Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

TenCent fourth quarter earnings are set for release on Wednesday, expectations are for earnings of 0.66 Renminbi per share. Remember however that the company is listed in Hong Kong, where there is a different currency. The inter-webs tells me that the ratio is 1.24 Hong Kong dollars to 1 Renminbi, the expectations are therefore 0.82 Hong Kong Dollars of earnings relative to the share price of 135.5 Hong Kong Dollars. The company would earn, at that level, 2.57 Hong Kong Dollars per share. The stock would then at these levels trade on a historic price to earnings multiple of 52 times. A really lofty historical multiple by any standards of any sort. Earnings however grew by 55 percent on the prior year (if we believe these expectations) meaning that the stock trades on a PEG ratio (price to earnings over growth rate) of less than 1.

On a forward basis, earnings are anticipated to clock 3.51 Renminbi for the current year, meaning that at current levels the stock trades on 38 times earnings, or a forward PEG ratio of 1.06, I guess that is slightly more than you would like for a high growth stock, not however out of the comfort zone. Revenues for the current year are anticipated to be close to 98 billion Renminbi, or 121.5 billion Hong Kong Dollars. Or, 194.4 billion Rand, if you like. Tencent on that basis trades at 10.5 times revenue. Facebook for comparisons sake trades on 17.5 times annual revenues.

Tencent pays a dividend, not a kings ransom, 24 HKD cents. The yield is laughable, the fact is that Tencent is hugely profitable (EBITDA margins of 33 percent), continues to invest heavily in their infrastructure. They will continue to become a more important part of the every day life in China, as an entertainment, messaging, commerce business, as well as keeping up with new technology and adapting. They will also have favourable government legislation on their side, the government wants them (and their Chinese peers) to prevail over multinational competition. That is both good and bad for the average consumer in China and definitely for the companies in the long run. It is what it is, however. I am looking forward to these results as much as I am looking forward to the quarter final against Sri Lanka, it should be cracking!

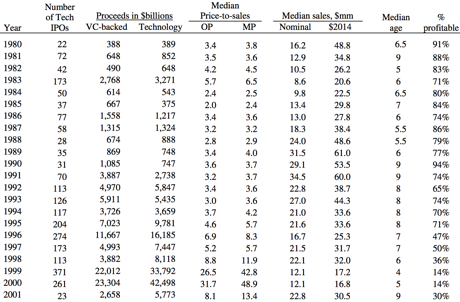

There are many comparisons between the dotcom era and now, there were 632 Tech IPO's in the US in 1999 and 2000, of which 14 percent were profitable (Yes, true story, here is the data -> Technology Company IPOs, 1980-2013), more importantly they traded at 26.5 to 31.7 times sales. Makes you think, not so? Here is the table: