Market Scorecard

After having four days of green, the US market had a down day yesterday. As Paul noted on Twitter yesterday, "

they aren't supposed to go up *every day*". Even though markets had a down day, the Rand has continued to strengthen and the price of oil has remained above $40 a barrel.

At a press conference yesterday the ECB indicated that they will increase their massive bond buying program. They also noted that there is further firepower at hand if it is needed. Even with all the extra monetary stimulus, they forecast that EU inflation will only be 1.3% in 2022, still below their target range of 1.5% - 2.0%. Having such low inflation is the reason why central banks can intervene in the big way that they have.

Yesterday the

JSE All-share closed down 0.82%, the

S&P 500 closed down 0.34%, and the

Nasdaq closed down 0.69%.

Our 10c Worth

One thing, from Paul

Threads on finance Twitter can be a useful information resource. A thread happens when someone gets on a roll and throws out a sequence of 10 or 20 separate but connected tweets. Oh dear! Fortunately there is a service called ThreadReaderApp, which turns them all back into one blog post for more convenient reading.

I liked this thread by a user called Aaron "Multibagger" Bush who seems to work at financial opinion website The Motley Fool. It's called

20 semi-controversial investing beliefs. He seems like a smart fellow.

Here's a sample, number 4. "[when picking stocks] one or two incredible pros can make up for a long list of cons .. usually only a couple key points determine 99% of an outcome. Don't overanalyze".

Or what about number 16: "Spotting and reacting to patterns in human behaviour is just as useful as spotting patterns in what makes a great investment". That is good stuff.

Forget about books and conferences, this is where the best investing insights are to be found. The post is worth a few minutes of your time.

Read the whole thread by clicking here.

Byron's Beats

A potential client who is sitting on cash asked me the following question the other day.

"I know a few smart people who think the market is going to crash, can I make money from the market going down? And once the crash has happened I can then buy your recommended stocks."

That sounds very easy on paper, of course, if it was that easy we'd all be rich. Here was my answer.

The short answer is yes, you can short the market and make money if it goes down. However I would strongly advise you against that.

Trading these market moves is like golf - on a very few people can actually make money from it because it is a lot more difficult than it sounds.

It is not just a few select smart people who think the market is going to drop at the moment, I'd say 90% of people who follow the market think it is going to fall soon. They have thought that since the recovery started though, and have been very wrong. What does that mean? The market is unpredictable and has a mind of its own.

The same happened in 2010 when the market was recovering from the financial crisis. Many smart people were calling for a second recession. There were a few hiccups on the way but we had a strong 10 year bull rally.

People who took that advise, and tried to short the market, must be livid.

If you are uncomfortable with market levels, it is better for you to sit on your cash and if a pull back happens, then buy in. But even that is hard to do. When a market is crashing, it feels unnatural to buy, and it always looks like it will get even worse. Vestact has seen enough market pullbacks to know that very few people have the stomach to buy the dip.

That is why we advise to buy quality and hold through the cycles. Our clients are up over 5% this year despite everything that has happened.

Michael's Musings

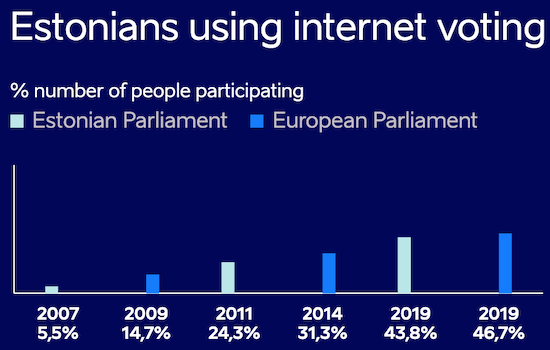

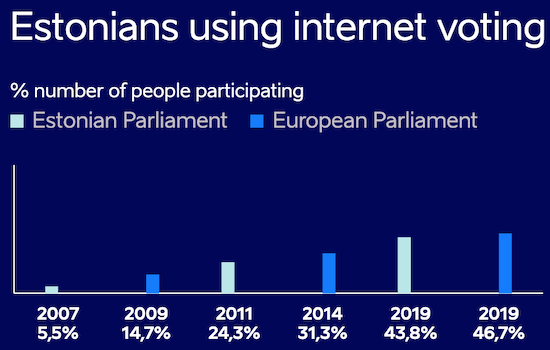

Estonia is a country with a population of 1.3 million people and is situated on the Baltic Sea in Eastern Europe. When I think of Estonia, I think of forests, log cabins and skiing. There are no famous tourist landmarks, so it is a country that I think most people will struggle to pinpoint on a map?

Estonia is well known for being very technologically advanced. The country pushed hard over the years to move their society online, and in 2020 it has been paying dividends.

There are only three things that people are required to do in person, marriage, divorce and buying property. Even voting can be done online. You can see some of their statistics here -

we have built a digital society.

The government has a policy that it should only ever ask you once for a specific piece of information.

The government has a policy that it should only ever ask you once for a specific piece of information. Imagine that! Having a population of only 1.3 million people does make it easier to be a digital country but we should not take anything away from the nation. They used to be part of the USSR, where communism decimated their economy. It goes to show that you don't need to be a wealthy nation to adopt technology.

With the current need for social distancing, I'm sure that many nations will start to look at the model adopted by Estonia and start to replicate some parts. This journalist has a look at why a country like the US is not more digital -

Estonia Already Lives Online—Why Can't the United States?.

Bright's Banter

Yesterday, my colleague Paul wrote a fantastic piece about one of the biggest beneficiary of the Covid-19 pandemic, the video conferencing company Zoom. I'm here to complement that piece with an infographic showing Zoom's rapid, mind-bending revenue growth over the past two financial years.

"We were humbled by the accelerated adoption of the Zoom platform around the globe in Q1," said Eric S. Yuan, Founder and Chief Executive Officer of Zoom in the company's earnings release for the three months ended April 30.

"The COVID-19 crisis has driven higher demand for distributed, face-to-face interactions and collaboration using Zoom. Use cases have grown rapidly as people integrated Zoom into their work, learning, and personal lives."

The infographic below shows steady revenue growth until the end of the 2020 financial year - Zoom's financial year end is 31 January. The revenue print jumps massively for Q1 2021 and

the company expects another big jump in Q2 as most of the world is still working from home.

You will find more infographics at

Statista

Linkfest, Lap it Up

A recent fossil find gives us a glimpse into the type of plants that dinosaurs liked to eat -

Fossilized dinosaur stomach reveals dino's 110-million-year-old last meal.

This is a very well spent R1.7m by Apple

This is a very well spent R1.7m by Apple. Paying people who find holes in their system is a cheap way of finding problems and flaws -

Apple Pays Developer $100,000 for Finding Serious Bug in 'Sign In With Apple' System.

Signing off

Signing off

Data out today includes a South African business confidence read released at 11:30. Then the big one for global markets is US unemployment data. The expectation is for their unemployment rate to reach 20% for May. Wow. Remember, even though the number looks dire, the market is expecting it. The Rand is at $/R 16.88 this morning.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista