it is hardly cheap. What the company has going for them is the shift to experiences over things. i.e. People want to spend their money to see the Taj Mahal, the Eiffel Tower, the Statue of Liberty and all of the other amazing places around the world, over "things". Although, I get that they must still have the latest technology in order to take the pics and selfies. There is plenty of growth left here in order to justify even accumulating the stock at these levels, remembering that they may display volatile price action on such a high rating (November 2015 Paris attacks, the stock got hammered).

Notwithstanding what are always headwinds that humanity faces (mostly made by themselves), there are more people with more resources that want to see the rest of the world, experience different cultures and eat different authentic food. I suspect that we may only be scratching the surface globally with this travel trend. We stay the course here.