Market scorecard

US markets had a great week, reaching all-time intraday highs on Friday, thanks to the Fed interest rate cut. In the closing moments of trade, the rally fizzled out, and both the S&P 500 and Nasdaq Composite finished slightly lower on the day.

In company news, Lennar dropped 5.3% after its new-home orders for the quarter ahead came in below Wall Street forecasts. Elsewhere, Intel gained 3.3% amid reports that Qualcomm might be considering a takeover. That would be a remarkable turn of events for a storied company that has fallen on hard times. Qualcomm was down 2.9% on the news.

On Friday, the JSE All-share was up 0.08%, the S&P 500 fell 0.19%, and the Nasdaq dropped 0.36%. Big picture - we are looking good.

Our 10c worth

One thing, from Paul

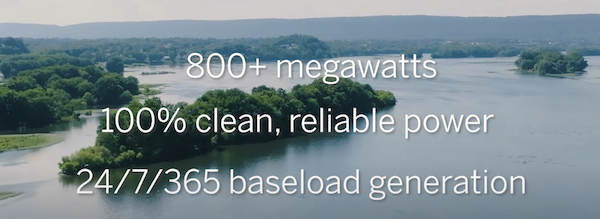

Those of us that were born in the 1960s, or earlier, will know the name Three Mile Island. A nuclear power station near Harrisburg, Pennsylvania, on the banks of the Susquehanna River, experienced a reactor meltdown in March 1979. Design faults and operating blunders at Unit 2 resulted in the release of radioactive substances into the air and water.

I remember that disaster well, with nightly reports on the television news. Although no one died, and no definitive increase in cancer occurrences were ever proved, the event fed into anti-nuclear fears and basically prevented the permitting of new reactors in the US.

Ironically, Three Mile Island's Unit 1 reactor ran for another 40 years after the meltdown, but was shut down in 2019 because it was too costly to run. US electricity demand was practically flat, and renewables and natural gas were able to meet the stagnant need.

Over the past couple of years, though, demand for electricity has picked up as we start to electrify everything - cars, appliances, and now AI. Electric power utilities have been doing rather well.

Constellation Energy, the owner of the plant, will invest $1.6 billion to revive unit 1 in 2028, agreeing to sell all the output for 20 years to Microsoft, who wants 835 MW of carbon-free electricity for AI data centres in Pennsylvania, New Jersey and Maryland.

Constellation CEO Joe Dominguez said: "Before it was prematurely shuttered due to poor economics, this plant was among the safest and most reliable nuclear plants on the grid, and we look forward to bringing it back." Restarting the plant will require the re-issuing of local, state and federal permits.

In the right context, nuclear power makes sense. Safety remains a concern so regulatory oversight is intense. Permitting new sites is very hard and construction is very expensive, so long-term off-take agreements are essential.

Microsoft is the perfect customer, and their confidence in the deal underscores their commitment to AI as a revenue-generating service. The plant will be renamed the Crane Clean Energy Center.

Byron's beats

Visa's monthly volumes report is a good indicator of how well the global consumer is doing. I am happy to tell you that in their latest update, things look pretty robust. According to CEO Ryan Mclnerney (pictured below), payment volumes in the US are up 5% through August, and cross-border volume is in line with their already optimistic forecast.

These positive trends seem to be consistent all over the globe except for Asia Pacific where volumes and cross-border trends are still below 2019 levels. Wow, post-Covid China really needs to change things up. Less regulation would be a good start.

Mclnerney is confident that Visa can maintain its 10% plus, year-on-year growth rate, for many years to come. With net margins above 50% and such consistent growth, we are very happy shareholders of this wonderful business.

Michael's musings

I was disappointed that the SA Reserve Bank didn't cut by 50 basis points on Thursday. The Fed gave them the perfect cover to be bold and follow suit. We have a great team governing our central bank, but you could argue they are too cautious. Mind you, a bunch of cowboys would be worse.

Even according to the SARB's own forecasts, inflation will not go above 4.5% for the next two years. If electricity prices can somehow be stabilised, they expect inflation to drop to 3.7% early next year! A strong currency, lower oil prices, dropping food costs, and a global lowering of interest rates, is the perfect recipe to be slightly more aggressive with rate cuts.

The SARB only expects to do another three 25 basis point cuts over the next two years That isn't much cutting! Maybe the SARB has a bigger plan up its sleeve. Lesetja Kganyago has done a marvellous job of shifting our inflation target from 6% to 4.5%. I wonder if Kganyago wants to bash inflation down to 3% to make an official inflation target change from 4.5% to 3% official?

In the long term, having a 3% inflation target would be a good thing, especially for the poor, who are hurt the most by rapidly increasing prices.

Bright's banter

Johnson & Johnson is making a third attempt to settle the flimsy claims that its talc products caused cancer. J&J denies the allegations, and they are medically unfounded, but it faces over 62 000 claims. At this point, they are just trying to make them go away.

The company's strategy, informally known as the "Texas two-step," involves shifting the claim liabilities to a subsidiary, which then files for Chapter 11 to push for a global settlement and stop future lawsuits. Despite legal challenges and opposition, J&J secured over 75% support from claimants for its $10 billion settlement, increasing its chances of success this time.

The settlement has divided lawyers, with some supporting it as fair, while others argue that J&J is using this strategy to avoid paying full compensation, whatever that might be. These "ambulance chasers" are driven by greed.

The bankruptcy settlement tactic being used here has its critics, and is threatened by recent court rulings and potential legislation. Let's see how this unfolds. Keep in mind that J&J has a market value of nearly $400 billion, so spending $10 billion to settle this mess isn't a dealbreaker.

Linkfest, lap it up

Thinking of retiring to the Eastern Cape? How about buying South Africa's oldest continuously licensed pub - The historic Pig and Whistle Inn is for sale.

Most companies don't last longer than 100 years. The company that built the Titanic is 163 years old but struggling - Harland & Wolff files for bankruptcy for the second time in five years.

Signing off

Asian markets are looking good this morning. In general, the Japanese and Indian indices are at or close to record highs, but the Chinese markets are at five-year lows.

Shares of PT Barito Renewables Energy plummeted 20%, extending losses to nearly 36% since Thursday after FTSE Russell announced its exclusion from their indices. The index provider cited "high shareholder concentration" as the reason for removing the Indonesian power company from its benchmarks.

In South African company news, Investec expects steady first-half earnings, in line with last year's 38.7 UK pence. Revenue growth remained strong despite early election-related uncertainty, and the outlook improved with potential global rate cuts.

US equity futures have edged higher pre-market. The Rand is trading at around R17.39 to the US Dollar.

Our next newsletter will be on Wednesday morning. Have a festive Heritage Day tomorrow.