Market scorecard

Wednesday was another downbeat day for US markets, marking the fourth consecutive session of losses. This is the S&P 500's longest losing streak since the start of 2024. Annoyingly, this was the third session in a row where the index rose in early trading, but reversed course and closed lower.

In company news, Micron Technology is set to receive over $6 billion in grants from the US Commerce Department to build memory chip factories. Elsewhere, ASML closed down 7% after it saw a big drop in orders in the first quarter. They're the world's leading producer of chip-making machines, but have a lumpy sales cycle and are having issues with Chinese customers because of US export rules. Lastly, United Airlines' stock surged by 17%, making it the top performer in the S&P 500, following the carrier's announcement of stronger-than-expected quarterly results. Despite all the bleating about Boeing planes, flights are full.

Here's how it went, the JSE All-share was marginally lower by 0.01%, the S&P 500 fell 0.58%, and the Nasdaq sank by 1.15%. Like Dubai, underwater.

Our 10c worth

Byron's beats

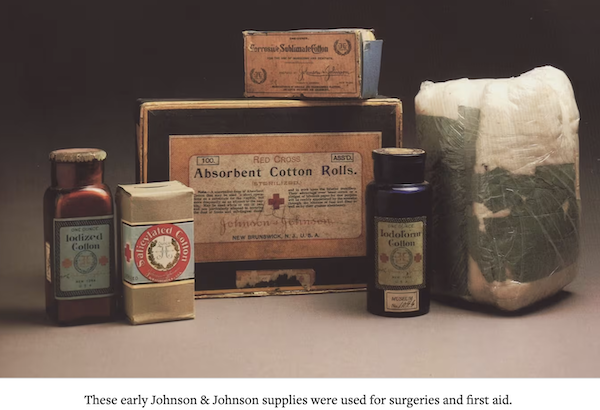

On Tuesday Johnson & Johnson released their first quarter results for the 2024 year. Earnings topped expectations while revenue was in line. J&J is now made up of 2 main divisions, medical devices and pharmaceuticals.

The medtech division did well with sales of $7.82 billion thanks to strong elective surgeries in the post-Covid era. That was 4% higher from the previous year. Pharma sales only rose by 1% to $13.56 billion but if you exclude the waning impact of Covid vaccines, which created an unrealistically high base, the rest of their brands grew by 7%.

J&J is a massive business with net income of $5.35 billion per quarter. That equated to $2.71 per share. The stock currently trades at 13 times this year's earnings and has a dividend yield close to 3.5%. Which, by the way, they just increased by 4.2%, the 62nd year of consecutive dividend increases.

This company ticks all our boxes but the share price performance has been very disappointing, basically flat over the last 5 years. The overhang of the talc class action and pretty sluggish growth compared to competitors has not helped.

We still think it can turn the corner and we advise clients to remain patient with this one. At least you are receiving that chunky dividend while you wait.

One thing, from Paul

Successful investing takes time. You need to add to your portfolio regularly, accumulate quality shareholdings, and then wait. And wait some more. And then see where you are after a decade, or two. Good things take time, great things take a little longer.

In that vein, I noticed that the unfinished Sagrada Familia Basilica in Barcelona will finally be completed in 2026. That's 144 years after construction started in 1882.

I visited the cathedral in 2010, on a family holiday. It was spectacular then, but the outside was covered in scaffolding. A few spires were missing.

The entry fees of tourists have funded the project. It currently costs EUR33 to go inside.

The building's architect, Antoni Gaudi, was untroubled by the slow progress and said, "My client is not in a hurry." He was referring to God, apparently.

Michael's musings

Yesterday, Stats SA announced that South Africa's inflation was 5.3%, lower than forecast and a drop from March's 5.6%, but still higher than the SARB's 4.5% target. These better-than-expected numbers resulted in the Rand strengthening and the ALSI popping higher.

Looking through the data, electricity and water tariff increases were significantly higher than average inflation. Sigh. Not only do you have to put up with these increasing monthly costs, but due to their higher-than-inflation increases, they are contributing to SARBs decision to not lower interest rates. Government incompetence is hitting your pocket twice.

Another contributing factor to sticky inflation is insurance prices going up 9.9% on average. When last did you get a comparable insurance quote? Maybe it's time to try that, especially if you haven't claimed recently. The price category that went up the fastest was 'sugar, sweets and desserts', rising by 17.8% over the last year. Maybe that isn't a bad thing?

Inflation is slowing, which is great, because that gives the SARB room to reduce the Repo rate. My best guess is that local interest rates will start to come down in the final quarter of this year.

Bright's banter

Luxury giant LVMH didn't have the hottest quarter, seeing its slowest sales growth since the pandemic rebound. Their fashion and leather goods division, including big names like Louis Vuitton, only managed a 2% bump to EUR10.5 billion in the first quarter, compared to the 18% surge seen a year back.

Overall, group sales ticked up 3% to EUR20.7 billion, meeting expectations. But currency swings made the numbers look less glossy. Blame it on the cool-off in Chinese demand for high-end French fashion and champagne.

Sales to Chinese customers globally rose by about 10%, but it wasn't as crazy as the post-lockdown frenzy in 2023.

Louis Vuitton didn't sparkle much in the US and Europe either, with sales almost flat in the US and slightly down in Europe. Even powerhouse brands like Dior and Louis Vuitton only managed around 2% sales growth.

Sales in watches and jewellery took a hit as well, especially Tiffany, which focuses a lot on the US market. Their wines and spirits had a tough time, with sales down 12%.

LVMH's growth may have slowed but it's still holding its own, unlike some rivals, I won't mention any names but Gucci and Burberry, I'm looking at you. LVMH's share price closed up 2.8% on the news, and has done well over a longer period. If you like the luxury goods industry, this should be a core holding.

Linkfest, lap it up

Barkley Marathons is the toughest foot race in the world. Only 20 people have made it to the end within the allotted 60 hours since 1989 - Jasmin Paris did it with seconds to spare, becoming the first woman finisher.

The most exciting sporting news from the weekend wasn't Scottie Scheffler winning the Masters. It was Wrexham getting promoted to the English 3rd division - Ryan Reynolds' football team is promoted for second year in a row.

Signing off

Asian markets rebounded sharply this morning sending the MSCI Asia-Pacific on track for its first advance since last week Thursday. Benchmarks rose in India, Hong Kong, Japan, mainland China and South Korea.

US equity futures are finally in the green pre-market. The Rand is trading at around R18.97 to the US Dollar.

On the earnings front, all eyes will be on TSMC, Netflix, Intuitive Surgical, and Blackstone today.

Best wishes.