Market scorecard

US markets were mixed on Friday but still posted strong weekly gains, with the S&P 500 and Nasdaq up 2.3% and 2.9% respectively. The S&P 500 is up around 30% since the October 2023 lows - a very good showing for only five months. Can you remember what the market was fretting about back then? No, and neither can we. Well done if you stayed fully invested.

In company news, the athleisure sector had a terrible day on Friday. Lululemon dropped 15.8% and Nike dropped 6.9%, as both companies said they expected weak sales in the months ahead. Similar companies sold off in sympathy, with Under Armour down 3%, On Holdings off 2.5%, and VF Corp 3.1% lower. FedEx was the biggest large-cap winner on Friday, up 7.3% after reporting expanded profit margins. That stock is still down from its 2021 highs though, because low-margin, high-pressure logistics services is a very tough industry.

In summary the JSE All-share closed up 1.15%, the S&P 500 slipped by 0.14%, and the Nasdaq moved 0.16% higher.

Our 10c worth

One thing, from Paul

A client asked me last week about the security of our shares in New York and whether Vestact had protections in place to avoid getting hacked. Here was my answer.

Our client funds are in a safe-custody account at Fidelity, in US Dollars, in the US. Fidelity is a very well-capitalised and closely regulated entity; one of the "too big to fail" institutions that the Fed keeps a beady eye on. Client funds are always separated from those of the custodian, that is a core feature of the US asset management industry. Fidelity had over $12.6 trillion under administration at the end of 2023.

At close of business on Friday, the value of Vestact client assets at Fidelity was $513 133 482.24. That's over half a billion US Dollars, made up of ordinary shares and some cash.

Our web systems have an "air gap" to the Fidelity platform. In other words, our clients can look at their portfolios on our website but can't do any trading or extract any cash. We do all of that after careful consultation.

The key risk in a business setup like this is the clients being hacked, and fraudsters submitting bogus instructions, especially "updated" bank details. As a result, we always confirm client communications of that nature by WhatsApp or by making a confirming voice call. We only have 1 224 clients and we know them all quite well. So even if you get hacked, your shares with us are safe.

If you ever feel that you have been the victim of a web hack, please let us know. We will be on extra-high alert.

Byron's beats

Air conditioning is expensive and uses a lot of electricity. I love this idea of surface paint that can cool down buildings. According to News 24 this paint product is being applied to military bases in Limpopo, a notoriously hot province.

The project is seeking to cover 1.37 million square metres by 2025. It also includes housing for staff, schools and clinics. It sounds like a no-brainer to apply the paint to all government structures around the province.

Apparently, the paint contains a specific titanium compound, is being manufactured locally, and has been successfully used for over two decades around the globe.

Michael's musings

I recently watched Amazon Prime's Air: Courting A Legend. It covers the early days of Nike, specifically looking at the story that led up to Nike and Michael Jordan joining forces. The movie is a reminder that Nike used to be a very small player in the footwear market. We all know that Nike is now a titan in the sportswear sector, holding about 66% of the global sneaker market.

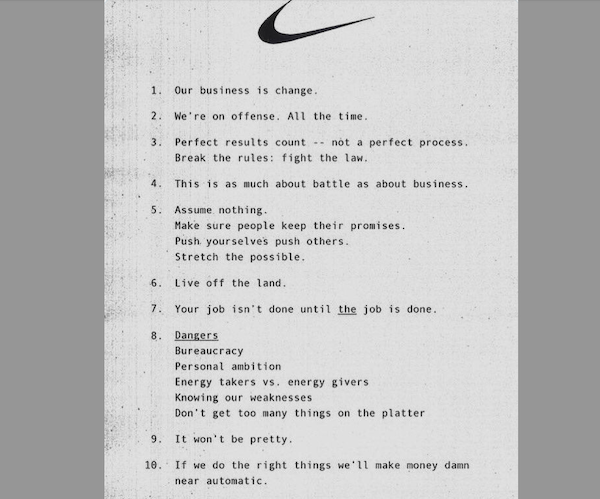

One of the reasons it was able to grow so big was due to the 10 principles below. This list was written by Rob Strasser, an executive at Nike, in 1977. Anyone who has worked in a corporate will know that many of these principles don't hold as a company grows. Increased headcount usually leads to bureaucracy and slow decision making.

Apart from being good business advice, I found many of the items on the list useful for my personal life too.

Linkfest, lap it up

Kongjian Yu pioneered China's sponge city concept. Less concrete and more green spaces to exploit stormwater instead of fighting it - Metropolises around the world are following suit.

Elvers are the most valuable fish in the world. That's because they're important to the worldwide supply chain for Japanese food - Wriggling gold: baby eels.

Signing off

Over in Asia, Japanese and South Korean markets are down, while mainland Chinese, Hong Kong and Australian shares inched higher. Last week, Japan's Topix recorded its best week in over two years.

It's a busy economic week ahead. Most notable is an interest-rate decision on Wednesday by the SARB, which will probably leave rates the same, and then on Friday is a US PCE reading (the Fed's preferred inflation gauge).

US futures are slightly lower this morning. The Rand is currently trading at R18.96 to the US Dollar.

Are you ready for another four-day week? Sounds good!