Market scorecard

After three down days, US markets rebounded yesterday. Apple had a strong session, up 2.1%, recovering most of its losses this week after the announcement of a DOJ antitrust case.

In company news, Enphase Energy (+9.6%) was the best performer. The maker of micro-inverters and batteries benefited from a good day for renewable energy companies. The stock is still down around 40% over the last year. Arista Networks (-3.2%) was the worst performer after its founder, Andy Bechtolsheim, settled an SEC insider trading case. Weirdly, the case had nothing to do with Artista shares but a previous company founded by Bechtolsheim. Arista Networks is a $90 billion business that most people have never heard of.

Yesterday the JSE All-share closed up 0.41%, the S&P 500 rose 0.86%, and the Nasdaq was also higher by 0.51%.

Our 10c worth

One thing, from Paul

Seth Godin made an interesting point recently about wilful ignorance. Back in the old days (when I was younger), learning about something new was hard. You had to visit a physical library, and walk around trying to find relevant sources. There were books, but it was hard to know if they contained the right stuff. You might have to fire up a microfilm reader to scan copies of old newspaper articles. When all else failed, you'd try to find an expert to consult. You'd write them a letter or telephone them to set up an appointment.

Today, learning is very easy. We all have phones, tablets or laptops and can gather information online via Google and Wikipedia. If it's important to you, you can become knowledgeable about anything, right now.

AI is making this even easier. You can drum up a 50 page report on any complex topic, tailored for your purposes.

Godin: "If there's something I don't know, it's almost certainly because I haven't cared enough to find out. What else have you chosen not to know?"

Byron's beats

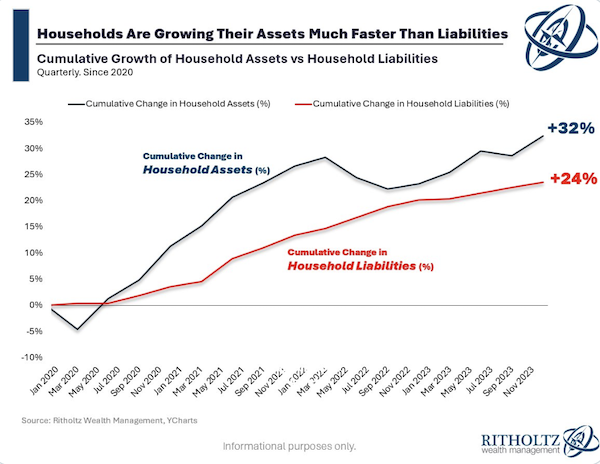

Have a look at this great graphic created by the team at Ritholtz Wealth, showing that households are doing much better than many headlines would suggest.

There are a lot of headlines talking about household liabilities in the US reaching all-time highs. What they are not telling you is that household assets are also at all-time highs and have grown more than the liabilities over the last 4 years.

What else is interesting from the image is the big bump up in savings during Covid, followed by a large spending spree as people were set free. It is good to see the momentum is back with asset growth.

Michael's musings

Larry Fink's annual shareholders letter out this week has people talking. Fink is the CEO of Blackrock, an investment firm with over $9 trillion in assets under management. In previous years, he addressed ESG issues and the role that companies need to play in ensuring a better tomorrow. This year the main talking point was retirement.

Fink said: "No one should have to work longer than they want to. But I do think it's a bit crazy that our anchor idea for the right retirement age - 65 years old - originates from the time of the Ottoman Empire."

It is a good question. What is the correct retirement age? Should we retire? When the US set their retirement age at 65 in the 1930's, life expectancy was only 58. Society has progressed a lot since then, leisure time is no longer reserved exclusively for a small portion of the population.

Given the increased value of leisure time, it makes sense that the retirement age has not increased with life expectancy, which is well into the 80s now, and still climbing. The catch though is that you need large amounts of savings to sustain a long retirement. France recently increased the national retirement age to ensure the sustainability of the national pension fund. The changes were met by widespread protests from government workers.

How we work is changing quickly. Hybrid work was the start. I expect four-day work weeks to become common and also a change in how we define work in older age.

Linkfest, lap it up

Finding simple and cost-effective solutions to big problems is amazing . Marine buildup on the bottom of ships can increase its emissions and running costs by 30% - New machines can scrap algae, seaweed and barnacles off ship hulls.

Having access to wifi is a top priority for all new office buildings. So it is a bit embarrassing when the roof on Google's new office 'eats' wifi signal - Google's newest office has AI designers toiling in a wifi desert.

Signing off

Asian markets are mostly green this morning. Japan's Topix fell 1.4%, but Australia's S&P/ASX 200, Hong Kong's Hang Seng and China's Shanghai Composite are all up over 1%.

As expected, the SARB kept local interest rates at a 15-year high yesterday. If we had to guess, rate cuts will only come towards the end of the year.

Today marks the end of the first quarter of 2024. Enjoy the 4-day break ahead. Don't eat too much chocolate, the price of cocoa is it at record highs!