Market scorecard

US markets rebounded yesterday as softer-than-expected wholesale price data eased concerns about inflation. These sentiment swings can be disorienting, but are fairly normal. The information technology sector led the way with a 2.4% surge, which suits us well.

In company news, Amazon shares hit a new record high, buoyed by CEO Andy Jassy's comments on the potential for generative artificial intelligence and more cost-cutting. Nvidia (+4.1%) and Apple (+4.3%) also enjoyed good gains. Elsewhere, Morgan Stanley dropped 5.2% after reports that federal regulators are investigating the bank's wealth-management division because their client take-on procedures may have missed a few money-launderers.

Here's the lowdown, the JSE All-share lost 0.29%, but the S&P 500 rallied by 0.74%, and the Nasdaq gained 1.68%.

Our 10c worth

One thing, from Paul

Fridays are for free advice, so here are some basic truths. Respect is earned, not given. The only way to feel good about yourself is to do the right things.

Take responsibility for your life, work hard, and be trustworthy. No one is coming to save you. Get your sh1t together.

Go to bed early and wake up early to exercise. Good health compounds over time.

Get organised by making a task list, then approach it with focus and determination. That will lead to good outcomes, and positive feedback. Be disciplined and diligent in all aspects of your life for a few decades and the results will be extraordinary.

Above all, get started. Time and tide wait for no man.

Byron's beats

According to the Federal Reserve, US household net worth hit a record high of $147 trillion in 2023. It grew by $11.4 trillion last year after dropping by $5.9 trillion in 2022. Ironically, 2021, saw the biggest growth in history with a $17.8 trillion increase. I say ironically because so many businesses were forced to close during that year due to the pandemic. Naturally, these numbers incorporate all mainstream assets like stocks, bonds, and property.

$147 trillion is a staggeringly large number. No wonder the US is such a powerhouse. When people feel wealthy, they are happy to spend. This has a lot of positive knock-on effects for a consumption-driven economy like the US. It's called the wealth effect.

Michael's musings

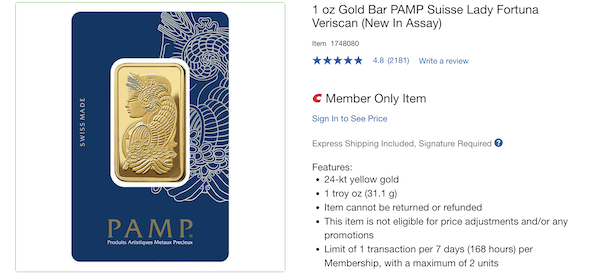

Towards the end of last year, Costco started selling 1-ounce gold bars on its website. According to Wells Fargo research, it is now a top-selling item, bringing in revenue of $100 to $200 million a month. If you don't know, Costco is like South Africa's Makro, but bigger.

I can understand why people want to own gold bars, because they are heavy and shiny. Costco only charges a 2% markup on the spot price of gold, which is a good deal.

I don't know how Costco makes money on this item. A 2% markup doesn't go very far once you factor in the cost (to them) of free shipping and maintaining secure storage facilities. I suppose gold bars create a bit of hype and drive revenue and traffic through their online channel.

In South Africa, physical gold buyers are ripped off by dealers who can charge as much as a 20% spread on their buy and sell prices. Excessive transaction costs makes physical gold a lousy investment. In addition, holding a lot of gold at your house is very risky. I'll stick to my Visa shares, thanks.

Bright's banter

A recent memo by Jack Ma to Alibaba employees gave the stock a 6% boost. Ma's opinion holds significant weight, even though the Chinese e-commerce scene has changed a lot since he left Alibaba.

PDD Holdings, owner of Temu, has become a big player and surpassed Alibaba in value. Temu's global push, especially in the US, is shaking up the industry. Their smart model, linking Chinese sellers with global customers, is working well. Shipping daily loads is causing airfreight issues in some areas. Temu has also spent billions on advertising with Google and Meta to gain market share.

Despite all the revenue growth, PDD's stock trades at a lower multiple than Amazon. I wouldn't touch it after my experience of investing in other Chinese companies.

PDD might be at the top today, the same way Alibaba once was, but with one swipe of his magic wand, Xi Jinping can make all of this disappear in the name of "prosperity for all."

Risks like US regulations and trade tensions, coupled with Chinese political uncertainty, are good reasons to avoid these companies. If you hold Alibaba shares, we recommend that you look for better options for your capital.

Linkfest, lap it up

Ozempic racked up sales of $21 billion in 2023. So how was it developed? - Belly fat blockbuster.

Humans can't function without rest. Brain performance, mood, and overall health require downtime - Not getting enough sleep may make you feel years older.

Signing off

Asian markets are a jumble this morning. Benchmarks rose in Japan but fell in India, mainland China, South Korea, and Hong Kong.

Here at home, WeBuyCars opened at R20.00 a share, higher than its listing price of R18.75 and finished the day at R20.40. Meanwhile, its holding company, Transaction Capital, closed down 63.9% to R3.61 a share, slightly below its implied value of R3.70. All in all, the unbundling seems to have unlocked a bit of value.

US equity futures are edging higher in pre-market trade. The Rand is at R18.74 to the US Dollar.

Several banks and financial institutions will report their earnings in the US today, including BlackRock, JPMorgan, Citigroup, and Wells Fargo. Earnings season is finally underway! We can shift our focus away from inflation for a while, to what really matters, company profits.

Another week is done. Have a restful break with lots of sleep and exercise.