Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

MTN have finally announced a settlement with the Nigerian government slash communications authorities. The announcement is pretty simple (excuse the poor format, not ours) - MTN - Nigerian fine update & cautionary withdrawal. As you can see, the fine is tiered, in terms of payment. The company will pay 330 billion Naira over three years. What amazes me about the release is this excerpt from the sentence detailing the fine - "the equivalent of USD1.671 billion at the official exchange rate and USD902 million at the Lagos Parallel Market Rate".

WHAT? The company talks openly about the unicorn rate (the so called official rate) and then the real rate that you get on the street, the "Lagos Parallel Market Rate". In other words, the rate that real people use when they change money. As is always the case, the collective knows the prices and rates better than governments do. If the government in Nigeria were to devalue their currency that would head in the direction of something resembling the "Lagos Parallel Market Rate", then the quantum of the fine is reduced. Perhaps if you know someone who lives in Nigeria to explain how it actually works practically, right now. I lived in Mozambique in the dark days, I know how it works, you rock up and change Dollars (or Rand) for the local currency and then use that to purchase goods and services. Of course if they were available, thanks to the awesomeness of communism, many things were unavailable.

How does it work however for a company? They cannot go along and change a ton of Dollar bills (here are my Benjamins!!) for a few thousand tons of Naira. Surely they just have to pay the Nigerian government the fine at the prevailing rate? What is good news for shareholders, in terms of this fine is that the company will fund this internally. There is also talk of a listing in Nigeria. If the government becomes an owner of a stake, that may well benefit the company in the medium term. Less regulatory hurdles to overcome and less pushback. All countries are weary of external influences, and somehow think their ways are best.

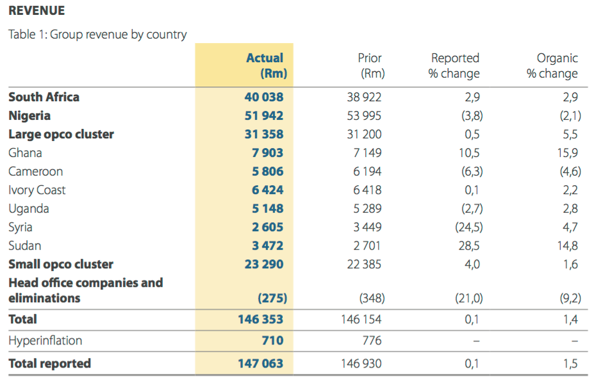

280 billion Naira, over three years, how much is that? On a relative basis? At the official Rand Naira exchange rate of 13.09 Naira to one Rand, this equals 21.39 billion Rand. That is still monster amount and in my opinion unreasonable. Watch the FDI flows, they are likely to be, errr .... not strong. Mind you, there are many external circumstances, including a change of government, and more importantly a crashing (and subsequent recovering) oil prices. First things first, from the recent MTN results, group revenues, including Nigerian revenues:

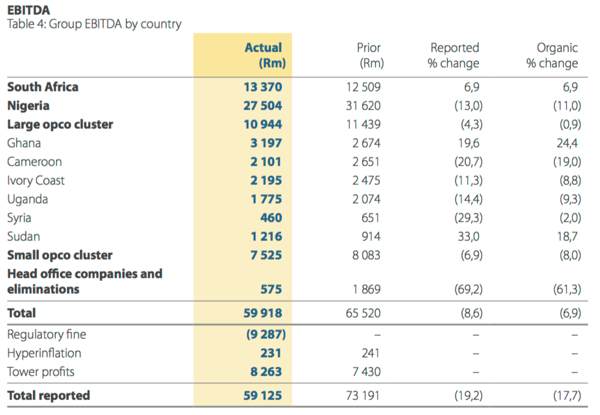

And then, remembering that group margins are around 40 percent, Nigerian margins are much higher than that, it is truly a very profitable territory for them. Herewith EBIDTA by territory:

So, doing quick and back of the matchbox calculations, last year EBITDA (2015) in Nigeria, relative to fine payable of 21.39 billion Rand is 77 percent, that is still left to pay. And in terms of turnover, it is around 63 percent of revenues that the company has been fined, that includes the "goodwill" payment that they have already made. If you don't disconnect your customers, in a country that has first world FICA requirements for cell phone users and a place where the rate of exchange from government is not believed, you get fined a significant amount of your revenues. Whilst we are still upset at the quantum of the fine, we are happy that it has been resolved. We will continue to monitor the ongoing results and advise accordingly.