Market scorecard

US markets closed lower yesterday as traders took a cautious stance amid rising tensions in the Middle East. Fears of broader US involvement in the conflict kept sentiment low, pushing the S&P 500 and the tech-heavy Nasdaq into the red. President Donald Trump convened with his national security team in Washington on Tuesday to assess the situation, adding a fresh layer of geopolitical jitters.

In company news, Amazon CEO Andy Jassy says that their headcount will likely shrink over the next few years, not because of slowing growth, but thanks to AI taking over more tasks. It's automation, not austerity. Elsewhere, Eli Lilly is putting $1.3 billion on the table to acquire gene-editing firm Verve Therapeutics, doubling down on next-gen biotech in a bid to fuel long-term pipeline growth.

At the close, the JSE All-share closed down 0.70%, the S&P 500 fell 0.84%, and the Nasdaq was 0.91% lower.

Our 10c worth

One thing, from Paul

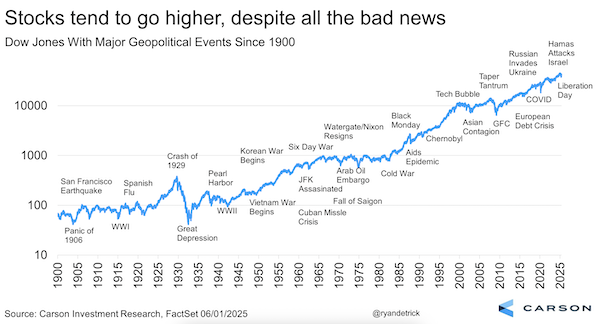

Sam Ro has a good post about how the market reacts to geopolitical risk, on his blog TKer.

The central point he makes is that stocks usually look past geopolitical events, but they shouldn't be ignored. Staying invested doesn't mean dismissing the risk of things getting worse.

There have been lots of events over the past 25 years that caused temporary market sell-offs, followed by quick recoveries. Those are the "crises" that we can't remember, a few years later.

But there are other events that are more serious. The attack on the World Trade Centre (9/11) in 2001 pushed the US economy into a recession, prolonging the dot-com crash. Russia's invasion of Ukraine in 2022 aggravated global inflation, prompting central bank intervention and a nasty market collapse.

We don't know how serious the current war between Israel and Iran will get, or which other countries will get drawn into the conflict. More people may die, and there could be a risk of radioactive fallout. The oil price may spike higher.

Hold on to your hats. We will stay fully invested in our quality companies.

Byron's beats

Sometimes I like to look at particular services available today that I couldn't imagine living without. One of those is internet banking. Whether it is personal or work, the ability to move money around as freely as we can, is an absolute blessing. This innovation is huge for productivity. Think of all the time you save by not having to go to the bank to make payments or cash cheques.

Banks often face criticism, and people constantly complain about the fees, but I would argue that the service provided by most banks is worth every cent. Your money is safe and you are able to move it around freely with very little friction.

I feel this is even more so in South Africa where it is easy to send money amongst the different banks and most of them have embraced the digital age. Don't always complain about your bank, be grateful too, they have made your life easier in many ways.

Michael's musings

On Friday, the Visa share price dropped around 5% on the news that some US retailers, including Walmart, are exploring using stablecoins as a payment method. If you aren't familiar with the term, which my spell check isn't either, a stablecoin is a cryptocurrency that has its value pegged to another currency. Usually, it is 1 to 1 with the USD.

The fear is that stablecoins could create a rival payment option to the rails already created by Visa and Mastercard. Imagine paying for groceries, where the money leaves your crypto wallet, goes via a blockchain network and arrives in Walmart's crypto wallet. Something like this would be a huge win for retailers, assuming that it is instant and cheap.

Depending on the size of each retailer, swipe fees cost anywhere between 1% and 5% of the purchase value. Those costs add up quickly! It is worth noting that Visa's portion of those fees is very small. The bulk of the fees is paid to the card-issuing bank and the card machine provider.

Getting consumers to change their spending habits is very difficult. For stablecoin payments to work, people have to create new accounts, fund those accounts, and then remember to use them at checkout. Along the way, consumers will also be giving up some very juicy credit card rewards. Sounds messy and cumbersome for no upside.

If consumers really want to avoid established financial channels, Visa already has stablecoin/ blockchain networks in place. In our books, Visa is still the future of the payments industry.

Bright's banter

Palantir shares have been on a tear in the Trump 2.0 era thanks to their ties to the White House. A recent media report detailed just how deeply entwined the company has become with the US government, particularly under the Trump administration.

Since 2017, Uncle Sam had paid Palantir $113 million until they secured a fresh $800 million expansion from the Department of Defence, announced two weeks ago.

So, it's no surprise that Palantir has emerged as the poster child of the "Trump trade," a basket of stocks investors believe could benefit from a return to law-and-order rhetoric and muscular federal spending. Other names in this club include Axon (makes Tasers) and Geo Group (runs private prisons).

Of course, this isn't all about politics. Palantir is also at the center of Wall Street's AI fever dream, pushing data analytics tools to governments and corporations alike.

But here's the thing: the stock has run hard. Yes, business is booming, but this rally has been juiced up by both hype and hope, two things that can turn on a dime. If you're a long-term investor who has missed the move, this isn't the time to chase easy money.

Linkfest, lap it up

When you think of the Ukraine, you mostly think of eastern battlefields. Life in the cities is mostly normal - A few reflections on visiting Kyiv.

Whales blow bubble rings. Newly documented behaviour research may offer insights into nonhuman intelligence - Are whales trying to communicate with us?

Signing off

Asian markets opened on a mixed note this morning. Hong Kong and mainland China slipped, still weighed down by tariff tensions and cautious sentiment. Meanwhile, Japan, India, and South Korea edged higher, brushing off Middle East concerns as traders sought bargains and maintained faith in domestic resilience.

In local company news, Retail-focused REIT Vukile Property Fund has cracked the R50 billion mark in property assets for the first time, with 65% now offshore, thanks largely to its growing footprint in Spain.

The Fed ends its two-day FOMC meeting today, with a small chance that they will announce an interest rate cut. The market thinks it is much more likely that interest rates will be cut after their September meeting.

US equity futures are marginally in the green pre-market. The Rand is trading at around R17.98 to the US Dollar.

Have a good one. It's already Wednesday.