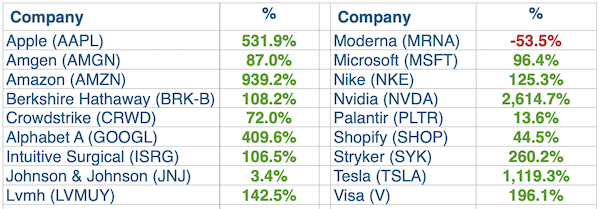

Market scorecard

US markets softened yesterday following the release of producer inflation and jobless claims data, which dampened expectations for interest rate cuts. PPI and CPI data for February both exceeded expectations, and the S&P 500 and Nasdaq retreated a little, for a second consecutive session.

In company news, Adobe is down 11% after hours after issuing a soft sales forecast for 2024. Elsewhere, Robinhood advanced by 5% after the low-cost online brokerage firm said trading volumes surged in February. Lastly, Under Armour shares slumped 11% on news that its founder Kevin Plank will be making a return as its CEO.

Izolo, the JSE All-share closed down 1.24%, the S&P 500 slipped 0.29%, and the Nasdaq was 0.30% lower. Not a disaster.

Our 10c worth

One thing, from Paul

It's advice time again (my usual Friday contribution). When faced with a difficult decision, favour the contrarian option. I got this idea from Erik Hoel, and you can read his full theory on this Substack post.

Here's the core thought: "If two options present an agonizing choice for you personally, then choose the one that would be the less common choice, the opposite of what your culture pushes, since you are likely downweighing its success substantially. If the ship is tilted, and both left and right have their own equal pulls, choose to go against the tilt."

The point is best illustrated with some examples. If faced with the choice of a great new job in a different city, or sticking with your current employment, and moving in with the newly-discovered love of your life, pick the one your parents would not want you to do. Don't just go for what is considered the "right thing to do" in your context.

Hoel gives another example of choosing between taking a degree at a university far away, because it sounds more prestigious, or opting for one at the institution in your home town. He suggests that if the programmes are the same, being physically close to your family might be more important in the long run.

Michael's musings

In March 2018 I decided to share my portfolio with our clients as a way of showing that Vestact eats its own cooking. Since then I've been doing it on an annual basis.

The last 12 months have been amazing for our clients, and that's visible in my account returns too. A year ago, my Palantir position was down 64%, Netflix was down 39%, Crowdstrike was down 38% and Shopify was down 25%. Not all my losers from last year recovered though, Moderna has gone from being down 39% to down 54%. Ouch.

The biggest story over the year is Nvidia's rocket ship flight higher. My position went from a 593% gain to 2 615% up. Hopefully this won't be the only 20-bagger in my investing career!

Getting those gains wasn't easy. I first bought Nvidia at the end of 2016. Since then there have been two periods where the stock lost 60% of its value. The first was in 2018, when an initial crypto bubble burst and Nvidia lost sales to Bitcoin miners. The second was in 2022, when most tech stocks got walloped.

You need real conviction to hold a stock through a 60% pullback, which I was able to do because I kept my eye on the horizon. We knew that Nvidia was perfectly positioned to take advantage of the growing need to process large amounts of data. We didn't know back then that AI was going to supercharge that trend.

Bright's banter

Telegram, the messaging app, recently hit 900 million monthly active users, up from 500 million in early 2021. The company, helmed by CEO Pavel Durov, is approaching profitability and eyeing a potential IPO.

Telegram has seen substantial revenue growth, reaching hundreds of millions of dollars, mainly through advertising and premium subscription services introduced in the last two years. Its valuation exceeds $30 billion and Durov wants to remain independent, indicating a preference for an IPO.

While Telegram has been a popular communication tool globally, especially in regions with limited freedom of expression, it has also faced scrutiny for its nonexistent moderation policies, which some argue facilitate criminal activity and misinformation.

They are introducing revenue-sharing initiatives for creators, expanding advertising globally, and trying to enhance moderation processes with AI.

Linkfest, lap it up

Great developers steal ideas, not products. Think Mark Zuckerberg - The difference between borrowing and stealing.

Amazon's online pharmacy just got a boost. The company is bulking up as it helps people drop weight - Amazon will now deliver Eli Lilly's weight-loss drug Zepbound.

Signing off

Asian markets are mostly down this morning. Benchmarks fell in India, Hong Kong, mainland China, and South Korea but rose in Japan.

The People's Bank of China maintained the rate on its one-year policy loans at 2.5% and implemented a cash withdrawal from the banking system for the first time since November 2022.

US equity futures have cooled off again pre-market. The Rand is trading at around R18.77 to the US Dollar.

South African internet users were hit by email and connectivity outages yesterday. Our inboxes seem to have stabilised, but if we haven't responded to a message from you, please send it again.

Have a good Friday and a great weekend.