Market scorecard

US markets climbed higher yesterday, touching fresh peaks. We are happy now, but the Fed's interest rate decision still lies ahead. The S&P 500 is at an all-time high, and up 9.2% year-to-date, while the tech-heavy Nasdaq Composite has risen 9.5% in 2024.

In company news, Unilever rose 3.2% after the FMCG giant said it was going to spin off its ice-cream division that includes brands such as Magnum and Ben & Jerry's. Locally, Remgro closed down 4.6% after the conglomerate reported headline earnings that came below expectations. CEO Jannie Durand complained that unnecessary regulations were slowing down corporate dealmaking.

Here's the lowdown, the JSE All-share closed down 0.78%, the S&P 500 rose 0.56%, and the Nasdaq was 0.39% higher. Nice!

Our 10c worth

One thing, from Paul

Japan has just done away with its negative interest rate policy. I'm happy about this, because in my view, borrowing someone else's money should always cost something. Also, it's ludicrous to deposit cash at a bank, and watch your balance go down at the end of every month, not up.

The idea behind negative rates was to discourage the hoarding of cash, and stimulate risk-taking investments, and was brought in after the global slump of the US sub-prime crisis. The European Central Bank tried them out, as did monetary authorities in Switzerland, Denmark and Sweden.

Japan seemed to be trapped by sluggish growth and deflationary conditions, but is on the mend now. Bank of Japan governor Kazuo Ueda (pictured below) announced the bank's first rate hike in 17 years on Tuesday. Well done!

We expect more normal financial conditions to prevail for the rest of this decade. Low inflation, decent growth and more policy certainty. A good time to be fully invested in the shares of world-leading corporations.

Byron's beats

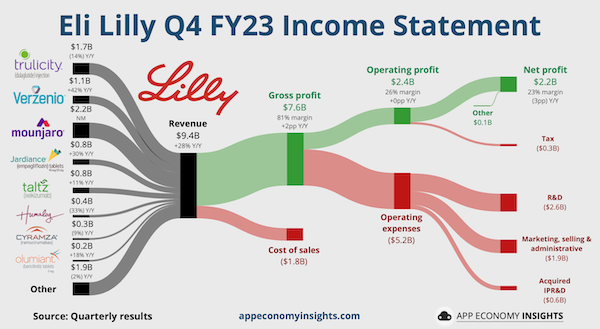

We have written about Eli Lilly a lot lately because it has recently received the highly sought-after Vestact stamp of approval. Most of the focus is on their weight-loss drug Zepbound which has only just hit the market. Keep in mind that before all this excitement Eli Lilly was already a well-established player with a diversified portfolio of pharma brands.

Take a look at the image below from App Economy Insights which shows their various products and their contribution to sales.

Trulicity and Mounjaro are both type 2 diabetes drugs that also have weight-loss side effects. In fact Zepbound was born out of Mounjaro. It has the same active pharmaceutical ingredient but is used to address different conditions, in different dosages. Verzenio is a breast cancer treatment, Jardiance is for managing blood sugar levels in diabetics, Taltz treats various autoimmune diseases, Humalog also treats diabetes, Cyramza fights colorectal cancer and Olumiant tackles Rheumatoid arthritis.

It is nice to know that this business has a stable underpin and is not just a one-trick pony.

Bright's banter

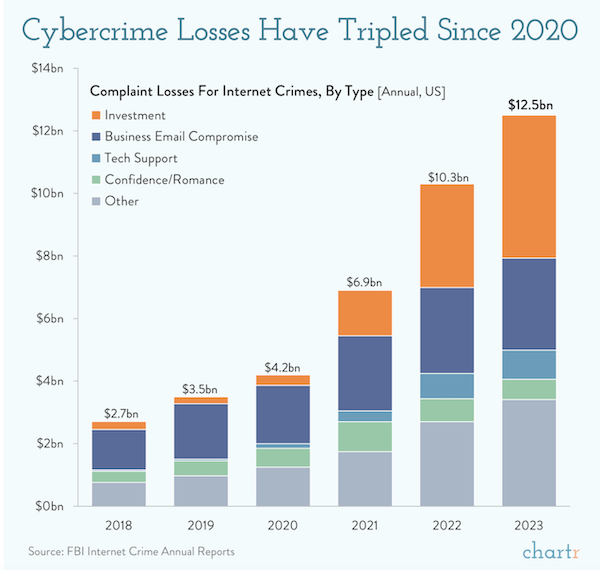

In today's digital age, our lives are increasingly intertwined with the online world, making us susceptible to cybercriminals.

The FBI's latest Internet Crime Report revealed a sharp increase in losses to internet crimes, totalling $12.5 billion in 2023, marking a significant 22% rise from 2022. Investment scams, in particular, saw a notable surge, experiencing a 38% increase in stolen money.

The monetary losses associated with cybercrimes almost tripled since 2020 to $8.3 billion. Scammers are becoming more adept at extracting larger sums per attack. This trend is partly attributed to a shift towards finance and tech-related schemes, with losses related to cryptocurrency scams alone spiking by 53% over the past year.

Even those who evade individual hacks may still fall victim to mass data breaches, which pose diverse risks given the widespread dissemination of personal information.

High-profile breaches like those targeting 23andMe have affected millions, underscoring the far-reaching consequences of cyber threats in today's interconnected digital landscape. If this doesn't convince you to buy some Crowdstrike shares, I don't know what will.

Linkfest, lap it up

Cystic fibrosis once guaranteed an early death. New treatments are giving patients a chance to live decades longer - Take Trikafta for a new lease on life.

Candy makers want you to chew gum again. They're pitching it as a stress reliever and concentration tool - Chomping in company, ew!

Signing off

Asian markets are broadly higher this morning, channeling moves from Wall Street. Chinese markets rose after the politburo kept lending rates unchanged. There's also focus on results from companies like Tencent and PDD Holdings which will help investors assess the health of the Chinese consumer.

US equity futures are slightly down pre-market. The Rand is trading at R18.91 to the US Dollar.

There's a lot happening today, with Eurozone consumer confidence numbers out, the Federal Reserve's interest rate decision, and Reddit's IPO.

Tomorrow is Human Rights Day in South Africa, so there'll be no newsletter. Happy fake Friday!