Market scorecard

US markets closed in the red yesterday, for the third day in a row. The moves have been rather muted, as if the market is looking for the next big piece of significant data.

In company news, spice-maker McCormick enjoyed a tasty 10.5% gain yesterday thanks to better than expected quarterly numbers. UPS went in the other direction, dropping by 8.2% after releasing a muted long-term strategic update. This was the opposite reaction to FedEx, who topped the gainers a few days ago. As we said then, delivering parcels is a tough business!

At the closing bell the JSE All-share was up 0.44%, but the S&P 500 slipped by 0.28% and the Nasdaq dropped by 0.48%.

Our 10c worth

One thing, from Paul

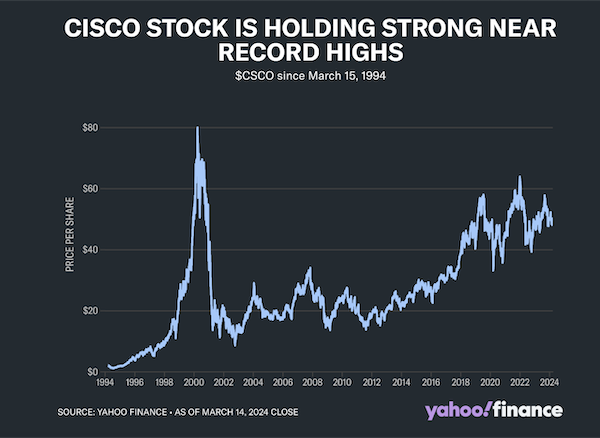

Twenty-four years ago, in March 2000, Cisco Systems was the most valuable company in the world. Ethan Wolff-Mann from Yahoo Finance notes that it had a market cap of $500 billion and was the leading supplier of routers, networks, servers, and switches in the first dot-com boom.

The chart below shows what happened next. It crashed in a general market sell off, falling by 90% by October 2000. It's done quite well since then, growing revenue from $12.5 billion per year to $57 billion now, but has still not regained those share price highs.

Some people look at Cisco's long-term stock chart and consider it a warning that bubbles exist in markets. Sceptics would say that any stock that goes up a lot should be sold. You might have heard the saying "trees don't grow to the sky". Kick it out, just because.

I'd counter that the Cisco price spike in 2000 was an anomaly. People back then went mad, bidding the shares higher and higher.

The long-term Cisco chart reflects the evolving value of a real business that employed thousands and made good products that underpin the Internet, perhaps humanity's most valuable asset.

As for other stocks that have done well recently, like ahem, Nvidia, keep an eye on their sales and profits. Those are still growing very steadily, so we are happy holders.

Byron's beats

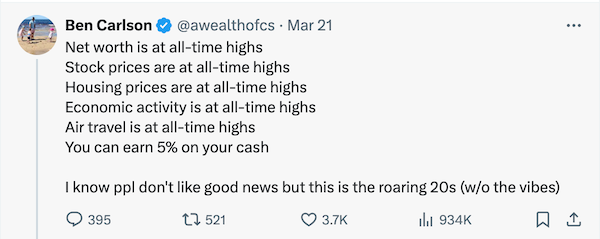

The media loves to report bad news. Market commentary is no different. Headlines are dominated by topics like war, inflation, elections, fines, The Fed, debt levels and so on. This is why I enjoyed the below tweet from Ben Carlson.

Don't forget that humans are very resilient and constantly innovating. We are slowly progressing all the time. In fact we are probably going through a purple patch of progress thanks to recent technological innovations.

Ignore all the rubbish and play your own part in the advancement of your self/family/business/community. It all adds up.

Michael's musings

One of the best things about working at Vestact is getting to meet and chat to intelligent and interesting clients. Being able to speak to people with different skillsets, views and experiences is hugely beneficial to my personal development, but also helps with my investment views. It reminds me of the story about Buffett who decided to invest in Apple after hearing how upset a friend was about losing his iPhone.

As I was leaving for my recent holiday, two different client books happened to arrive at the Vestact office. Perfect timing for me to tick 'holiday reading material' off of my packing list. Unsurprisingly, we have a number of authors in our client base. Johan, the author of one of the books, very kindly sent five free books for the Vestact community. So if you are a Vestact client, and Joburg based, let us know if you would like a copy.

I started reading Johan's book for his business insights, but found myself very interested in his amazing overlanding stories; now I need to plan some of my own. Check out the book - Overlanding through the boardroom: using adventure principles for success in business.

Linkfest, lap it up

Stepping out your comfort zone improves your life. Humans have an evolutionary need to be challenged - Reclaim your wild, happy, healthy self.

Would you eat lab-grown meat? Your pets might be less fussy - Meatly has teamed up with pet food company Omni to create the first wet cat food containing lab-grown chicken..

Signing off

Looking to the East, Japanese and Australian markets are up, but Chinese markets are down. The region as a whole is set for its best March quarter since 2019.

Locally, the SARB will probably announce that our interest rates will stay the same this afternoon. We can always hope for a cut though, as some other central banks have started doing that already.

US equity futures are currently pointing to a positive open and the Rand is at $/R19.00.

Only one and a half days left in this week. Make the most of it.