Market Scorecard

US markets ended lower yesterday, as the selloff in social media and technology stocks deepened. Downbeat corporate reports, concerns about economic growth, and rising interest rates continued to weigh on markets. As the old saying goes, the beatings will continue until morale improves.

US home sales data came in well below economists' expectations, a sign that rising mortgage rates (that's American for "home loan") are squeezing buyers.

In company corner, Snap Inc. plummeted 43% after management moaned about the macro environment, and fretted about a softening of online advertising revenues. Elsewhere, Abercrombie & Fitch fell 29% after the retailer said it had made a loss for the quarter.

At the end of another tough trading day, the

JSE All-share lost 0.99%, the

S&P 500 retreated 0.81%, and the

Nasdaq fell 2.35%.

Our 10c Worth

One Thing, From Paul

It's not enough to pick the right sector of the economy to invest in, you also have to pick the right stock in that sector. While a rising tide lifts all boats, some companies will do a lot better than their peers.

Here's

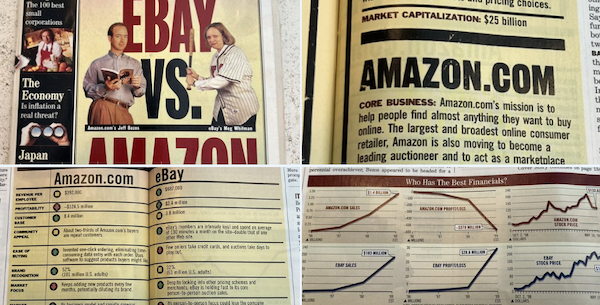

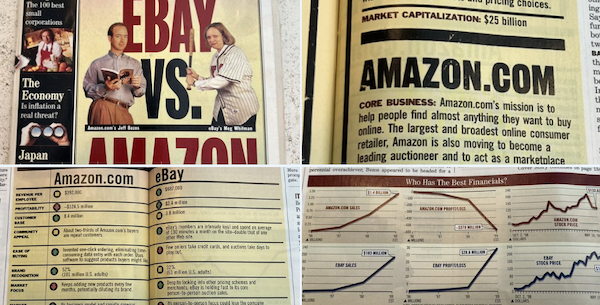

an interesting comparison between Amazon and eBay, both of which are e-commerce platforms, broadly speaking. The images below are from a Business Week magazine special published at the end of May 1999, exactly 23 years ago.

At the time, the two companies had comparable revenues (about $700 million per annum) and market capitalisation (about $23 billion). The one was run by Jeff Bezos and the other by Meg Whitman.

Fast forward to today, and eBay has the same market value now as it did back then (if you exclude the spin-off of PayPal).

Amazon's market value has grown 50 times larger.

Bright's Banter

Facebook (now officially known as Meta Platforms) came to market 10 years ago on the 18th of May, 2012 in what was then the largest IPO in history. The Menlo Park-based social media giant raised $16 billion at a $104 billion valuation. Something that was unheard of back in those days.

The company didn't exactly shoot the lights out, and the share price did not pop higher on day one. In fact, things went from bad to worse as they struggled to monetise their main platform. The share price flopped, sinking from $38 to $19 per share by October. It wasn't until August 2013 that the share price returned to its IPO level.

What happened from then onward was pure magic.

The power of their ad-centric business model became apparent as more and more advertisers used the platform to reach their target audiences. Facebook's $1 billion purchase of Instagram was also a stroke of genius. That platform is worth well over $150 billion now.

Today, Meta owns four of the most downloaded apps of the decade. Even though its share price is 500% higher, its existence is being questioned and tested once again. I think the current weakness in the share price is an overreaction to a poor set of quarterly numbers, and Meta will bounce back soon.

You will find more infographics at

Statista

Linkfest, Lap It Up

A vintage Cartier Crash watch just sold for a record price at Sotheby's. The 18 carat 1967 timepiece was inspired by a painting by Salvador Dali -

"The Persistence of Memory" watch just sold for $50 million.

NASA is testing the effects of radiation on female dummies in space. This is in preparation for the 2025 Artemis mission to the moon -

The crew will include a women and a person of colour.

Signing Off

Asian markets have stabilised and are moving slightly higher after sharp retreat in recent days. The MSCI Asia-Pacific gauge is in the green at last. China's central bank and banking regulator urged lenders to boost loans in its latest effort to shore up their battered economy.

US equity futures are also up in early trade. The Rand is trading at R15.71 to the US Dollar.

It's only Wednesday morning. On we go. Stay upbeat.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista