Ouch! April was the worst month for the Nasdaq since 2008, and yesterday was its worst day since 2020. After a refreshing rally on Wednesday afternoon, we gave it all back yesterday. Most market participants (not us) seem to think that aggressive interest rate hikes are in our near future.

The default view for the moment is that the Fed is behind the curve and will need to hike rates sharply to tame inflation. The financial media described yesterday's market move as ugly panic selling.

In company news, Twitter shares rose 2% on further details of Elon Musk's takeover bid. Equity commitments have been made by the Qatari sovereign-wealth fund and Larry Ellison, amongst others. Musk will be the temporary CEO once the deal goes through. Shopify dropped 15% after they reported sloppy numbers.

After a bruising session the JSE All-share closed down 0.96%, the S&P 500 sagged by 3.56%, and the Nasdaq was poleaxed by 4.99%.

Our 10c Worth

Michael's Musings

Last week, PayPal released a rather mixed quarterly update. The good news is that the share price firmed by 10% after the numbers; a relief given how badly the stock has performed over the last year. In broad terms the weak price can be attributed to slower account growth and the eBay/PayPal divorce progressing more quickly than expected.

PayPal is now in a transition phase. Most of the pain from the eBay split should be through the system by the middle of this year. In February, management announced a shift in strategy to focus on growing activity from current customers, instead of pursuing new sign-ups.

The idea is to make PayPal a 'super app' where users can access savings products and financial services, over and above the current payment offerings. The change is already bearing fruit, with existing customers using the app more.

PayPal's Venmo service is now a prominent payment option on Amazon.

PayPal has 394 million consumers, connected to 35 million merchants. The scale of their network gives them a solid moat against competitors. Online payments and convenient, cheap banking services are a growth market. They have a clean slate and plenty of upside. We advise you to hold your PayPal shares, if you own them.

One Thing, From Paul

Friday again? Advice time!

If you like your job, stick to it, don't chop and change. Over time you'll get better and better at your profession, and make a real difference.

Also, why retire? Just keep going in to work, if they'll let you. Make yourself useful. If you own the business, you can keep pitching up.

Here's a story about a 100-year-old man in Brazil, who has been working for the same company for 84 years. When he was just 15, Walter Orthmann started as a clerk at the textile company Industrias Renaux. The year was 1938.

Here are his comments: "I don't do much planning, nor care much about tomorrow. All I care about is that tomorrow will be another day in which I will wake up, get up, exercise, and go to work".

What a legend! In my view,

humans are at their best when they are working hard.

Byron's Beats

Markets have been very rough this year, as you know.

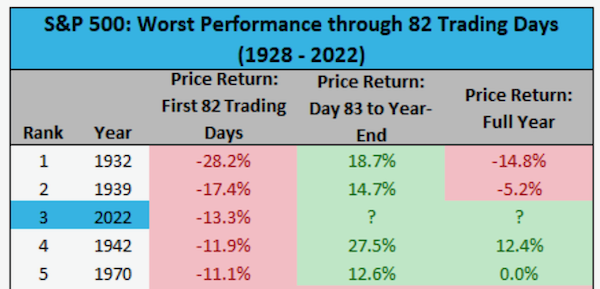

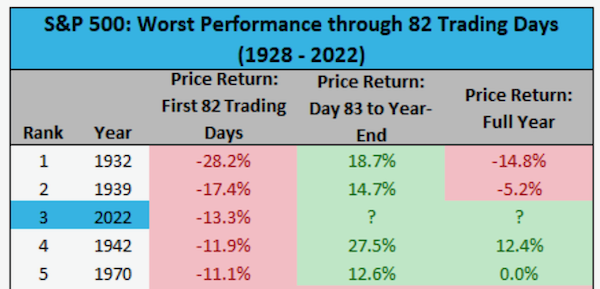

April 2022 was the 12th worst month for the Nasdaq in its 51-year history. This has also been the third worst start to a year in the S&P 500's history. If you look at the numbers below, which excludes yesterday's slump, you will see that decent recoveries followed all those tough starts.

As they say, history doesn't always repeat itself, but it does rhyme.

Each time the market drops for different reasons, and the ensuing recovery has its own unique features. I find it very helpful to look back at history, even just to remind myself that markets do bounce back. It's hard to see the light when you are in a tunnel.

Hold, hold, hold.

We may sound like a stuck record, repeating the same message, but that is our job, especially when markets are slumping. There's a huge amount of cash on the sidelines at the moment. My opinion is that the recovery will be swift once there is a bit more certainty on the slow-down in US inflation.

Hold tight and maybe take a break from following the markets, leave that to us.

Linkfest, Lap It Up

Linkfest, Lap It Up

Eli Lilly's new obesity drug Tirzepatide helped patients shed a lot of fat. On the highest tested dosage, research participants lost 21% of their body weight -

Will the weight loss drug be approved despite side-effects?

Nike turns 50 this year. The company started out as Blue Ribbon Sports in 1972 with $1.3 million in sales -

The Rise of the Swoosh.

Signing Off

Asian markets are in a hole this morning, other than Japan which is playing catch-up after a long holiday. US equity futures are slightly below par. We are back on our feet, ready to face a new day.

This afternoon the monthly US jobs data will be released. In the past this was a major market-moving data point, now not so much. US inflation data out next week will be more significant.

Enjoy your weekend. Get some rest, because next week will have 5 working days, the first in a while!

Sent to you by Team Vestact.