Market scorecard

US markets closed in the green yesterday following encouraging remarks from Fed chief Jerome Powell. The US central bank is on track to cut interest rates sometime this year, we just don't know when. The S&P 500 reclaimed the 5 100 level.

In company news, Chinese e-commerce giant JD.com rose 16% after delivering a solid set of results and announcing a $3 billion share buyback programme. Elsewhere, Nvidia closed up another 3.2% on an upgrade by Moody's. What a star performer this company has been! Lastly, cloud-content software company Box Inc. rose by 8.6% following a positive earnings surprise.

At the end of the day, the JSE All-share was up 1.85%, the S&P 500 rose by 0.51%, and the Nasdaq ended 0.58% higher. That's more like it.

Our 10c worth

One thing, from Paul

Warren Buffett's latest annual letter to Berkshire Hathaway shareholders was his first since the death of his partner Charlie Munger in November 2023. He paid tribute to his old pal by noting a valuable lesson Munger imparted back in 1965.

"Warren, now that you control Berkshire, add to it wonderful businesses purchased at fair prices and give up buying fair businesses at wonderful prices. In other words, abandon everything you learned from your hero, Ben Graham. It works but only when practiced at small scale."

In 2016, they started buying Apple shares, a very large and successful corporation, widely owned and not trading at a discount. Over the years, Apple continued to thrive, and its shares went up by a lot. It's by far their largest investment.

Don't bother scouring the market for bargains, or stocks that are trading at low prices because they've fallen on hard times. Usually, dogs remain dogs. They don't bounce back to their former glory, they are value traps.

Byron's beats

I thoroughly enjoyed this quote from legendary investor Peter Lynch (pictured below).

"Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in the corrections themselves."

The point is very relevant at the moment because markets are at all-time highs, so some people believe they can beat the system by selling shares before an inevitable drop. But that would be a huge mistake.

Markets are almost impossible to predict; I've personally seen many examples of people trying to get out before a dip only to get back in 10% higher because the market carried on going up. Not to mention the taxes and unnecessary brokerage costs.

If you were planning a stealthy exit and then buying back in at lower prices, I hope this has convinced you otherwise.

Michael's musings

Are you a trader or an investor? Do you know the difference? A trader is someone who hops in and out of the market, trying to catch momentum swings, the latest fads and cyclical changes. It is very difficult to do, and for most people, it results in underperforming the market.

An investor buys quality businesses and holds them through the cycles. This approach is more boring but it results in much better returns long term.

Many people think trading and investing are the same thing, because they've been watching too much business TV or Hollywood movies. The market pundits on TV have to be exciting and entertaining, so they can't talk about boring buy-and-hold strategies.

At Vestact, we are long-term investors. Our market-beating returns justify our approach.

Bright's banter

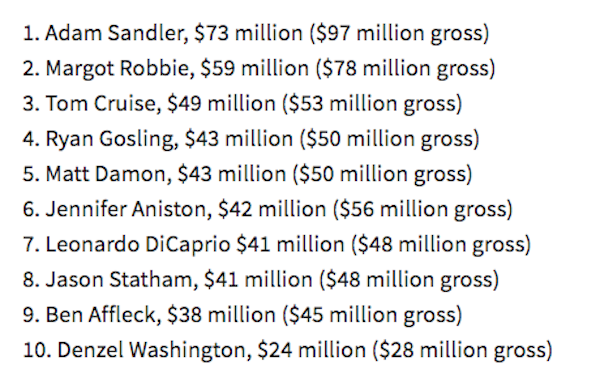

Forbes has unveiled its list of the highest-paid actors of 2023. Netflix's top star, Adam Sandler, claimed the number one spot thanks to a lucrative $250 million deal with the streaming giant inked in 2014 and renewed again in 2020.

Netflix viewers collectively spent over 500 million hours streaming Sandler's movies in the first half of 2023. He's churned out successful productions such as 'Hubie Halloween,' 'Murder Mystery,' 'Leo,' and 'You Are So Not Invited to My Bar Mitzvah.'

Rounding out the top 10 are familiar faces like Margot Robbie (thanks Barbie), she is the youngest actor on the list at 33, Tom Cruise, boosted by the latest Mission Impossible installment, Ryan Gosling (aka Ken), long-time pals Matt Damon and Ben Affleck, Leonardo DiCaprio, Denzel Washington, action star Jason Statham, and Jennifer Aniston, who continues to benefit from 'Friends' residuals.

Linkfest, lap it up

Millions of people are "under-muscled". These foods help repair muscle and build strength - How to get more protein in your diet.

Building homes with 3D printers is meant to be faster and cheaper than traditional methods. That is not the case at the moment - Detroit's first printed house.

Signing off

Asian markets are mostly lower this morning. Benchmarks like India's Nifty 50 and Japan's Topix remained unchanged after giving up earlier gains, while Hong Kong's Hang Seng, mainland China's CSI 300, and South Korea's KOSPI were all in the red.

Taiwan Semiconductor Manufacturing Co is up 4.2%, piggybacking off the rally of semiconductor stocks on Wall Street.

China reported a faster-than-expected jump in exports. Conversely, Japan's two-year government bond yields rose to their highest level since 2011 on speculation that the central bank will wind down negative interest rates as early as the end of this month.

US equity futures have edged lower pre-market. The Rand is trading at around R18.82 to the US Dollar.

It is still hot on the Highveld, stay cool this Thursday.