Market Scorecard

US equities markets rose to fresh new highs on Friday after data out confirmed solid jobs growth in October. The S&P 500 added 2% for the week, its biggest weekly gain since June. The Nasdaq advanced 3.1% for the week, its best weekly performance since April. The Vestact model portfolio is now up 27.9% for the year to date.

The latest payroll report showed that the US economy added 531 000 jobs in October, more than the 450 000 jobs that economists were expecting. Meanwhile, the unemployment rate fell from 4.8% to 4.6%. Good news all-around.

In company news, shares of Peloton tanked by 35% after the fitness equipment maker reported a slowdown in subscriber growth. Meanwhile,

Airbnb saw its shares soar 13% after posting record revenues on the back of a busy Northern Hemisphere summer season.

In summary, on Friday, the

JSE All-share was down 0.49%, the

S&P 500 was up 0.42%, and our fave the

Nasdaq was up 0.81%.

Our 10c Worth

Bright's Banter

Illumina reported its third-quarter numbers last week, showing that sales exceeded expectations. The gene-sequencing company has now raised its growth guidance three times this year, with the latest one estimating sales to rise by 36% for the whole of 2021.

The company reported third-quarter sales of $1.11 billion, up an impressive 40% from a year earlier.

Earnings rose by nearly 50% from a year ago to $221 million, notwithstanding the share dilution from Illumina's acquisition of Grail, the cancer blood-screening firm. Grail has a test called Galleri which can detect more than 50 kinds of cancer.

Illumina enjoyed a significant increase in demand for DNA analysis for people about to undergo medical treatment. They also provide testing for birth defects. Illumina's customers are the laboratories that sell these DNA-reading services. They sell them the machines as well as the associated consumables for each test.

We like the company's unique niche. They survived the pandemic thanks to their rock-solid balance sheet, now it's onwards and upwards!

One Thing, From Paul

I enjoyed a recent exchange on Twitter.

Someone pointed out that Bill Gates would be worth $1.2 trillion now if he still owned all of his Microsoft shares. Instead, he became best friends with Warren Buffett and decided to diversify his portfolio. Thanks to that decision, he is "only" worth $136 billion today.

I'm not sure if this is true, or if the numbers have been calculated correctly, but it's thought provoking.

Someone else countered with the observation that

if Gates hadn't sold his shares, Steve Ballmer might have been Microsoft CEO for an extra five years and Satya Nadella would've gone to Salesforce, and started Azure there instead. Bill might have only been worth $30 billion today, because Microsoft might have languished if Nadella had not been at the helm.

The same applies to your investing history.

It makes no sense to say "what if" about missed investment opportunities in the past. Worry about the assets that you have now, and how you are positioned today. All the rest is just pointless dreaming and/or self-flagellation.

Byron's Beats

I enjoyed the fantastic sport events over the past weekend. The huge crowds in the stadiums, especially in Europe, were most impressive. I didn't see one empty seat in all the games and highlights I watched. Even Cardiff, in the relentless rain, was absolutely heaving during the Springbok match. The players could barely hear each other.

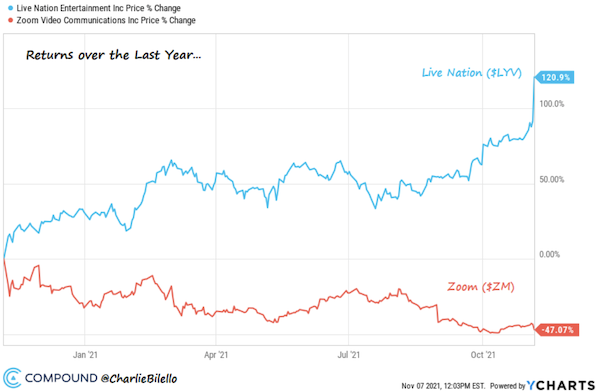

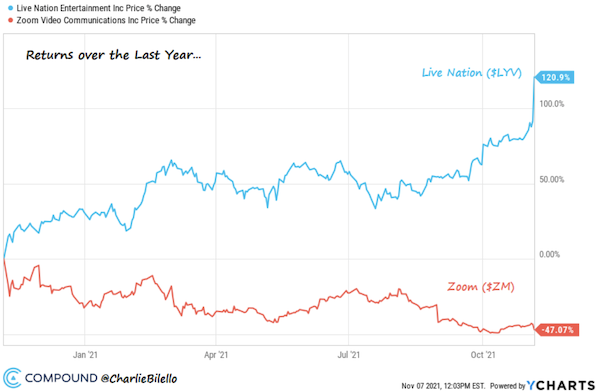

People are thoroughly enjoying the freedom to attend live events. Take a look at Charlie Bilello's graph from the weekend. He compares the share price of Live Nation Entertainment, a concert organiser, to that of Zoom Video. As the realisation sinks in that life will go back to normal (mostly) once people are vaccinated, the entertainment industry will get busier and busier. People have been starved of these experiences and are raring to go.

The sport, travel and entertainment industries deserve a big recovery; it's been a tough 18 months. As a consumer, don't expect the prices of old. People will be paying up, because there's lots of pent-up demand.

Michael's Musings

Uber was among the companies reporting third-quarter numbers. With a bit of adjusting, this was their first quarter of reported profits. The core business made money but their investment in Didi, the Chinese ride-hailing company, lost $3.2 billion in value. The ride-hailing (mobility) division made $544 million and Uber Eats (delivery) only lost $12 million, and is on track to be profitable by the end of the year.

In a sign that things are returning to normal, mobility saw a 67% increase in bookings and delivery saw a 50% increase, off of an already high base.

Uber also noted a 203% increase in airport journeys.

Globally, Uber does an average of 18 million trips a day. Management notes that it has been difficult to balance drivers' supply with riders' demand due to sporadic Covid lock downs. Both riders and drivers are their customers. A balance is needed so that riders don't wait too long for a car and drivers can make a good living from regular trips.

The company is well positioned to continue growing in the post-Covid world. Patient shareholders should do well owning this one.

Linkfest, Lap It Up

Linkfest, Lap It Up

Seiko has released the Prospex US special-edition watch. The Japanese watchmaker made its foray into the affordable luxury watch market last year and this timepiece comes in three different colours -

Seiko's Prospect US Special Edition watch is a breath of fresh air.

A maths tutor was struggling to grow his customer base. So he asked himself, where do college students spend a lot of time? He posts free classes on P*rnhub to drive traffic to his own website -

Maths teacher hosting his lessons on P*rnhub.

Signing Off

Asian markets are steady this morning. Equities in Hong Kong and South Korea fell, while Japan and mainland China were little changed.

The Chinese Communist Party starts its Central Committee plenary session in Beijing today, and it runs through to Thursday. This is the first time that the top dogs have met in more than a year. Hopefully, no further crackdowns or anything of the sort? Just waffle about ideology, that will be fine.

US equity futures are slightly lower in early trade, perhaps it's time for a little breather after a good eight days of gains. The Rand is stronger this morning, trading back below R15.00 to the US Dollar. Buongiorno from a wet Johannesburg! We hope your week goes well.

Sent to you by Team Vestact.