Market scorecard

US markets hit new highs yesterday after traders bet that the cost of borrowing will come down soon. On Wednesday, the Fed kept its benchmark rate unchanged but signalled a few cuts later this year. All three major indices rose to new records simultaneously for the first time since November 2021. Great stuff!

In company news, Apple sank by 4.1% last night after the US Department of Justice accused it of illegally maintaining a monopoly in the smartphone market. What nonsense! We will hold the shares. Nike delivered good results but the shares went down in after-hours trade as its management team sounded dejected on the earnings call. Nerd-favourite website Reddit debuted on the markets and popped 48%. Finally, Steinhoff swindler Markus Jooste shot himself in Hermanus.

To recap, the JSE All-share closed up 0.77% on Wednesday, yesterday the S&P 500 rose 0.32%, and the Nasdaq was 0.20% higher.

Our 10c worth

One thing, from Paul

Rob Henderson (pictured below) is an interesting writer who focuses on personal development issues and the problem of "luxury beliefs". He had a tough upbringing as a foster child, then entered the US military, and went on to study at Yale. He's just 33 years old and recently wrote a book called "Troubled".

This comment of his is perfect for my Friday advice contribution: "Two-parent families are more important than college". In other words, growing up in a stable home with a reliable mother and father is a better predictor of success in life than going to university and getting a degree.

Henderson: "I'm well aware that there are situations in which divorce makes sense. Abuse, mistreatment, truly irreconcilable differences, and so on. Most divorces, though, are the result of low-conflict disputes. And most single-parent families are not the result of divorce, but rather deadbeat dads."

Byron's beats

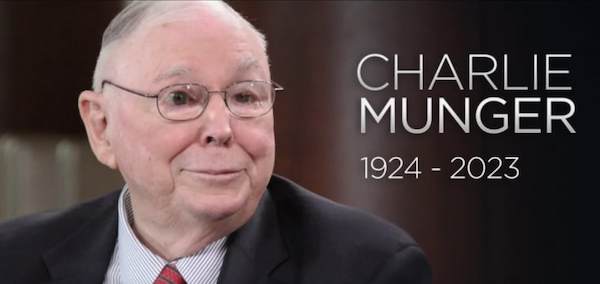

Here's a good line from the late, great Charlie Munger. "(1) Take a simple idea and (2) take it very seriously)".

I would say that Vestact has done this pretty well. We often get asked why we don't offer tax advice, holding structures, run a fund or do financial planning? Because that stuff is distracting. The simple idea is to offer clients a platform to buy listed equities and to give advice on which are the best shares to own. There is one layer of fees and each client has a personal relationship with us. Crucially, we are a consistent team so your relationship with us will remain with the same people throughout your investment journey.

By keeping our business simple we are able to offer clients the best service and we can apply our full attention to stock picking. Which, as Charlie advises above, we take very seriously.

Bright's banter

The FDA has greenlit Novo Nordisk's Wegovy, a popular weight-loss drug, for use in reducing the risk of serious cardiovascular complications in adults with obesity and heart disease. This move could broaden insurance coverage for the drug, addressing a significant access barrier.

Wegovy, administered through weekly injections, has shown promise in cutting the overall risk of heart attack, stroke, and death from cardiovascular causes by 20%, according to a key late-stage trial. This makes it the first weight-loss medication to receive expanded approval for this purpose.

Both Wegovy and its lower-dose counterpart Ozempic are hard to get hold of due to production challenges. They belong to a class of drugs that mimic a gut hormone to curb appetite, with a monthly cost in the US of around $1,000.

Wegovy underscores the broader health benefits of weight-loss drugs beyond just shedding pounds and managing blood sugar levels. We expect to see similar results from Eli Lilly's Zepbound.

Linkfest, lap it up

In a brain activity study, walking a poodle relaxed people. Brushing the dog improved concentration and playing with her had both effects - Get a dog.

Pollen is partly responsible for increasing car accidents. New study links seasonal pollen levels with traffic fatalities - Driving under the influence of allergies.

Signing off

Asian markets have backtracked this morning a day after the Japanese Nikkei hit new highs.

The People's Bank of China (PBOC) made its most significant reduction to the daily reference rate since early February. Beijing is also allowing further depreciation of the Yuan amidst a challenging economic recovery. The Chinese CSI 300 index and the Hong Kong Hang Seng are down 1.5% and 3%, respectively, marking their largest daily drop since January.

US equity futures are unchanged pre-market. The Rand is trading at around R18.94 to the greenback.

Happy Friday to those who are hard at work today. If you are on holiday, well done for still reading your daily dose of Vestact.