"Consumers lied about their income to get a loan from a loan officer who didn't do their homework. Banks on sold the mortgages to have them packaged by other financial institutions who then got the collective mortgages rubber stamped with a great credit rating. Global investors were then sold these instruments, themselves not doing enough homework, they believed everyone along the way. So who is to blame?"

To market to market to buy a fat pig Not a particularly good day for markets, not here, not there, not anywhere it must be said. That is to borrow a line from green eggs and ham, be sure to give everything a try, as long as it is in reason, is the moral of that Dr. Seuss story. Or, he just had to use only a limited bunch of words, and green was the only color he had. There certainly was less of that on the screen locally in Jozi yesterday, the heat in the air continues (countrywide really), the heat in the stock market wasn't there.

Gold mining stocks were the only companies that caught a bid, up one and two-thirds of a percent on the day, Sibanye bouncing off the lows (which were 12 month lows) for the session, ending the day up. Outside of that, I am afraid not much to cheer about for the bulls. Some broad based selling of SA inc. stocks, from Tiger to Remgro, Nedbank to Shoprite, I suppose someone is taking a big view in a low volume market. Amplats and Richemont were the only two noticeable standouts in the majors, lower down I noticed that Oceana had a cracking day, up over three and a half percent. The currency was marginally weaker against the majors.

You remember what a Mortgage backed security is, right? It is a packaged bunch of mortgages that basically act as an instrument that pays out regular cashflows, as people always pay back their mortgages. Or so that is the theory. You remember when it was rated Triple A, right? It was not only safe as houses, it was as safe as US Treasuries, they carried the same rating. WRONG. Last evening Barclays was fined for "stuff" that they did around a decade ago, the US justice department suggested that the bank misled investors. They sold them quality Mortgages Backed Securities. Meanwhile, the underlying loans were hanging by a thread.

I kid you not, someone called them

craptacular, see the Bloomberg story -

Barclays to Face Off Against U.S. Over 'Craptacular' Loans. Rated Triple A (only the agencies know), more than half of the underlying loans defaulted. It smells distinctly like Barclays, who are of course having to defend their turf, have a giant stinking craptacular problem. See -

United States Sues Barclays Bank to Recover Civil Penalties for Fraud in the Sale of Residential Mortgage-Backed Securities.

There are a number of "problems" in this press release quote:

"Millions of homeowners were left with homes they could not afford, leaving entire neighborhoods devastated. The government's complaint alleges that Barclays fraudulently sold investors RMBS full of mortgages it knew were likely to fail, all while telling investors that the mortgages backing the securities were sound."

Consumers lied about their income to get a loan from a loan officer who didn't do their homework. Banks on sold the mortgages to have them packaged by other financial institutions who then got the collective mortgages rubber stamped with a great credit rating. Global investors were then sold these instruments, themselves not doing enough homework, they believed everyone along the way. So who is to blame?

Everyone, good at greed, not so good at foresight.

Big banks still trade at a discount, still attract must distrust from governments, investors and broader society, yet fill the most basic of needs for consumers, credit. We are still inclined to avoid at most levels.

Meanwhile (back at the pasta ranch) -

Italy Sets Up Fund to Help Troubled Banks. Hmmmmm.... And then on the strudel and sauerkraut (and sausage) ranch -

Deutsche Bank Reaches $7.2 Billion Settlement Over Toxic Securities. Which is a big number, right? Well, perhaps less than they thought initially.

Oh well, better luck next time. Stocks in New York fell again, albeit very marginally. The broader market S&P 500 sank around one-fifth of a percent, the Dow Jones Industrial Average lost a mere 23 points, we now are 91 points away from that magical 20 thousand mark. I am not normally one for levels, perhaps being Christmas this feels like a present of sorts. The nerds of NASDAQ closed the day off 0.44 percent, consumer discretionary stocks down a lot on the day after a "lot going on" for this time of the year.

The usual monthly reads of durable goods orders, which fell less than expected (good) was overlaid with weekly initial claims that climbed more than expected (bad), and all mixed together with a GDP read that was better than anticipated. It was personal income and spending that led consumer discretionary stocks lower, sigh, the chugging and motoring along, whizzing by data and then changing direction. Sometimes I think that those people who have those types of jobs must get very frustrated. And what really gets me, about all of this, is that revisions can drastically change what you thought initially about something.

Linkfest, lap it up

Whoa! Quartz has an interesting article titled:

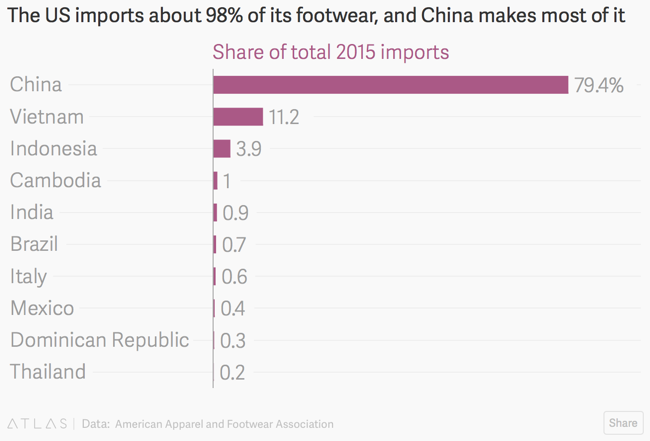

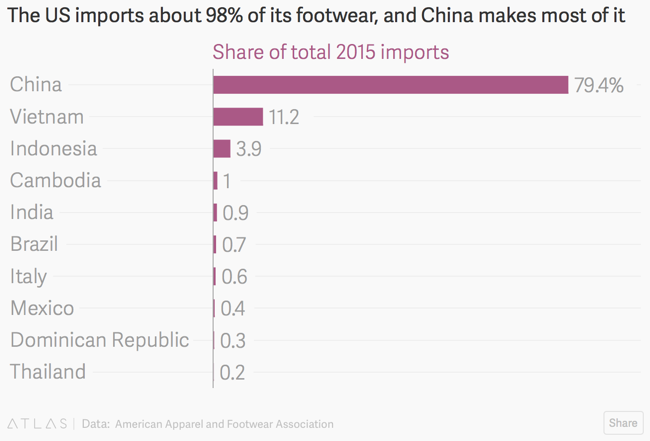

Your sneakers are a case study in why Trump's America-first trade policy is nonsense. Why? On the retail price for each pair of sneakers imported into the US, 20 Dollars is roughly duties. Yet .... 98.4 percent of all production of shoes takes place outside of the US, mostly China.

How do you say "protectionism doesn't work and consumers know best" in multiple languages?

I know you are going to have fun with this one -

These 3 Animated Maps Show the World's Largest Cities Throughout History. There are periods through history in which wars and dread diseases wiped out large urban populations. The Visual Capitalist article throws back to another one of my favorites, for investing perspective over which consumer in the future will power the flows -

The Majority of the World's Population Lives in This Circle

Startups. Think big?

Startups. Think big? This fellow has some useful perspective, including scaling slower and monetizing earlier. Automate and outsource. Useful for any young (or older) person looking to start a business -

Five things I will do different for my next startup.

Can computers learn how you think? Of course they can, they are already. I have in the WSJ article however no idea what to make of this -

The World's Largest Hedge Fund Is Building an Algorithmic Model From its Employees' Brains

Home again, home again, jiggety-jog. Stocks across Asia are mostly lower, Japanese stocks are off just a little. There it is people, one week of the year left here. 2016 was a pretty wild one, many unexpected bit and pieces. 20 thousand on the Dow, one more?

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.