Market Scorecard

US markets were closed for Thanksgiving, the good news is that today they're open until lunch time for Black Friday. Locally, there wasn't much action either as our markets closed flat with industrials and financials outperforming. That was more like a reversal of Wednesday's market moves.

In company news, Swedish gaming company Evolution saw its shares tank 15% after the company said it was conducting an internal review regarding accusations of working with sanctioned countries. Meanwhile, French hard liquor maker Remy Cointreau reported strong earnings with net profits more than doubling in the first half of the year, sending its shares up 13%.

At the end of the day, the

JSE All-share was down 0.01%.

Our 10c Worth

Byron's Beats

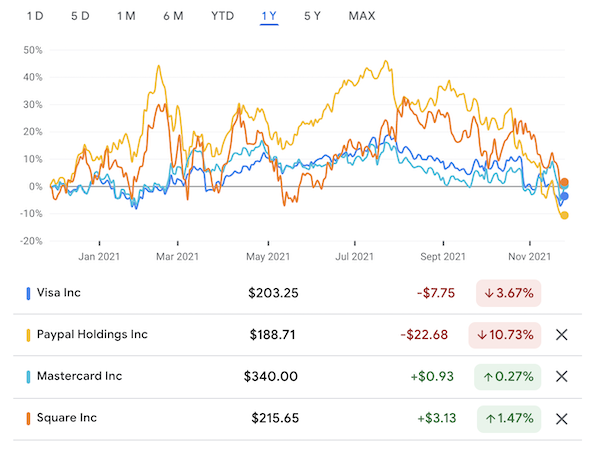

It is hard to pinpoint exactly why the payments companies peaked in July and have fallen quite heavily since. PayPal is down 39%, Visa is down 18%, Mastercard is down 14% and Square is down 23% since then.

Maybe it is because travel has not picked up as much as expected? Maybe it is because some of the big retailers like Amazon are fighting back on their margins? PayPal, in particular, got punished by the market when rumours did the rounds that they were looking to buy Pinterest, but that has been denied and nothing new has emerged.

Maybe they were just overheated and the market brought them back to earth? That is not unusual. Either way, we think the space is a fabulous place to invest. Payments is evolving fast in favour of the consumer. Things are getting easier and simpler. We see this dip as a good buying opportunity into these quality companies.

The below graph compares the four payments companies I have hand picked. Notice how the disrupter businesses are far more volatile than the more established Visa and Mastercard. That is also to be expected.

Michael's Musings

Since you are missing your usual Friday life advice tidbits from Paul today, here are the thoughts of Morgan Housel instead. In this blog piece,

Counterintuitive Competitive Advantages, he talks about when life and business is too easy, we tend to lose focus and motivation.

Here are some of his observations:

"Debt is an impediment to having options. But having zero debt can give you so many options that you lack focus. A little debt can keep you away from distraction. It makes you think about backup plans, rainy day funds, and cutting bloat. . . Nassim Taleb writes: "Abundance is harder for us to handle than scarcity." "

"Taleb again: "Men destroy each other during war; themselves during peace." . . .

Scared and running > fat and happy."

Yesterday we spoke about how most of the Nifty Fifty companies imploded. For many, life was too easy, meaning that they didn't adapt with the times.

Kodak shelving the digital camera because it would disrupt their film business is a classic example.

We can apply the same principles to our own lives. When we think we have arrived, there isn't anything driving us anymore.

Bright's Banter

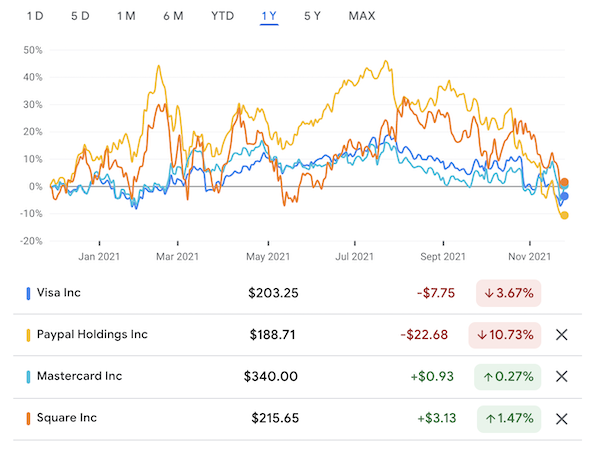

Earlier this week we mentioned that Monster and Constellation Brands are in potential merger talks. How do you think the Monster share price has performed over the past two decades? Do you think it has done better or worse than the top-performing tech companies like Apple and Amazon? Instinctively, tech should have done much better, right? Right? Well, you're in for a surprise.

The infographic below shows how Monster's bet on energy drinks paid off for its patient shareholders. Look, don't get me wrong, Apple and Amazon also crushed it but they could only do about a third of what Monster has achieved in the same period. Remarkable!

You will find more infographics at

Statista

Linkfest, Lap It Up

Many of our clients have significant assets to pass on to the next generation. The view in our office is that it is better and more rewarding to give your children and grandchildren part of their inheritance while you are still alive. Here is a some advice if you are planning on donating money early -

Helping Wisely.

One of our favourite finance bloggers, Michael Batnick, got scammed and he wrote a blog about it. These fraudsters are getting smarter by the day because they stay ahead of the technology curve -

A good reminder that web3.0 is no different when it comes to illegal activity.

Signing Off

Asian markets are down heavily this morning, sending the MSCI Asia-Pacific index to its lowest since early October as travel and entertainment companies see their share prices decline. The new Covid variant seems nasty, and markets are bracing for renewed lockdowns.

Hong Kong, Japan, mainland China and South Korean markets are all down, is this the black Friday sale people were referring to? US futures are down in early trade as the major indexes fail to hold on to their recent gains post-Thanksgiving.

The Rand is currently trading at R16.23 to the US Dollar, as the greenback hovers close to its highs. Having South Africa as a hot spot for a new Covid strain hasn't helped our currency either.

Stay safe out there!

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista