Market Scorecard

The news broke yesterday that Meng Wanzhou, the CFO of Huawei and daughter of the group's founder, was arrested on Saturday in Canada. Huawei is accused of violating US sanctions with Iran. Ms Wanzhou will appear in court today, and depending on how it goes may be extradited to the US. The news of the arrest sent financial markets reeling.

Imagine if Tim Cook was taken into custody in China? Think about how angry the US would be. The next time the US and China sit down to talk about trade, the first thing on the agenda will be a discussion about the release of Ms Wanzhou. The massive sell-off in markets yesterday tells you what traders think about the future relationship between the two powerhouse countries.

A saving grace for the US market, with about 2-hours left of trading, was the news that the Federal Reserve might slow, even further, the raising of interest rates. The news even helped the Nasdaq finish in the green. Does this show that the market is more concerned with the Fed than with trade talks?

Yesterday the

JSE All-share closed down 1.75%, the

S&P 500 closed down 0.15%, and the

Nasdaq closed up 0.42%.

Our 10c Worth

Byron's Beats

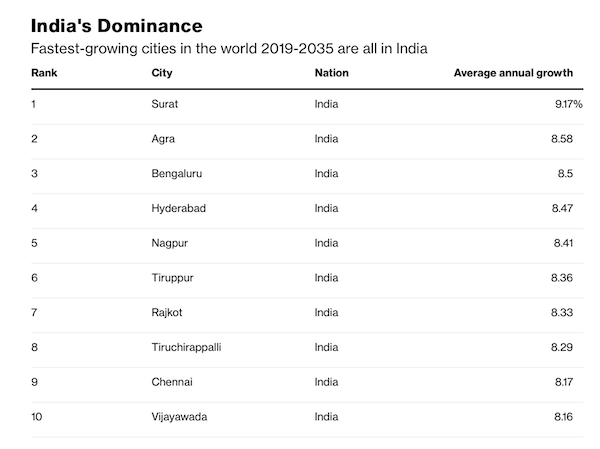

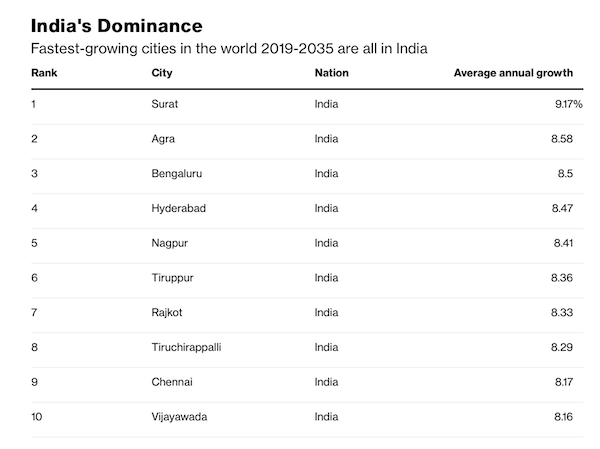

A research report published by Bloomberg suggests that the top 10 growing cities in the next few decades will all come from India.

India has long been suggested as the next China

India has long been suggested as the next China in terms of driving global growth. They certainly have the scale. Although there have been some hiccups, the Indian revolution is slowly gathering steam. This is good news for most global businesses, be it industrials, materials or technology.

Michael's Musings

Last week Barry Ritholtz went on a rant about share buy-backs;

Bad Buybacks.

He makes the point that companies are wasting billions on share buy-backs, instead of using that money for innovation. In his rant, he implies that directors are biased when considering when to do share purchases because creating extra demand for your stock also increases the value of insider share options.

One of the companies that he sets his sights on is Apple. His suggestion was, instead of spending tens of billions on buying back stock, what about buying Tesla, Netflix or Disney? Imagine how Tesla or Netflix would fly if they didn't have to worry about their growing debt burden?

We have had the same suggestion in the office for the last few years.

In the case of Tesla, you would have Musk focussing on producing the best car in the world, and Apple would focus on funding it. It is not too late!

Bright's Banter

Ride-hailing company

Lyft has finally filed for IPO, in their efforts to beat Uber. This is a brave move considering where we are in the market and economic cycles, the recent volatility hasn't helped much.

This gangster move by Lyft will give it access to the pockets of public shareholders, pockets I could argue are deeper than those in the unlisted space. The company could raise capital with ease in order to accelerate its growth in areas where they've identified potential.

This IPO filing means that

Lyft is on track to be a publicly listed company by the first half of 2019, a year that will be a blockbuster for new IPOs. The 2019 IPO roster could feature the likes of Airbnb, Slack, Instacart and of course Uber.

The current year has been very interesting in its own right when it comes to IPOs. We saw the likes of Dropbox, UpWork, ADT, DocuSign, Eventbrite, Tencent Music and even Spotify come to the market this year.

I am personally excited to see a listing in the ride-hailing space, this will help us have access to their financials so we can further aid our understanding of the business model and the economics of ride-hailing.

Linkfest, Lap it Up

Linkfest, Lap it Up

It is great to see South African companies making waves offshore -

This massively successful South African start-up may list in the US next year

Amazon is putting further distance between it and its competitors -

Amazon to Expand 'Amazon Air' With Investments in Chicagoland Airport

Vestact Out and About

Vestact Out and About

Michael chats to Nompu on SAFM about Steinhoff -

Delayed PwC report, financials sends Steinhoff shares falling.

Watch Bruce Whitfield and Michael on eNCA talking about 2018 -

Taking Stock - A wrap of 2018

Signing off

Signing off

Asia is higher, Tencent is higher and so is the JSE All-share. Last night the US showed that they are officially an oil net exporter, the first time in 75-years. This coincides with OPEC meeting in Vienna, where the cartel is likely to reduce their production. The big data points for today; there is EU GDP and then US jobs data. If you managed to get your hands on Cape Town 7's tickets, enjoy! Go Blitz Bokke.

Sent to you by Team Vestact.