Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Stryker reported results for their third quarter last Thursday, after the market closed. This is the kind of business that has changed significantly, keeping relevant and up to date as medical science has evolved. Knee and hip operations are more prevalent than any other time in history. More and more each and every day! Complicated stuff for us mere mortals. When you think of the business, think of a company that has three divisions, Medical and Surgical (MedSurg), which includes all the power tools, the hospital beds, the ambulance cot (beds) to more hardcore software for complicated procedures. There is also a wide array of surgical equipment, cement mixers, waste management (blood and the like), as well as even cleaners and detergents.

Then there is the more complicated hips, knees, soft tissue and computer assisted repair (amongst others) business, the orthopedics business. This division includes newer technologies like the Mako Robotic-Arm assisted surgery device. The whole aim is to make sure that the quality is maintained, each and every operation looks like the last one. See? Knee replacements are like big Macs. Only kidding, obviously you want and need the consistency time and time again, maintain quality. The last knee implant must look like the next. Eliminating human error. The question is, with the technology available to us, with regards to the precision afforded to us by fine tuned machines, are they (the machines) as good as the surgeon? Time will tell.

Lastly, there is the Neurotechnology and Spine division. This is the division that I find incredible, cutting edge and incredibly futuristic. This stuff blows my mind - > Interbody/Vertebral Body Replacement. I am speechless that parts in humans can be 3D printed (Cranial replacement) to last.

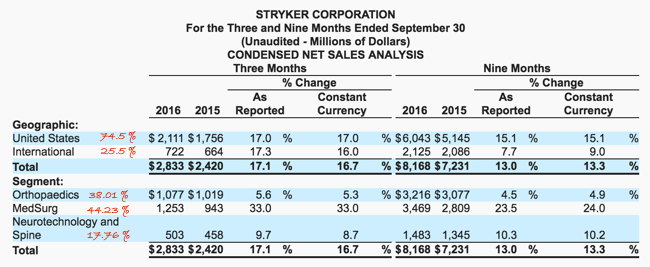

So that is the split. As per the last quarter (below) 38.01 percent orthopedics, 44.23 percent Medsurg, and the balance (17.76 percent) Neurotechnology. And then, North America is still the main part of this business. Which is why I really like it, there are huge growth prospects for this business around the globe.

The company guided forward for the full year in a tighter range, at the top end. So not too much of a spectacular change, the stock still trades on around 19.3 times forward (to the end of the year), the dividend is not why you own it, a paltry 1.33 percent yield currently. Mind you, the dividend has doubled in the last five years, that tells you a lot. This is a very exciting space to be invested, if you think about it at the simplest level, people are living longer and require solutions from science in order to be able to replace parts that have been subjected to wear and tear. As science evolves, there will be more parts and more solutions, more equipment to do the surgeries. The company also has the ability to do small deals and add to their portfolio where they see fit. We continue to recommend the stock as a solid long term investment and are currently buying.