Market scorecard

US markets slipped yesterday, weighed down by a drop in semiconductor stocks. We can't complain, as the S&P 500 only fell slightly after hitting a record high on Tuesday. The biggest losers were Dollar Tree (-14.2%), Tesla (-4.5%), Intel (-4.4%), AMD (-3.9%), and McDonald's (-3.9%).

In company news, Japan's Nippon Steel declined following reports that Joe Biden was against its proposed acquisition of US Steel. The latter tanked by 15%, ouch. Over in Germany, Adidas closed up 3.8% as it swung back into profitability and reported better-than-expected numbers. Lastly, Volkswagen closed down 5.9% after yet another set of lacklustre results.

In summary, the JSE All-share closed up 1.05%, but the S&P 500 fell 0.19%, and the Nasdaq was 0.54% lower.

Our 10c worth

One thing, from Paul

The elections that affect us most are those in South Africa (where we live) and in the United States of America (where we invest). The voting days will be 29 May and 5 November, respectively.

Both elections will be tense affairs, with wide policy differences between rival candidates. There may be delays in counting the votes, contestation of the results and time taken to form ruling coalitions.

Investors are not fond of uncertainty, so equity and currency markets may be volatile in the months ahead. In the lead-in, a great deal of attention will be focused on opinion polls. Keep in mind that small groups of potential voters are surveyed, and asking someone months ahead of voting day where they plan to put their 'X' is like asking people if they will regularly attend gym next month - they may make a different decision closer to the time.

Whatever happens, we are patient investors who own shares of resilient companies. We will bide our time, assess the outcomes, and only take carefully-considered actions. We are well-positioned for all scenarios.

Michael's musings

We've known for a while that the US election would most likely be Trump versus Biden, this week it became official. I still can't believe that out of 260 million US adults, these two were the best that the country could do. As you can tell, I'm not a fan of either candidate.

Who would be preferable from a South African perspective? Probably Biden because he is more in favour of globalisation, and supporting weaker foreign trade partners. When Trump was in power, he put the US's globalisation efforts into reverse gear.

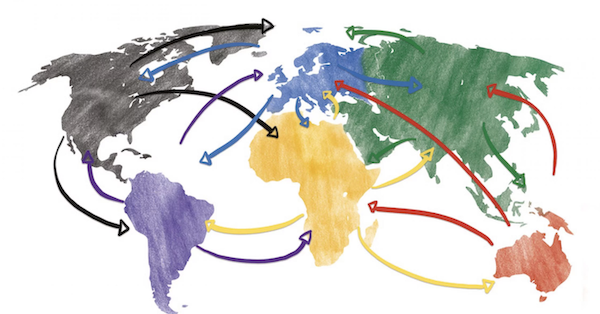

The recent DHL Global Connectedness Report showed that global trade levels have recovered to pre-pandemic levels and that global connectedness is near its 2022 record high. Even though we are moving in the correct direction, there is still a lot of work to do.

According to a Bloomberg take on the report: "The absolute level of globalisation remains relatively low - at 25% on a scale where zero means no trade is happening and 100% means borders and distance don't factor at all".

If every nation became inward-looking, not trading with neighbours or sharing knowledge, human progress would completely stall. Humanity is at its best when we are connecting with people from all over the world, and exchanging goods and services.

Bright's banter

Despite a slowdown in electric vehicle (EV) sales, BMW has defied expectations. The German carmaker has adopted a unique approach by producing both petrol and electric vehicles on the same assembly line, and they're seeing some success.

In 2023, BMW sold 376 000 EVs, marking a significant 75% increase from the previous year. While this placed BMW second in the luxury car sector, it still trails behind Tesla, which sold 1.8 million cars in the same period.

BMW is gearing up to compete more fiercely with Tesla by introducing a new line of EVs in 2025. These vehicles will feature batteries capable of holding up to 20% more energy per kilogram and will boast innovations not found anywhere else.

Linkfest, lap it up

Steve Jobs said people should try LSD. The drug may be cleared for medical use soon - Single dose of LSD provides immediate and lasting relief from anxiety.

Weight-loss drugs are putting gyms out of business. Older people can stay trim without working out- Ozempic and Zepbound are causing a rethink in the exercise industry.

Signing off

US equity futures are unchanged pre-market. The Rand is trading at around R18.60 to the greenback.

Adobe, Dick's Sporting Goods, Ulta Beauty, Weibo and Dollar General will report earnings today. To be honest, these are all second-division companies.

We will be back with more ideas tomorrow. All the best.