Market scorecard

Yesterday the S&P 500 opened 0.9% lower but squeaked into the green at the close. Local stocks had a tough day as the exchange rate weakened to $/R19.21, and most sectors were down over 1%.

In company news, Howard Hughes Holdings soared 9.21% after billionaire hedge fund manager Bill Ackman offered to acquire the portion of the real estate developer that he doesn't already own. His plan is to turn the property company into a modern Berkshire Hathaway by investing surplus cash in other companies.

Conversely, vaccine maker Moderna plunged 16.8% as it lowered its revenue guidance by $1 billion. The stock recently rallied after the US reported the outbreak of bird flu, but that was short-lived. Abercrombie & Fitch also had a bad day, dropping by 15.7% after it raised is guidance. Unfortunately, Wall Street had expected a higher increase. Expectations drive share prices in the short term.

In summary, the JSE All-share closed down 1.70%, but the S&P 500 rose by 0.16%, and the Nasdaq slid 0.38%.

Our 10c worth

One thing, from Paul

It's the start of a new business year, and we are ready to roll. We've had clients sending funds to invest, others making withdrawals to fund other projects, and everything else in between.

This a great business. You save, we help you to grow your capital. I love it.

In the last few days, I read a quote of Albert Einstein's: "There are only two ways to live your life. One is as if nothing is a miracle. The other is as though everything is a miracle."

Byron's beats

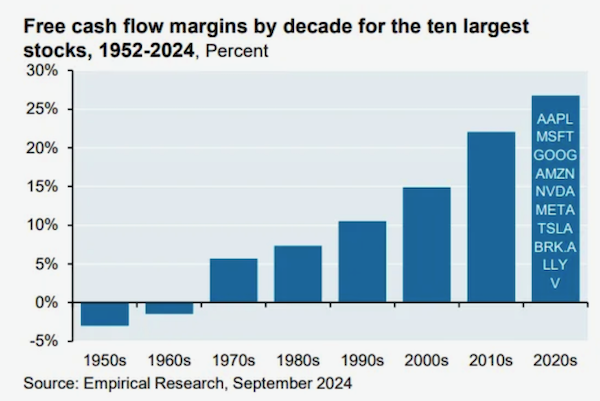

Some market participants believe that US stocks are too expensive. These people usually compare today's P/E value versus historic levels. There is no doubt that US stocks are historically high if you use that simple comparison.

But that analysis is too basic and lazy. If you look under the hood of many of the companies driving the S&P higher, you will notice that their quality is unrivalled by companies of the past. They have less leverage, are asset-light, and have better margins and wider moats than ever before.

Take a look at this graph shared by Michael Batnick from Ritholtz Wealth. It looks at free cash flows from the biggest listed stocks by the decade.

As with most things in life, you need to pay a premium for quality. The US stock market is made up of many top notch companies that have earned the right to trade at a premium to the valuation levels of the past.

Michael's musings

I noticed many new cars driving around on the roads over the festive season. Two interest rate cuts in 2024 definitely helped the cause. It got me thinking about how much money South Africans spend on their cars versus their houses.

By global standards, cars in South Africa are expensive, so it is interesting that we spend so much money buying new ones. By contrast, properties in South Africa are comparatively cheap. Does this reflect South African priorities?

A friend of mine lives in the US and he recently bought a new Toyota Land Cruiser for $50 000 and stays in a $1 million house. The house is nice, but not unduly lavish, only slightly above average for his city. In South Africa, you would pay close to R1.5 million for that car, and would only need to live in a R6 million house to be well above average.

Put differently, my friend in the US owns a home that is worth 20 times the value of his car. In South Africa, the comparative is closer to four times.

If I had to choose, I would much rather live in a country where the houses are cheap and the cars are expensive. It's better for your wallet over the long term.

Linkfest, lap it up

If more creatures are sentient, do we need to rethink our approach? A book argues that we've not thought enough about the subject - Don't eat octopus.

Many uncontrollable things influence our lives. Your looks, birth date and surname might determine your future - Why an end-of-the alphabet last name could skew your grades.

Signing off

Asian markets are higher this morning on the news that members of President-elect Donald Trump's economic team discussed a gradual approach to ramping up tariffs. Tencent is up 3% in Hong Kong today, which should offer some reprieve to Naspers and Prosus' recent share price woes.

Locally, Life Healthcare shares jumped 3.5% on the news that they will sell Life Molecular Imaging (LMI) to Lantheus Radiopharmaceuticals UK. Life Healthcare CEO Peter Wharton-Hood said that if we go back two years, shareholders, investors and analysts thought this asset was worth zero. Well done to the team for turning the asset around over the six years of owning it.

US futures are green this morning and the Rand has made a bit of a comeback, now trading at $/18.98. This afternoon, US PPI data will be released for December, given the market an idea of trends in US inflation.

Have a good day, it's good to be writing again!