Market scorecard

US markets took a breather yesterday, after some iffy producer price data. It's been a stellar year so far, with the S&P 500 up 27.6% year-to-date, and the Nasdaq Composite up 34.8%. We have no complaints!

Giants like Nvidia (+185%), Meta (+82%), Tesla (+68%), and Apple (+34%) have led the charge this year. Staying fully invested through the cycles has paid off, and we're grateful for your trust in our long-term approach.

In corporate news, chipmaker Broadcom surged another 5% after hours on strong fourth-quarter profits. Meanwhile, Adobe tumbled 13.7% after issuing a cautious annual sales forecast, fuelling concerns over competition from AI-based startups. ServiceTitan made a splashy debut, opening 42% above its IPO price after raising $625 million.

In summary, the JSE All-share was down 0.17%, the S&P 500 fell 0.54%, and the Nasdaq was 0.66% lower. Ah well.

Our 10c worth

One thing, from Paul

This is my last Friday advice column for the year. Thanks for reading them.

This short poem has been bouncing around the internet again this week. As you wade into the festive season, keep this in mind.

The real luxuries in life:

time

health

a quiet mind

slow mornings

ability to travel

rest without guilt

a good night's sleep

calm and "boring days"

meaningful conversations

home-cooked meals

people you love

people who love you back

Byron's beats

One of the biggest lessons of 2024 is to ignore price targets. The S&P 500 is now at 6 050 points, 11% above the highest year-end price target set by Wall Street firms and 25% higher than the average target. The most bullish prediction was 5 400 points from Yardeni Research, and the most bearish one was 4 200 from JP Morgan. Come on Jamie Dimon, that is embarrassing.

We are constantly getting updates about analysts changing their year-end price targets for certain stocks. What is the point of having a price target if you are always changing it?

Don't expect Vestact to ever give you any price targets for stocks or forecasts about the unknown. In fact, if anyone tells you with conviction what is going to happen in 2025, unfriend them. Have a good Dezemba all.

Over and out from Byron's Beats 2024.

Michael's musings

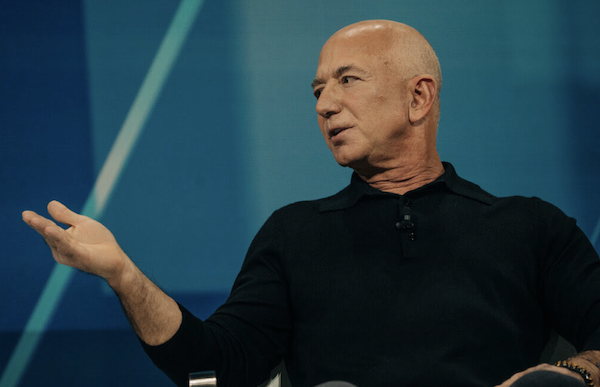

Here is some advice from Jeff Bezos. In a recent interview he talks about where he got the confidence to take Amazon to be a multi-trillion dollar business.

"I think it's generally human nature to overestimate risk and underestimate opportunity. And so I think entrepreneurs in general, you know, would be well advised to try and bias against that piece of human nature: The risks are probably not as big as you perceive, and the opportunities may be bigger than you perceive.

And so you say it's confidence, but maybe it's just trying to compensate for that - accepting that that's a human bias, and trying to compensate against it. The second thing I would point out is that thinking small is a self-fulfilling prophecy".

Bright's banter

Google and Samsung are teaming up to take another swing at mixed reality, unveiling Android XR and a Samsung-built headset called Project Moohan. This partnership aims to rival Apple's $3 499 Vision Pro and Meta's mixed-reality devices.

The Samsung device, set to launch soon, promises lighter, more comfortable hardware and will undercut Apple's price. It's powered by Qualcomm chips and built around Google's revamped XR platform. These headsets will integrate with AI services for tasks like furniture assembly and navigation.

The strategy echoes Google's success with Android for smartphones, with hopes that companies like Sony and Xreal will adopt the platform. Ironically, Google once pioneered this space with Google Glass, which flopped a decade ago. Now they are back with another attempt.

Linkfest, lap it up

Smoking in public used to be commonplace. The smoke used to give photos a cool filter, way before Instagram - Old sports photos often have a blue haze.

The Jolly Roger is an institution in Joburg. If you studied or played sport in Jozi, you've most likely had a beer there - Who was the Roger behind the Jolly in Parkhurst?

Signing off

Asian equities slid this morning, weighed down by vague outcomes from China's Central Economic Work Conference.

In local company news, Pan African Resources expects gold production to climb 16% in the 2025 financial year, driven by steady output from Mogale Tailings Retreatment (MTR) and improved underground operations at Evander Mines.

US equity futures are edging higher in pre-market trade. The Rand is at R17.80 to the US Dollar.

Have a good December break. This newsletter will resume again on 13 January 2025. We will be online and working every day that the market is open. If you need to get hold of us, email us on support@vestact.com to make sure that your message comes to the whole team.

Merry Christmas and a happy new year.