Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

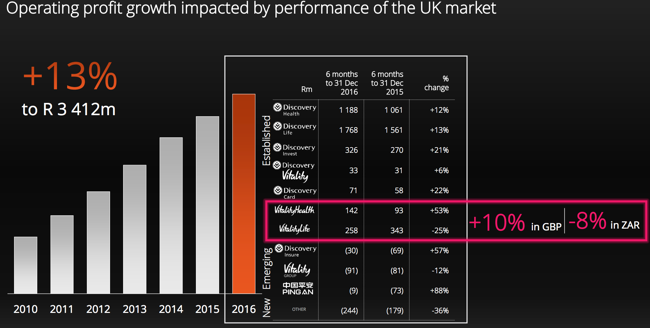

Discovery released interim results for the half year to end December yesterday morning. This is a great business. A business that was conceptualised by an incredible individual who has seen in large part his vision realised. Adrian Gore is not finished. He seems passionate about the business, he walks the walk and he talks the talk. And talk he can. At the results presentation he made it known that Brexit, the weaker Pound to the Rand and the weakness in the investments (statutory capital) in the UK (yields in Gilts powering to an all-time low) has had a negative impact on the UK operations.

The company cannot be responsible in any way for the actions of the UK citizens, and equally how the market responds to that, it is in the grouping of those factors beyond their control. Brexit weighed, when it all eventually settles (it may take a couple of years), it will be easier to have a comparable numbers. Until then, the cost of doing business in the UK, from a mindset point of view too, is going to be exceptionally hard to quantify. As Adrian Gore rightfully pointed out, they (Discovery) will focus on their business. For the record, see the slide below, the UK business "did" 10 percent better in Pound Sterling, negative 8 percent in Rand terms:

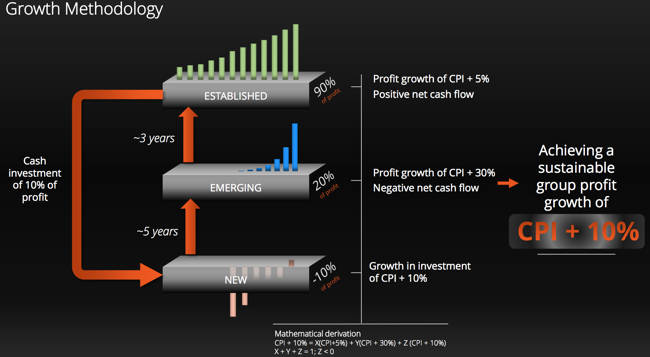

For the very first time that I can remember, the company in a slide in their presentation explained the business "trajectory" and route they follow. In other words, what their internal expectations are with the businesses that they start from scratch. For all intents and purposes, Discovery are a disruptor of the status quo, they take an industry that they think needs a shake up and change, they push it in the right direction adding technological innovations and leveraging off the human desire to be better. That is why New Year is such a big thing, people want to always "be better" than last year.

So here is a slide to explain that when the company starts motor vehicle insurance to take on their competitors in the market, what their time horizon is for that business to move into the category of developing and developed business. The three terms you have to remember are, new, emerging and then established.

To cut to the chase, the business for the time being is a Health and Life insurance business, with smaller contributions from the invest business. There are lots of opportunities that are likely to emerge in the coming years, most especially with regards to PingAn, Vitality (white labelling) and of course Discovery Insure. There are over 160 thousand insured vehicles out there, I can count myself one of those. I hate being told that I am about average relative to the other drivers on the road, I guess I am being compared to the average Discovery Insure driver. I suspect that within a year or two, the Discovery Insure business will be profitable, as will the Vitality business.

There is something more than the cute rewards program for you the shareholder, and indeed being part of the scheme as a member, alongside incrementally more healthy people. The more healthy the scheme members, the more profitable the scheme, the greater the buffer, the more likely for the scheme to do good by their members. i.e. All members benefit. What is quite interesting is that the lapse rate is greater if your "status" is lower. i.e. blue or bronze, then you are more likely to think that the expense is not for you. None of Discovery products are cheap, that is for sure.

The stock is not cheap either. It is not expensive either. At 16 times forward, with the growth in their business, through the technology innovations (the most technology savvy insurance business in the world), there is more growth to come. We are pleased with the initial market reaction, we are pleased with the outlook, notwithstanding some problem areas. We continue to accumulate the company.