Market scorecard

US markets hovered between modest gains and losses yesterday, with the S&P 500 ending flat while the Nasdaq managed to edge slightly higher.

It's a big week for monetary policy watchers as the Fed's annual Jackson Hole symposium begins Thursday. All eyes will be on Jerome Powell's Friday speech, where he's expected to unveil the Fed's new policy framework, outlining how they plan to balance inflation and employment goals.

In company news, Palo Alto Networks gained 4.9% after-hours thanks to an upbeat annual revenue forecast, with plans to roll out bundled AI-driven cybersecurity tools to help clients defend against rising digital threats. Elsewhere, Novo Nordisk is cutting the out-of-pocket cost of its diabetes drug Ozempic for US patients, addressing criticism of high drug prices. At the same time, its weight-loss blockbuster Wegovy has secured US approval to treat a severe form of liver disease.

At the close, the JSE All-share closed down 0.79%, the S&P 500 was unchanged, and the Nasdaq was 0.03% higher.

Our 10c worth

One thing, from Paul

I just arrived in New York, and after attending to some tasks and checking into my hotel, I went for a run along the Brooklyn side of the East River. As usual, I was struck by the number of people out exercising.

There are stats to back this up. The American Time Use Survey shows that adults engaging in "sports, exercise, and recreation" is up 20% in the last decade. The increase is most notable among young people (all sports) and women over 65 (yoga and Pilates).

This is part of a wellness wave that surged after the pandemic, as the crisis made people more aware of their mortality. It's been amplified by wearable fitness devices and apps.

This is all good news for (our currently) underperforming investments in companies like Nike, Lululemon Athletica and other athleisure gear makers.

Byron's beats

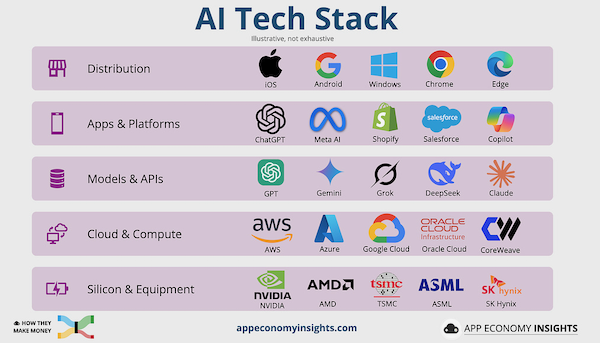

Understanding the value chain of AI can be difficult. It is all very new and things are changing fast. The App Economy Insights crew has made a great infographic showing the AI tech stack. These are just the main players in the industry, there are many others involved, but you get the idea.

The end consumer mostly sees only the first two layers. For example, downloading ChatGPT (application) on your iPhone through iOS (distribution). Behind the client-facing stuff are models, APIs, cloud and compute services, and then the hardware.

If you are a Vestact client, your share portfolio is heavily exposed to this entire value chain.

Michael's musings

I remember going for a job interview in 2010, in the middle of the financial crisis when most firms were laying off people. Hiring someone new wasn't even on the horizon. It was a tough time, especially for the financial community. The interviewer said to me that back in his day, if someone had a degree, they were almost guaranteed a job because so few had the right qualifications.

Things are very different these days. Many people around the world have the opportunity to go to university, which means having a degree doesn't make you stand out from the crowd anymore.

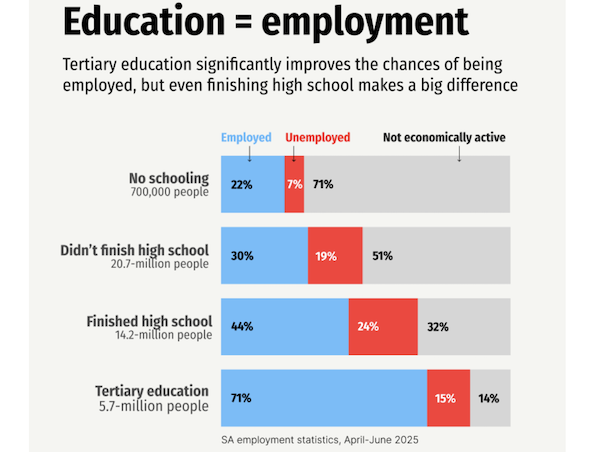

In South Africa, where we have an unemployment problem, having a university degree is still very important. If you have gone to university, your chances of getting a job are significantly higher; look at the image below, created by The Outlier. Note how many university graduates are still unemployed, however. I think part of the problem is that people study courses that aren't usable in the real world.

In the developed world, things are starting to shift away from universities. In a recent survey of 1 000 full-time US Gen Z employees, 23% said that they regret going to university and 19% said that university didn't contribute to their career.

When unemployment rates are nonexistent, and employers can't find enough reliable workers, you don't need a degree to get a job. Imagine amassing student debt of $100 000, only to get a job in a different industry to your degree. For some industries, a degree is a must, but for others, all you need is common sense and a good work ethic.

I think for the next generation, going to university won't be the default career route. Things like apprenticeships and trade schools will be the path for many.

Bright's banter

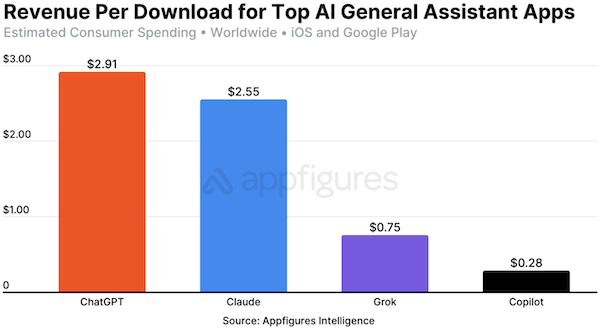

ChatGPT's app has turned into a money-making machine. Since launching in May 2023, the iOS and Android versions have raked in $2 billion from consumers, according to Appfigures. That's about 30 times the combined lifetime haul of rivals like Claude, Copilot, and Grok.

The growth curve is dizzying. So far in 2025, ChatGPT has pulled in $1.35 billion on mobile alone, a 673% surge from the same period in 2024. Monthly revenue now averages $193 million, up from $25 million last year. For comparison, xAI's Grok, the nearest competitor, has made just $25.6 million year-to-date, about 1.9% of ChatGPT's pace.

Of course, app store spending isn't the whole revenue story. Companies like OpenAI and Anthropic also sell web subscriptions and API access. But the mobile data offers a clear window into consumer traction. Lifetime spending per download stands at $2.91, compared with $2.55 for Claude, $0.75 for Grok, and a meagre $0.28 for Copilot. In the US, ChatGPT's average spend per install is even more striking at $10, with that market accounting for 38% of global revenue.

The install base is equally telling. ChatGPT has been downloaded roughly 690 million times worldwide, versus Grok's 39.5 million. Average monthly downloads now hover around 45 million, nearly triple last year's pace. India leads on volume, accounting for 13.7% of lifetime downloads, while the US ranks second at 10.3%.

In short, ChatGPT's lead on mobile is widening fast, no surprise here, as they had the first-mover advantage. For now, our exposure to OpenAI is through Microsoft, but it would be more fun if they listed on the Nasdaq.

Linkfest, lap it up

Today, fashion trends are killing class. Don't get me started with baseball caps, elastic-waist shorts, rock n roll t-shirts, and crocs - Why men shouldn't dress like boys.

AI content creator is a new job type. People seem to enjoy 'AI slop' being posted on social media - AI has created a new breed of cat video.

Signing off

Asian markets are mostly higher this morning, with the MSCI Asia-Pacific index in positive territory as hopes of a Russia-Ukraine truce lifts sentiment. Benchmarks gained in Hong Kong, India, China, South Korea, Taiwan, and Japan, which rebounded after opening sharply lower.

In local company news, Thungela Resources posted a tough first half as weaker coal prices and rising costs hammered margins. Net profits plunged 79% to R248 million and revenue was down 12% to R14.8 billion. Elsewhere, Absa Group posted decent first-half results, with revenue up 5% to R56.49 billion.

US equity futures edged higher pre-market. The Rand has strengthened to around R17.65 to the greenback.

Things are happening around the world, as they always have been and as they always will. Don't take it all too personally.

Wishing you a smooth day ahead.