Market scorecard

US markets edged higher yesterday, after a challenging session. The S&P 500 fell precipitously soon after the opening bell, but managed to recover and surpass the 5 200 level. Gains from megacaps like Tesla (+2.25%) and Alphabet (+1.28%) helped the cause. Financials and industrials traded lower.

In company news, Nvidia declined by 2% after Intel launched a new artificial intelligence chip, even though it has yet to be proven in the field. Elsewhere, Norfolk Southern stock climbed 1.3% following the railroad operator's agreement to pay $600 million to settle lawsuits stemming from a train derailment in Ohio last year.

In short, the JSE All-share closed up 0.20%, the S&P 500 rose 0.14%, and the Nasdaq was 0.32% higher. Not a bad outcome.

Our 10c worth

One thing, from Paul

I love stories about rich people living their best lives. Jeff Bezos just dropped $90 million on a third Indian Creek Island property. He has spent nearly a quarter-billion dollars buying up homes on this barrier island in Biscayne Bay, close to Miami in Florida.

I was in that area six weeks ago, and did some early-morning jogging around the man-made residential islands. That part of Miami has water everywhere, wide roads, lush vegetation and a brilliant climate. As in many suburban areas of America, the electrical infrastructure is above ground, which is regrettable. We had dinner one night in Surfside, just across the bridge from Indian Creek Island. It's all very glossy.

Why does Jeff need a third house in the area? He will live in this six-bedroom mansion while his dream home is built on two adjacent properties nearby, that he purchased in 2023.

Bezos is one of the world's richest people because he created the wonderful business which we co-own (we are ordinary shareholders of Amazon). He didn't marry into money, or inherit it. He's an entrepreneur. He deserves it all. Good for him.

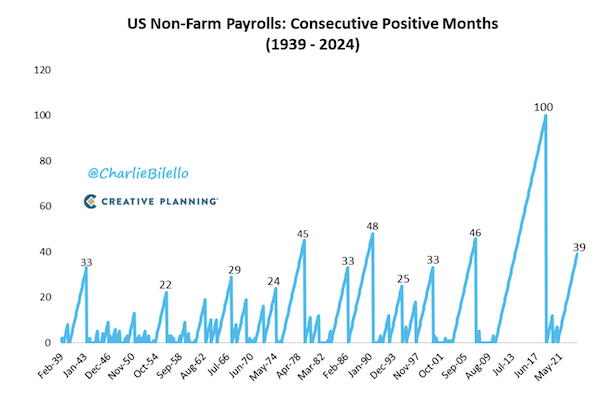

Byron's beats

The US released its monthly jobs report last Friday. A whopping 303 000 new positions were added, blasting past expectations of around 200 000. March was the 39th consecutive month of positive job growth, which is just phenomenal. The last time the US economy was not creating jobs was during the Covid lockdowns.

Another interesting statistic (thanks Charlie Bilello) is that the US unemployment rate has been under 4% for 26 consecutive weeks, the longest streak since the late 1960s.

Despite a massive surge in interest rates during 2022, the US economy has proved remarkably resilient. Markets are higher because they should be. Things are looking pretty rosy for businesses and their underlying earnings. It is a good time to be long US shares.

Michael's musings

Not all companies are created equal. Things we don't see, like their processes, systems and culture, play a very significant role in success. I was reminded of this recently when reading about the Williams F1 team. Williams is one of the oldest teams but haven't won a race since 2012, and are now regularly near the back of the field. They just haven't kept up with the times.

For example, the entire parts list for their car contains over 10 000 entries, and is kept on an Excel spreadsheet which doesn't contain information like the cost of the part, how long it takes to produce or where it is stored. Missing crucial data and wasting time with this outdated system means Williams has no hope of competing with the top teams.

We like to invest in the market leader within our preferred sectors, because they usually have these unseen things covered. They wouldn't have reached the top and stayed there without having a healthy culture and good internal processes. Winning companies tend to continue to be winners.

You can read about the issues at Williams here - A painful makeover.

Bright's banter

Ultramarathon runner Russ Cook accomplished an extraordinary feat by becoming the first person ever to run the entire length of Africa, covering nearly 16 250 km across 16 countries in 352 days! That's a little over a marathon a day.

The 27-year-old Brit faced numerous challenges on his journey, including being robbed at gunpoint and battling food poisoning. However, he remained determined to reach his goal and succeeded in raising over half a million British pounds for charity. He calls himself the Hardest Geezer on social media.

In a heartwarming conclusion to his epic adventure, supporters, including some who travelled specifically for the occasion, joined Cook on the final leg of his journey in Tunisia. There, he crossed the finish line to the cheers of "Geezer, geezer" before celebrating with a well-deserved strawberry daiquiri.

Can Nike sponsor this guy already so he can return to work and create shareholder value?

Linkfest, lap it up

Since 1970, how have stock returns compared to gold? It isn't even a contest, stocks won comfortably - Visualizing the growth of $100 by asset class.

Why do we need physical, stamped passports? Digital passports remain a dream - Stuck in our old ways.

Signing off

Asian markets are painting a mixed picture this morning. Benchmarks rose in India and Hong Kong but fell in Japan and mainland China. South Korean markets were closed as they observed National Assembly Election Day.

US equity futures are unchanged pre-market. The Rand is trading around R18.45 to the US Dollar. Not a bad level to do some switching from Randelas to George Washingtons?

Today, the US publishes updated CPI numbers. Economists anticipate a 0.3% increase in US consumer prices for March on a monthly basis, excluding food and energy costs. Meanwhile, the swaps market indicates an expectation of approximately 65 basis points of Fed rate cuts by year-end, a figure slightly lower than the central bank's forecast from last month.

Cool, cool. Have a lekker day.