Market Scorecard

The South African and Asian markets were in the red yesterday due to concerns around the coronavirus outbreak in China. When we spoke about the virus's impact on markets earlier this week, a reader told us that we are not taking the outbreak seriously enough. We are not downplaying the severity of the virus, but rather its influence on company earnings. In the end, all that matters, in the long run, is how much profit a company makes. Here is why we think that an extreme reaction from markets, is an overreaction.

The SARS outbreak in 2002 is estimated to have reduced Southeast-Asia's GDP by between $12.3-$28.4 billion. That may sound like a lot, but in 2003 China had a GDP of $1.7 trillion, so the impact was somewhat muted. Today their GDP is around $14 trillion, meaning the impact probably won't even be noticed. What made the SARS outbreak in 2002 scary was that if you caught the virus, you had a 10% chance of dying. In the end there were 774 deaths, across 17 countries. For comparative purposes, smoking is estimated to kill around half a million people a year.

The point is that the virus is scary, but it will have an insignificant impact on most companies. Companies exposed to tourism will probably feel it a bit more, but it will be temporary. The market sell off has even hit companies that don't even have operations in China. It demonstrates how market movements over the short term are driven by emotion. Paul talks more about the virus in Blunders below.

Yesterday the

JSE All-share closed down 1.77%, the

S&P 500 closed up 0.11%, and the

Nasdaq closed up 0.20%.

Our 10c Worth

One thing, from Paul

Uber listed on the new York Stock Exchange back in May last year. It traded at around $42 on its first day as a public company, and we bought them at that level for a group of risk-tolerant clients.

After that, things did not go so well. If you did not get the call to buy some, you might consider yourself to be lucky?

Lots of pent-up insider selling and muted results pushed the stock down to a low of $25.58 in November 2019. In particular, disgraced founder and former CEO Travis Kalanick sold his entire stake, worth over $2.5 billion. Goldman Sachs sold all of the stock that they held for clients in venture funds (in other words bought at lower prices long before the listing).

I'm very confident that Uber is here to stay.

The business model combines the power of the GPS mapping mobile phone app, the seamless payment backend and the flexibility of opportunity for its drivers. Even mature people find it easy to use. In future, ride-sharing will be much more common than vehicle ownership. The future is all-electric, driverless mobility-on-demand!

In news out yesterday,

Uber said that after eight exhausting years of lobbying they finally got a licence to begin operations in Vancouver, which is Canada's third-biggest city. As usual it was pathetic local authorities and regional regulators keeping them at bay. This happens in lots of places, where cities sell medallions or rank spaces to mafia-style metered cab operators. It's never the customers who want to protect those old goons. The customers want Uber.

In recalcitrant cities like Cape Town, Uber tends to start anyway, pay the fines and wait for users to put pressure on the idiot city councillors or transportation board members to concede defeat. I guess that the regulators in a place like Vancouver were bigger slime bags than usual? Someone even made a rap music video about it:

Uber in Vancouver (Music Video) by Ekke and Sound of Kalima.

I'm happy to say that Uber stock seems to be on the mend, hitting $37.40 last night on its way back to par. I said to Ted Weisberg (our partner and service provider at Seaport Securities in New York) yesterday that Uber was "back from the dead" and he scolded me, saying Uber is still too young and fresh to be described that way. Fair enough. Anyway, I think that it's a good buy at these levels.

This week on Blunders -

How to Inoculate Yourself Against the Coronavirus. (Not for sensitive viewers)

Byron's Beats

Believe it or not, sometimes you do pick up some good insights from Davos. I saw this tweet yesterday, which I thought was interesting.

Bill Gross (the other one) is a tech investor and Ben Evans (a Vestact favourite) is a silicon valley investor rockstar.

We are invested in both Google and Instagram hence the interest in what he had to say. In a world of intense competition, it is those that create the market place that will do incredibly well. But don't underestimate their role in allowing small businesses to get their product out there. They wouldn't be selling stuff if it was not worth their while.

But as an investor, keep your money with the Googles, Amazons and Facebooks of the world.

Michael's Musings

How cities change is something that really interests me. Modern society is structured around people living close to each other, in large cities. The globe crossed the rural to urbanisation mark in 2007; the year that more than 50% of people lived in cities.

With more and more people moving to the cities, we need to start rethinking how we do things as a society. One suggestion is to do more urban farming, where instead of trucking fresh produce over long distances, we have many mini-farms to grow some basic food. It makes sense. Having many mini-farms will allow for fresher food, fewer trucks on the road and more green elements in our cities.

This article has an in-depth look at the topic -

The Future of Architecture: Urban Farming Is Growing.

Bright's Banter

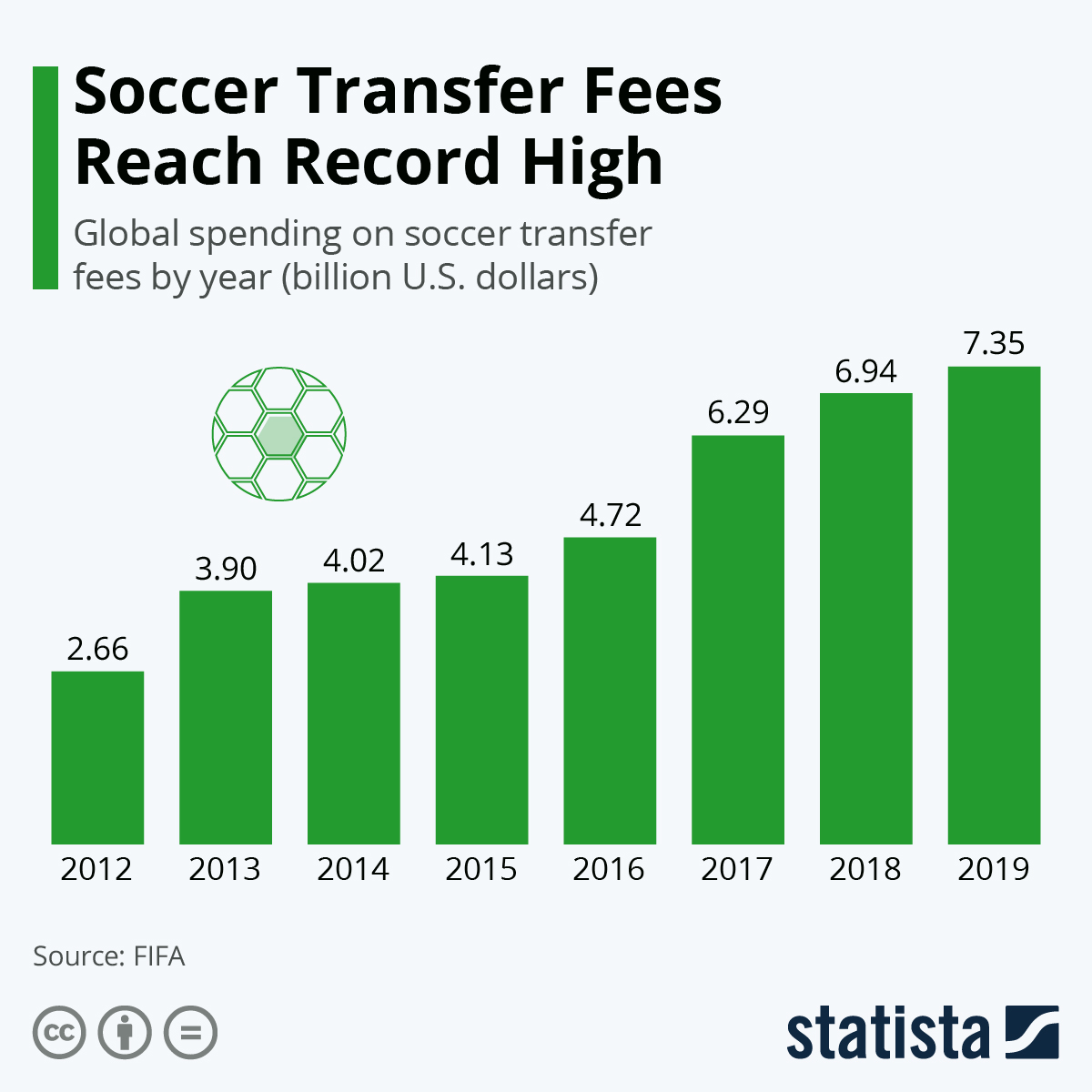

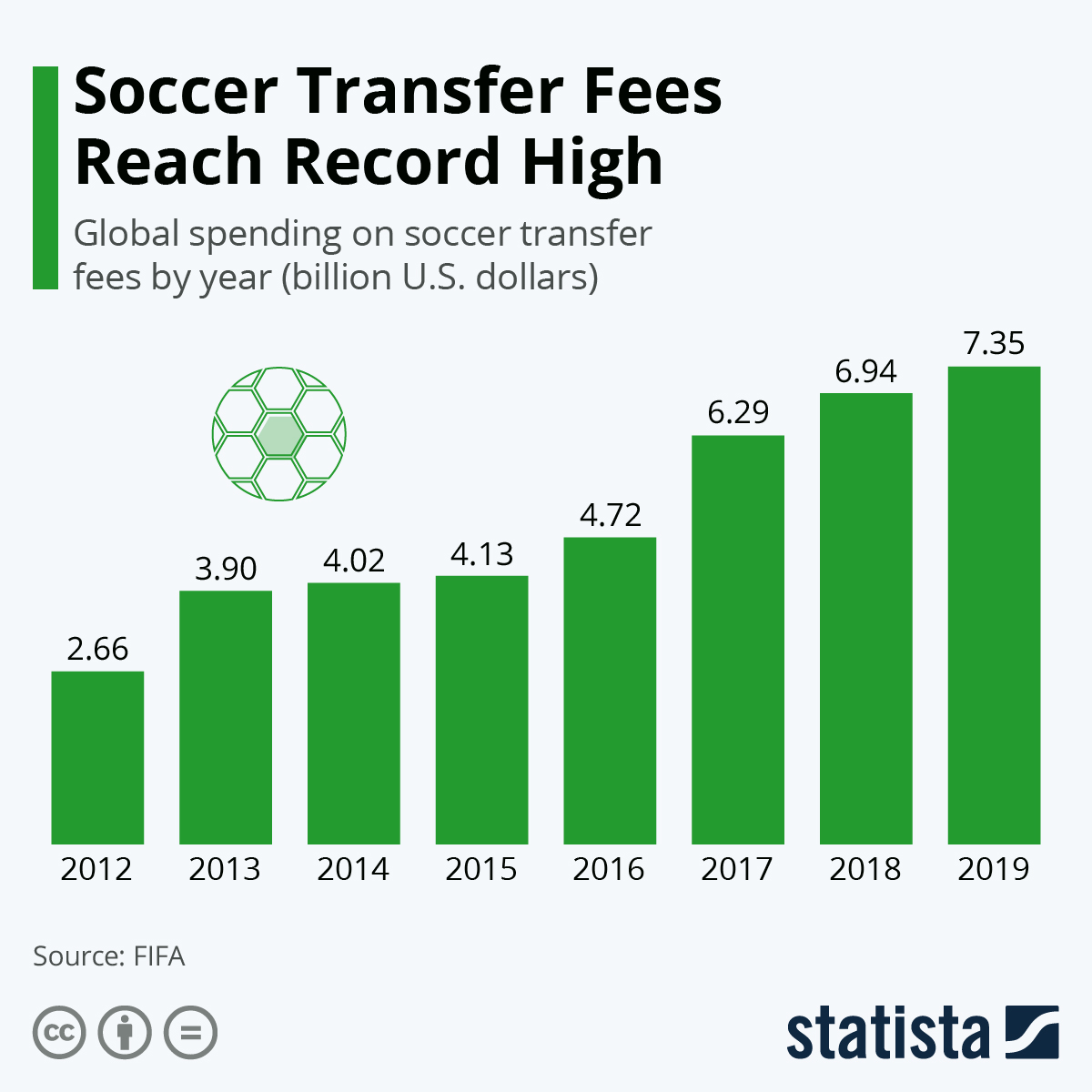

FIFA

released its global transfer market report for 2019 showing how the men and women transfer market is performing in monetary terms. Spending in mens football has reached a new high of $7.35 billion, 5.8% more than in 2018. The number of international soccer transfers is up 19.7%, and transfer fees are up 16.3%; womens football is also on the rise.

A new record of transfers was set with 18 042 international transfers, which involves 15 463 players from 178 different nationalities. This is diversity on a grand scale. Apparently, over 80% of all spending on transfer fees came from just 100 clubs. Portugal stands out by having the largest positive net balance with $384 million, while England sits with the largest negative net balance with -$549.9 million.

The graph below shows the growth in soccer transfer fees over the years.

You will find more infographics at

Statista

Linkfest, Lap it Up

Following on from yesterday, here is another success story of South Africans in the technology space -

Two South African varsity drop-outs launched a financial planning app that grew to 10,000 users in six months.

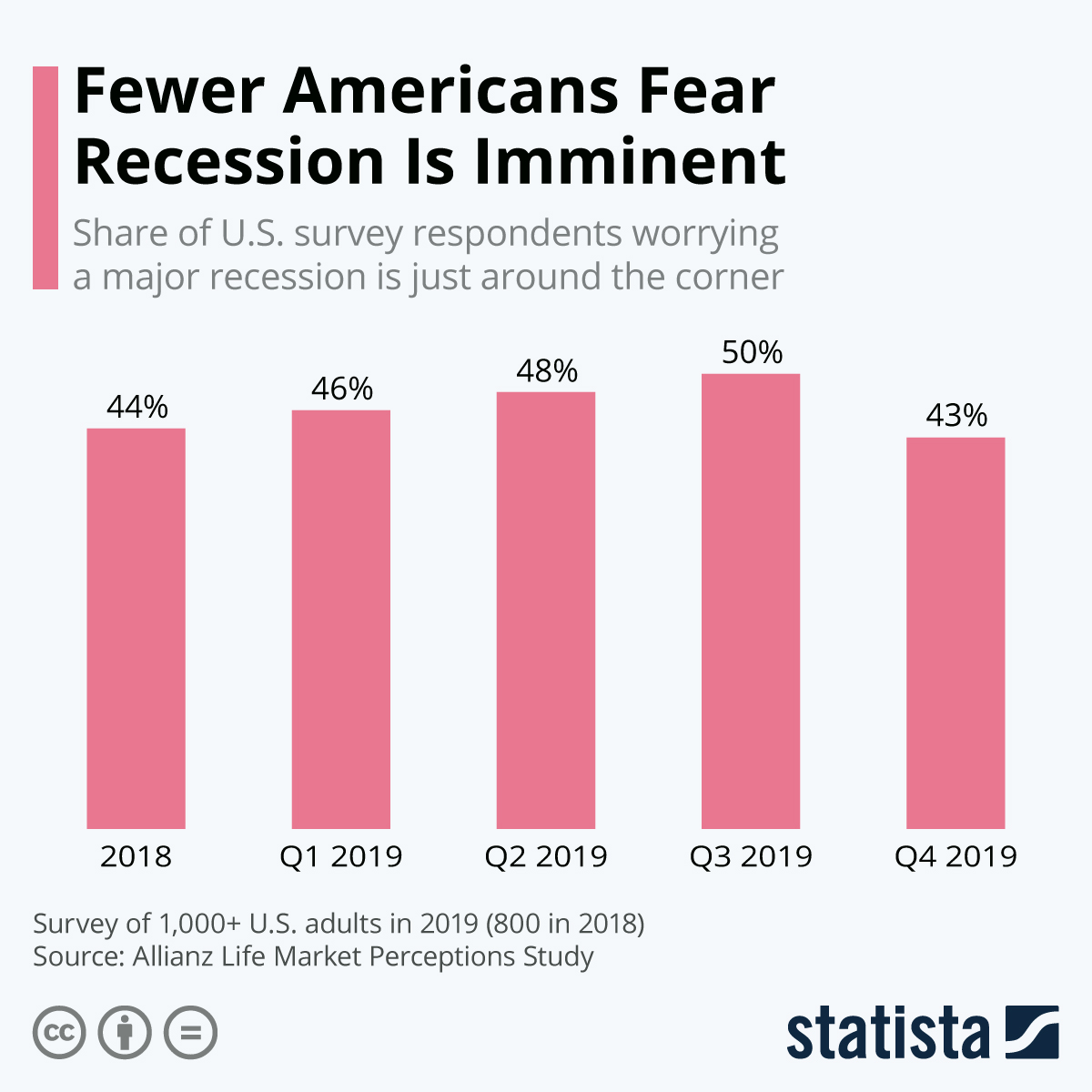

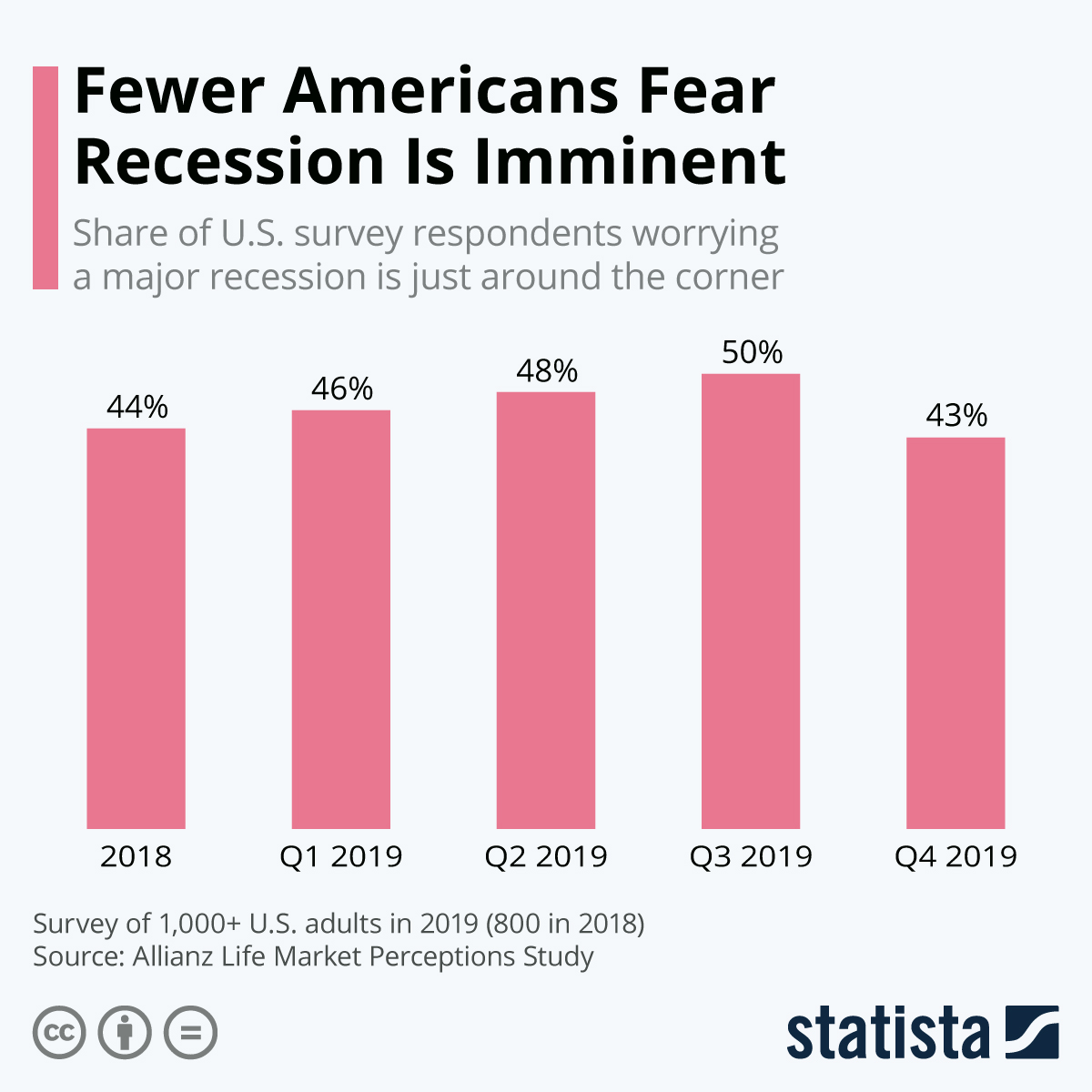

How many people actually think about an impending recession?

How many people actually think about an impending recession? Probably not many. More than likely, when people are surveyed about recessions, it is the first time they have thought about the topic all year? Anyway, worrying about an impending recession, that you can't control, is a waste of energy and bad for your health.

You will find more infographics at

Statista

Signing off

Chinese markets are closed for the Chinese New Year. We are moving from the year of the pig or boar to the year of the rat. Economic data out today includes manufacturing data out of the EU, UK and US. The JSE All-share is higher this morning. Good luck to the Protea's this weekend.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista