Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Apple. Just wow. Their last quarter once again blew estimates away. In truth there is only one risk to their business and that quite simply is a superior product. A superior product to theirs that is adopted with the same uptake of their flagship product, the iPhone. Out there, there could and might be a better product. What it lacks is the adoption and more importantly, the ecosystem. What I mean by that is pretty simple, the ecosystem of Apple draws you in. It is evident in the company numbers, away from the iPhone itself. Mac Sales, a device on which I am writing this message, are set to grow 10 percent this year and continue to take market share away from their peers. Sales in China of Mac units grew 31 percent in the last quarter, when the rest of the PC market went backwards! In total, the company sold 4.56 million Macs, their old flagship product.

You don't really want to know about that. You want to know about the iPhone, the new 6 and 6 Plus. I have one, I have recently upgraded to a 6. And whilst I read articles that bemoan the fever pitch excitement as unnecessary, in terms of getting a new phone every two years, the design features and improvement on my last phone, the iPhone 5, is something to behold. The speed, the clarity, the size, the response times, just when you think it cannot get MUCH better, the design team at Apple, led by Jony Ive (sorry, Sir Jonathan Ive), releases another incredible product. I guess they are always under incredible pressure to trump the last version. The leap from 3 to 4 was huge, from 4 to 5, not so much other than screen size, the leap from 5 to 6 feels the same as 3 to 4. Those of you who have the phone know what I am talking about.

Let us have a look at sales units and numbers. 58 billion Dollars worth of sales in 90 odd days is amazing, net profits of 13.6 billion for the quarter is even more amazing. That translates to 2.33 Dollars per share of earnings. Gross margin improved to 40.8 percent from the comparable quarter (Q2 2014) last year, where it clocked 39.3 percent. Forget the strong Dollar, which has been the flavour for the reporting season thus far, 69 percent of Apple's sales are beyond the US borders. Meaning that only 31 percent of their sales are mainland US. In fact, for the first time iPhone sales in China were bigger than that of the US, unit sales grew 72 percent, revenues grew 71 percent to 16.8 billion Dollars of the group total of 58 billion. Tim Cook, the Apple CEO had indicated a few quarters ago that China was going to be huge. And now it is.

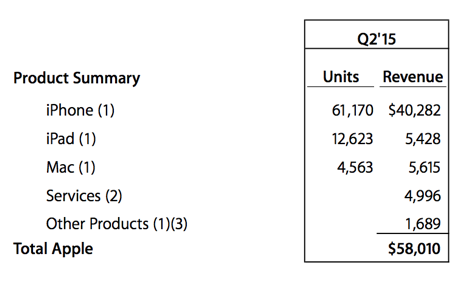

Total product sales are as follows, including revenues generated from those:

Services. Check that out, nearly 5 billion Dollars worth of sales, for the quarter alone. As they point out, services is as follows: Includes revenue from the iTunes Store, App Store, Mac App Store, iBooks Store, AppleCare, Apple Pay, licensing and other services. And then other products, which includes sales of iPod, Apple TV, Beats Electronics and Apple-branded and third-party accessories. I wonder where the watch is? Or where it will be in the future, a separate line?

If you were wondering about the take up of the watch with watered down and muted response, you are wrong. The watch take up was the most successful first day sales of any product ever for Apple. So there. Perhaps pre order data might have been in there (the "other products") segment, I suspect if so it is negligible. What you can see is that for the first time since the release of the iPad, Mac revenues have surpassed tablets. Which means that the bigger screen phones have definitely started to cannibalise iPad sales. The clearer and crisper screen enable users to ditch the tablet. Equally the greater adoption of the Mac means that Apple closes the loop, in terms of the ecosystem.

The company has also announced that they are boosting their buyback program by 50 billion Dollars, from 90 to 140 billion and have also boosted the quarterly dividend by 11 percent, from 47 to 52 cents per quarter. That amounts to 208 cents a year, on an after market share price of 134.42 Dollars, that is 1.54 percent yield. Better than the 2 year government debt, which is 0.53 percent. I have seen some analyst reports that suggest that the company by 2017 can register sales of 270 billion Dollars plus. That is a long way away, projected sales for this year is expected to be somewhere around 225 to 230 billion Dollars. With earnings expected to be around 9 Dollars, the stock hardly looks expensive at current levels, less than 15 times current year earnings. Earnings are expected to grow somewhere in the region of 17-18 percent, meaning that the multiple forward to 2016 is around 12.5 times.

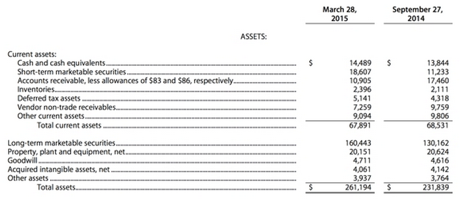

By that measure I think that there is still huge upside. Not as before where the base was lower, the fact that there is however new markets, the Chinese specifically. 6 new stores were opened in mainland China last quarter, there are expected to be another 40 by this time next year. Guidance is around the middle of most folks estimates for the current quarter, a foreign exchange "element" is expected to impact margins. There is something amazing in these Apple numbers. See if you can spot it:

190 billion Dollars worth of cash. No wonder Apple can expand their capital return program from 2012 to 200 billion Dollars through to 2017.

As a shareholder, what do you do? What is there to do? Nothing. If you own the shares, then enjoy the performance of the stock price now, in the past, and expectations based on future earnings. We continue to recommend that you accumulate the shares at current levels, buy. Be mindful that there are other products out there, Apple has only 20 percent of the smartphone market. Meaning that there is plenty of room to grow, plenty of people to convince that this is the best product, the best all around hardware and software combined.