Market scorecard

US markets declined on Friday, ending the week on a downer, influenced by mixed signals from the latest US jobs report. The information technology sector was the hardest hit on the day. All three major indices logged weekly losses.

Friday's employment report showed that 275 000 jobs were added in February, exceeding expectations. Somehow, the unemployment rate edged up to a two-year high of 3.9% and wage growth slowed. These mixed signals point to a strong but slowly cooling labour market, which is fine really.

In company news, Broadcom closed down 7% after the chip and software company reported profits that missed forecasts. Nvidia was down 5.6% in sympathy. Costco slipped by 7.6%, becoming the S&P 500's worst performer after the warehouse-based retailer announced sales that missed estimates.

On Friday, the JSE All-share closed up 0.15%, but the S&P 500 fell 0.65%, and the Nasdaq was 1.16% lower.

Our 10c worth

One thing, from Paul

Last month, the blue-chip Nikkei 225 Index in Japan finally reclaimed its 1989 high. Investors had to wait 35 years before making any capital gains. That must have been challenging for those that were advised to "buy and hold".

Interestingly, the recovery has been driven by foreign investors, who account for around 70% of trading in the Japanese market. Local investors aren't really interested in stocks, which is understandable.

Equities are just 11% of household financial assets in Japan, compared with 39% in the US and 21% in Europe. Japanese families hold over half their assets in cash.

A government program to incentivise stock ownership could help. There's an expanded tax-free Nippon Individual Savings Account (NISA) scheme similar to our tax-free savings accounts (TFSAs) here in South Africa.

I'll be visiting Japan with my family in May, and look forward to learning more about the country. They are now the fourth biggest economy in the world, after having recently been overtaken by Germany.

Byron's beats

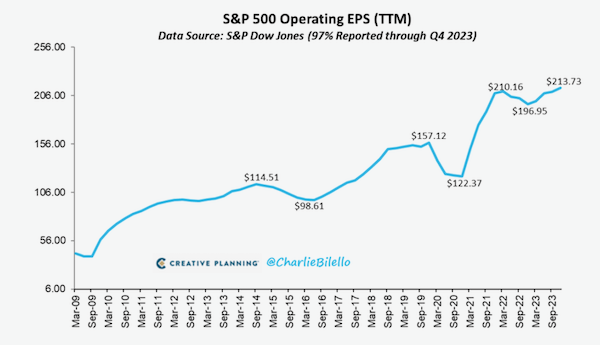

Yes, the US market is at all-time highs, but more importantly, so are the underlying company earnings. The recent earnings season, which provided a look back at the final quarter of 2023, was very solid, with aggregate earnings surpassing the previous all-time high set in Q1 of 2022.

Earnings per share grew 22% compared to the same period a year prior. It was the fourth straight quarter of growth and the highest rate of growth since 2021. This is proof that the recent rally is not just smoke and mirrors, or based on AI hype. There is real money being made and the market is going up because it should be going up.

Michael's musings

Last week, Grindrod released results that were a mixed bag. The best feature was a 28% volume increase at their Mozambique port operations. The Mozambique government decided to allow the private sector to run its ports, and companies like Grindrod and DP World operate some of the terminals.

Our neighbour's ports are thriving thanks to South Africa's incompetence. This is economic activity that our own economy desperately needs, but our rail infrastructure is in shambles and the volume of cargo going through our ports is declining. If you have driven to the Lowveld recently, you will have seen a large number of trucks heading to Maputo. Some of the smaller towns along the N4 have become unofficial truck stop depots, it's a mess.

Until we have a government that understands that the only way to grow an economy is through the more efficient use of our resources, we will continue to bumble along at 1% growth a year. It doesn't matter how many people the government employs or how many grants they dish out, if our infrastructure continues to crumble, the economy will be a lame duck. Vote wisely on 29 May.

Bright's banter

YouTuber Marques Brownlee's scathing review of Fisker's latest EV has garnered significant attention. Brownlee, known for his detailed tech reviews, labelled the Fisker vehicle as the "worst car I've ever reviewed," sparking a heated exchange between him and the company.

Brownlee's review already has 4.4 million views and highlights various problems with the car, including unlabeled buttons, non-functioning features, and software glitches. Despite acknowledging the car's appealing physical design, Brownlee's overall assessment was highly critical.

Fisker's response to the review took a bizarre turn when a senior engineer contacted the dealership that loaned Brownlee the car in an attempt to mitigate the damage. However, the conversation inadvertently revealed ongoing software issues with the car, further damaging Fisker's reputation.

The fallout from Brownlee's review has been significant, with Fisker's stock plummeting 52% since the video was posted. This incident underscores the growing influence of social media reviewers in shaping consumer perception and product reputation.

Linkfest, lap it up

Netflix continues to expand into live sport. This time it is with boxing - Mike Tyson, 57, will return to the ring against YouTuber turned fighter Jake Paul.

Mercury levels in tuna are unchanged since 1971. This is not good news - Don't quit your seafood yet.

Signing off

Asian markets are mixed this morning, with benchmarks rising in Hong Kong and mainland China but falling in India, Japan, and South Korea. Japan led the losses as traders speculated that the central bank would have to start increasing interest rates soon after its economy expanded in the fourth quarter. The Yen strengthened against major currencies.

US equity futures are in the red pre-market. The Rand is trading at around R18.78 to the US Dollar.

This week we will see quarterly reports from Oracle, On Holdings, Adobe, Ulta Beauty, and Dick's Sporting Goods.

The US has re-entered daylight savings, so Wall Street will open today at 15:30 South African time. This is great news!