Market scorecard

US markets closed marginally lower on Monday. There is a key monthly inflation read out today, and traders will be looking for clues about the speed of potential interest rate cuts from the Fed. The CPI rate is expected to hold steady at around 3.1% year-on-year.

In company news, natural gas producer EQT dropped 7.8% after it announced a deal to acquire back its former subsidiary for $5.5 billion. Elsewhere, Chinese electronics giant Xiaomi rose by 9.6% after announcing sales of its long-awaited electric vehicle models this month. Finally, Moderna was the biggest winner in the S&P 500 (+8.7%) on news of a new clinical trial for a skin cancer treatment.

In summary, the JSE All-share closed down 0.32%, the S&P 500 fell 0.11%, and the Nasdaq was 0.41% lower. A muted start to the week.

Our 10c worth

One thing, from Paul

We're often asked how we come up with our portfolio recommendations. Some suspect that we have a secret method that spits out random suggestions, involving proprietary algorithms. Others ask us for our "models", hoping that we have some complex, multi-input Excel spreadsheets that they could pick apart.

In truth, we select well-known companies in sectors that we like, that we've been following closely for years. It's just based on reading the news and paying attention to what's working in the global economy.

Once we decide to add something new, we recommend it to a small group of clients, then start taking the idea more widely. We will advise investors to send fresh money to get stuck in.

That's the reason that we recently tipped Eli Lilly. Their weight loss drugs are going to sell very, very well in the years ahead. The share price has already gone up a lot, but there is more upside to come.

I'm reminded of this great quote by French poet Charles Baudelaire, when asked to explain how he had such creative ideas: "Inspiration is merely the reward for working every day."

Byron's beats

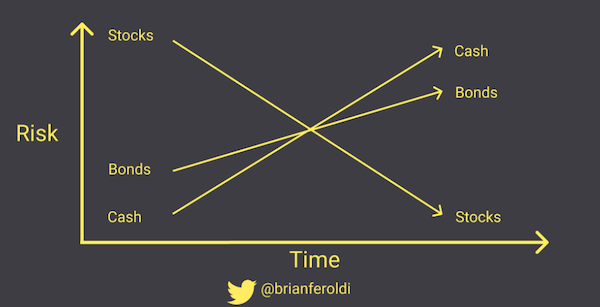

Over the last 7 years, US bonds have returned 1% per annum, on average. By comparison, the S&P 500 has given patient investors 10.5% per year. When I saw those numbers, I was reminded of the image below, which we have shared before in this newsletter but is worth repeating.

Over a short period, sitting on cash (or bonds) is almost risk-free because the value of your money will not go down. However, if you sit on cash for the long term you are guaranteed to lose money, because of inflation. A guaranteed loss sounds like risky business to me.

However, when it comes to stocks (US stocks in particular), the market can be volatile and your investment could go down as soon as you get in. But history has shown that over the long run, shares will go up. The risk becomes less the longer you are invested. Nice and simple.

Michael's musings

On Sunday, oil giant Saudi Aramco reported profits of $121 billion for the last year. This is lower than the $161 billion reported the year before, but still makes it the second-highest profit declared by any public company in history. Apple makes profits of around $95 billion, by comparison.

I generally cheer on company successes, but the Aramco profits leave a bitter taste in my mouth. Eskom and South African businesses are spending tens of billions of Rands on diesel to run generators and turbines to mitigate loadshedding. A chunk of that money goes to Aramco, which in turn pays it out in dividends to the Saudi government, which is using it to develop their nation.

It is very frustrating to watch money that could have been used to support our economy being transferred to other nations. Instead of fixing the loadshedding problem, our political leaders just drive around in large motorcades (using more diesel), feeling important. I was going to use foul language to describe our ineffective politicians, but here is some Nando's humour instead - Blue light brigade.

Bright's banter

There are indications that TikTok's rapid growth is beginning to level off, marking a significant shift from its explosive expansion since launching in 2016.

According to market intelligence firm Sensor Tower, Instagram saw a 20% increase in total app downloads in 2023, reaching 768 million downloads worldwide. This growth positioned Instagram as the most downloaded app globally for the year.

By contrast, TikTok saw a more modest 4% increase in downloads, reaching 733 million over the same period. These figures suggest that Instagram, Meta's photo-sharing platform, is effectively attracting new users.

Meta CEO Mark Zuckerberg has previously highlighted the growth of TikTok as a major threat to his company's social media dominance, and the data reflects Instagram's success in addressing this challenge.

Linkfest, lap it up

Are you a one percenter? Here is how much wealth you need in different countries to be at the top of the pyramid - You don't need a private jet to be in the top 1%.

Everyone wants financial freedom. However, saving and investing for a long time takes discipline - Can the typical person become a millionaire?

Signing off

Asian markets are mostly higher this morning. Benchmarks rose in India, Hong Kong, mainland China and South Korea as technology shares outperformed. The Japanese market fell. Shares of regional steelmakers dropped after the price of iron ore slipped to its lowest level since 2022.

US equity futures are in the green pre-market. The Rand is trading at around R18.70 to the US Dollar. May be a good time to send some funds offshore?

Have a good day, wherever you are.