Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

MTN released a very mixed trading statement for the first six months of their financial year, it required very careful reading in order to catch all of it. Since the Nigerian fine resolution and payment terms have been finalised, there has been a certain amount of relief for shareholders. That does not remove the fact that trading conditions in some of their core territories are likely to be become any easier. There are unintended consequences of the way that they dealt with the fine that are potentially negative to the business, if only from a short term consumer perspective. We can't quantify the damage. Having said that, those with the infrastructure and ability to meet consumer needs, as a result of having spent heavily on a network when others were late, win in the end.

Here is a copy and paste of the important part of the trading update from yesterday: "Shareholders are therefore advised that MTN expects to report negative basic headline earnings per share (HEPS) and basic earnings per share (EPS) for HY2016. In the prior year comparable period MTN reported HEPS of 654 cents and EPS of 653 cents." That sounds terrible. Why? Mostly as a result of the Nigerian fine, the group quantifies: "The Nigerian regulatory fine is expected to have an estimated negative impact of 474 cents on HEPS and EPS, respectively." And the rest? Where does that come from? "Foreign exchange losses in a number of operations, losses from joint ventures and associates and hyperinflation adjustments on MTN Irancell are also expected to have a negative impact on HEPS and EPS for HY2016." I guess the best thing about this is that these events are in the past, they are events that have happened.

I am afraid it doesn't end there, they are still battling even in their home market: "HY2016 results are further expected to be negatively impacted by the under-performance of MTN Nigeria and MTN South Africa. MTN Nigeria's performance was impacted by the disconnection of 4,5 million subscribers in February 2016, the final batch of subscribers to be disconnected in compliance with the Nigerian Communications Commission subscriber registration requirements." So whilst more clarity will emerge with another trading statement before the results on the 5th of August (I think that is breakup day for my kids), this looks like a leaky ship at best. We are always continually reviewing the stocks we own, it could be argued that being wrong immediately does not mean that the thesis is still intact.

In fact there is a strangely encouraging sign in the trading statement that forces you to do a double take: "MTN South Africa is expected to report a decline in the EBITDA margin, impacted by the marked increase in handsets sold during HY2016." A marked increase in handsets sold? Does that sound like, in the end, a bad thing? Remember that these handsets are subsidised on the basis that there will be more and more people consuming data over the coming years. And whilst data prices are still decreasing, we are using a larger amount than at any other time in history. And are likely to use more in the future.

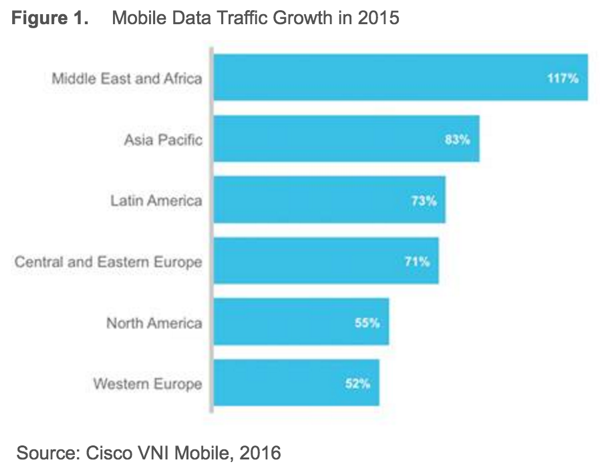

Cisco are pretty big in projecting what the internet of things is likely to do for their business. There is quite an interesting piece here - Global Mobile Data Traffic Forecast Update, 2015-2020 White Paper, in which cisco reckons that "Mobile data traffic will grow at a compound annual growth rate (CAGR) of 53 percent from 2015 to 2020" and "By 2020 there will be 1.5 mobile devices per capita. There will be 11.6 billion mobile-connected devices by 2020, including M2M modules-exceeding the world's projected population at that time (7.8 billion)." And you can bet your bottom Dollar/Naira/Rand/Rial that in the territories that MTN operate in, that the growth will be ahead of the global norm. In fact, let us leave this with a graph from that paper, which needs little explaining: