Market scorecard

US markets rebounded strongly yesterday after benign inflation numbers bolstered expectations of a Fed rate cut next week. The Nasdaq 100 surged to a record high, led by the "Magnificent Seven" tech giants. Tesla (+5.9%), Amazon (+2.3%), and Meta Platforms (+2.2%) all hit individual all-time highs, while Alphabet (+5.5%) and Nvidia (+3.1%) also posted solid gains.

In corporate news, Broadcom jumped 6.6% on reports of a collaboration with Apple on AI-focused server chips. Meanwhile, GameStop soared 7.6% after delivering a surprise Q3 profit, attributed to successful cost-cutting efforts. Finally, contact lens manufacturer Bausch + Lomb was the biggest loser of the day (-12.1%) on news that Blackstone may back out of an attempted acquisition of the company.

In summary, the JSE All-share was down 0.18%, the S&P 500 rose 0.82%, and the Nasdaq was 1.77% higher. Cowabunga!

Our 10c worth

One thing, from Paul

Every now and then, we get a Vestact client who wants to leave because they don't feel like paying our 1% per annum advice fee anymore. They think they can pick stocks for themselves and achieve even better overall returns.

Research shows that most self-guided retail investors do very badly. They flip-flop based on news headlines, panic when international events seem scary, chase fads, and get scared out of holdings that struggle for a while, right before they recover. They battle to maintain a well-balanced portfolio.

Active day traders, who speculate in stocks based on technical analysis (drawing squiggly lines on charts) and social media hype (small caps punted on TikTok), do even worse. In general, day traders blow up their accounts. The online brokerage platforms that entice them make a great deal of money from stock jobbers, even if there are no dealing or advice fees, because they sell the order flow to market makers. Active retail traders are the most lucrative counterparties to have.

Our service is worth what you pay for it. We offer good stock selection advice, a helping hand, a very secure custody platform in New York, and a sounding board to guide you through tricky times.

Byron's beats

Looking back at 2024 there have been some dominant themes. Politics has certainly been one of them, with many elections changing the status quo. It remains to be seen how that will work out. I am still feeling positive about South Africa's medium-term future, as the GNU was probably the best election outcome for us.

Artificial Intelligence has been an incredibly dominant theme in investment markets. We have written countless articles about AI and how it is already impacting the way individuals and businesses do things. The stocks we own are heavily involved in the AI trend and this has resulted in some really good returns. The US has remained the central hub of innovation in this area.

As usual, the enthusiasm for other sectors has ebbed and flowed. Green energy and electric vehicle stocks have wavered, but I think that is just part of the journey. We are clearly in an energy transition from fossil fuels to renewables. Some pundits like to push a polarising agenda, but it does not have to be one or the other. We can move to green energy gradually while still relying on fossil fuels to keep the economy humming.

All in all, 2024 was another year of solid progress for humanity. Global GDP is growing, and innovation is ongoing, especially in sectors embracing AI. Democracy remains popular and, for the most part, has performed its functions. I am looking forward to 2025, which will no doubt have its challenges, but that's what keeps it interesting.

Michael's musings

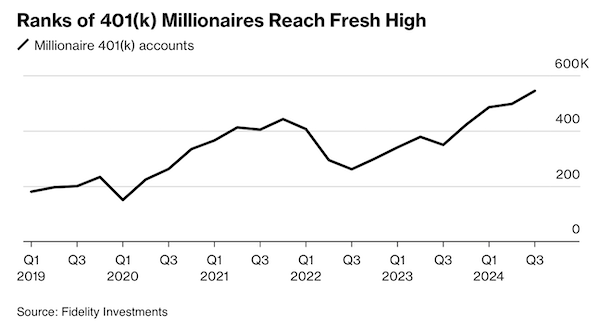

Fidelity, a financial services firm handling over 49 million American retirement investments, released a breakdown of those accounts. What stood out for me is that since 2019, the number of retirement clients with over $1 million in value has more than doubled.

According to Mike Shamrell, Fidelity's vice president of thought leadership, "there's no secret or 'hot stock' which helped savers achieve millionaire status". It all came down to "taking a long-term view of savings". Adding regularly, regardless of what the market is doing.

Since 2019, we have had Trump and Biden presidencies, Covid, wars in Ukraine and Gaza, high inflation, and steep interest rate increases. But even with all of that, long-term savers are significantly wealthier today than they were five years ago.

Bright's banter

General Motors (GM) is winding down its robotaxi ambitions by canning its Cruise unit. The pivot follows significant challenges, including a pedestrian accident that grounded Cruise's fleet, regulatory scrutiny, and mounting expenses.

Instead, GM will focus on enhancing its SuperCruise assisted driving system with Cruise's expertise, aiming to offer driverless features to retail car buyers, in time.

This capitulation will save GM over $1 billion annually. They aren't the first company to decide that it is too expensive and difficult to crack the code for self-driving. It highlights how well Waymo (Google) and Tesla are doing in their autonomy advancements.

Linkfest, lap it up

The ruby slippers from The Wizard of Oz are famous across generations. A collector paid 8 times more than expected for a pair - Slippers from movie sell for $28 million.

Spotify released a list of the most listened-to podcasts of 2024. The Joe Rogan Experience took top spot for a fifth consecutive year - What people enjoy on Spotify.

Signing off

Asian markets rallied this morning, buoyed by strong performance in technology stocks, following the Nasdaq's record-breaking surge yesterday.

In local company news, Barloworld shares surged as much as 21% to R111.30 after receiving a buyout offer from a group led by CEO Dominic Sewela and Gulf Falcon Holding, which already holds an 18.9% stake. The offer values the company at R23 billion.

US equity futures are mixed pre-market. The Rand is trading at around R17.67 to the US Dollar. If you plan to externalise funds, consider doing so before Christmas to avoid potential delays during the holiday season.

Have a good Thursday. Today and tomorrow are the last working days for most of us in Joburg. Traffic in coastal towns will be surging. Travel safe if you are relocating soon.