Market scorecard

US markets rallied yesterday after softer inflation numbers boosted hopes for a Fed rate cut. The S&P 500 surged 1.8%, its best day since the November election and erasing its 2025 losses. Big names led the charge: Tesla jumped 8.0%, Nvidia gained 3.4%, Meta added 3.8%, and Amazon rose 2.6%.

In corporate news, Goldman Sachs popped 6% after smashing estimates, thanks to its equity traders delivering their best year yet. Meanwhile, NetApp is offloading a portfolio of cloud software assets, originally picked up during its acquisition spree to Flexera, backed by private equity giant Thoma Bravo.

In summary, the JSE All-share was up 1.69%, the S&P 500 leaped 1.83%, and the Nasdaq screamed 2.45% higher.

Our 10c worth

One thing, from Paul

The US government announced on Monday it would further restrict AI chip and technology exports. The regulation divides the world into three tiers. 18 countries, including Japan, Britain, South Korea, and the Netherlands, will be exempt from the rules. Another 120 countries, including South Africa, Singapore, Israel, Saudi Arabia, and the United Arab Emirates will face sales caps. Arms-embargoed countries like Russia, China, and Iran will be barred from receiving any high-end chips at all.

The move has dented the Nvidia share price this week, since they are by far the most important AI chip maker. They have fallen from a high above $153 per share to the current level, about $136 per share.

I think that these restrictions are a terrible idea. My belief is that free trade results in better outcomes for all, including powerful nations. I may be naive, but I expect these regulations will delay innovation and have unintended, negative consequences.

The leadership team at Nvidia agrees with me. A company spokesperson called the new rules "sweeping overreach" and said the White House would be clamping down on "technology that is already available in mainstream gaming PCs and consumer hardware".

Byron's beats

I have been following the ban of TikTok in the US with interest. I get why they want to do it. TikTok is owned by Chinese company Bytedance who now have access to private data on millions of Americans. They also control the algorithms which have the potential to influence and shape societies.

As we well know, the Chinese government is very controlling over its private sector. If they want ByteDance to supply the data or alter the algos, ByteDance will have to collaborate. Just ask Jack Ma and Alibaba what happens when you say no to the communist party officials in Beijing.

On top of that, Facebook, Instagram, X, Google, YouTube, WhatsApp, and many other US apps are banned in China. The Chinese don't want those big tech giants to have any influence in their country. These bans provide support for the local knockoffs offs who will always collaborate with the government.

Depending on the extent of the ban, it will surely be a positive for Meta which competes with TikTok. But hey, who knows, Maybe Elon Musk will buy TikTok which will solve the ownership issue. He seems to have plenty of spare time to run another social media site.

Michael's musings

It is fascinating how quickly the diamond industry has changed. The price of lab-grown diamonds has gone from a 10% discount to natural stones in 2015, to a 90% discount now. As a result, lab diamonds account for more than 20% of the total diamond market, and is growing at around 50% a year.

What has been really interesting is reading the different forecasts of where the market will go from here. Some feel that lab diamonds are too cheap and freely available, meaning people won't want to buy them because the whole point of jewellery is to have something exclusive.

In December, Business Day quoted Larry Brown, creative director at Browns Jewellers, who said "As gold prices continue to soar, savvy individuals know it's the best time to invest in real diamonds. Diamond jewellery offers both intrinsic beauty and lasting value, making real diamonds the most desirable option." He might be a bit biased because his company offers trade-ins of small diamonds for bigger diamonds, which relies on prices increasing over time.

I think lab-grown diamonds will be over 80% of the market in years to come. Natural diamonds cost 10 times more and generally don't shine as brightly. Plus, there is a slim chance that children mined them. As a result, natural diamond prices have dropped 8% over the last five years, and De Beers recently cut the price of rough stones by 15%.

Diamonds are no longer an investment. Drug dealers and warlords will have to find another way to do business.

Bright's banter

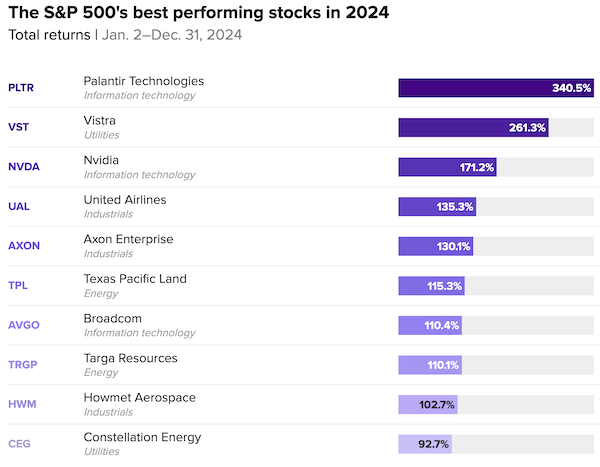

It's good to be back in the groove of writing about all things investing in 2025. The markets are already giving us plenty to talk about. Let's dive into one of the most popular stories at this time: the top-performing big-cap stocks of 2024.

Palantir stole the show last year, topping the S&P 500 with an eye-popping 340.5% return, leaving Nvidia, the year's media darling, in third place with a 171.2% gain. Sandwiched between them was Vistra, a utilities company that surged 261.3%, while United Airlines with 135.3% and Axon Enterprise at 130.1% rounded out the top five.

The graph below shows the winners of 2024. We are happy to see familiar names in the mix.

Linkfest, lap it up

Weight loss drugs are a booming business. It's hard to manufacture the injectables and many people don't like needles - Eli Lilly's weight loss pill could get federal approval by early next year.

Mercado Libre isn't just Latin America's biggest company by market cap. It's the engine powering the region's digital revolution - The digital backbone of Latin America.

Signing off

Asian markets are on the rise this morning, driven by Wall Street's strong performance yesterday. Meanwhile, the Japanese Yen is climbing as expectations for a Bank of Japan rate hike grow.

In local company news, Richemont just set a new record with quarterly sales hitting EUR6.2bn, up 10%. Luxury is thriving! Shares are soaring, up 13.7% in Jozi this morning. Elsewhere, Cartrack's parent, Karooooo, posted a solid 21% earnings jump for the third quarter and announced plans to expand further into Southeast Asia's telematics market. With a dominant 60% market share in Singapore, they're well-positioned to make moves in the region. Lastly, Spar is looking to sell its head office to raise cash to help reduce its R9 billion debt burden.

US equity futures are in the green pre-market. The Rand is trading at around R18.80 to the US Dollar.

Have a top day.