"The therapy (which sounds like a one trick druid from the Asterix series), is an anti-coagulant and compliments their recent acquisitions in this space. It is currently only available in Germany, Switzerland and Austria. Subject to approval from the German competitions authorities, they will fork out that fairly sizeable sum. The product is pretty small for now, having revenues of only 68 million Euros only."

To market, to market to buy a fat pig. Wow, up, up and away. Not as much here locally, that was due to a weakening Euro relative to the Rand, Dollar strength and that led to general emerging market strength. Flows in equal stronger currencies, that is not necessarily good for the dual listed businesses, even though they would have had a tailwind from their primary listed prices. Why did we get these on fire markets? As the message headline from yesterday suggested "il QE", it was our version of trying to make quantitative easing sound more European. Italian of course. Our Italian is sadly confined to eating Americanised Italian food, the original pizzas do not have cheese on them, they were made for poor people, flatbreads.

The whole idea of the ECB stimulus is not intended to avoid people from eating flatbreads again, rather to inspire confidence, to get the banks lending to businesses and consumers again. OK, so if you need to read the entire statement and the Q&A session, here goes:

Introductory statement to the press conference (with Q&A). What you don't get when you read the Q&A is actually how funny the ECB president is, he is truly a genius not only in delivery, rather being able to go toe to toe with folks in English. Bearing in mind that many of the folks present have English as their second languages too. To get a very good idea of what the ECB are trying to achieve, here is an answer from ECB chief Mario Draghi:

This programme should increase the lending capacity of the banks. This programme, the national central banks, the ECB would buy bonds, and then banks will have this money, and this money can be used either to repay some liabilities, or it would be placed in our deposit facility, in which case they would have to pay a negative interest rate, so there is an incentive to lend to the private sector, stronger incentive than there was simply on collateralised borrowing as we used to do in the past, namely out of TLTROs. In this case, there is no limitation. The limitation, the three-year maturity that was present in the TLTROs, in this case isn't there.

As a result of negative interest rates in the Eurozone, banks can keep the money on deposit, they will however "lose" it if they do not lend the money out. At the end of the day too, Draghi is right, governments need to continue to reform. Which is why the Germans have been against this, part worried about the inflationary impact of this bond buying program, and in part worried about that the much needed reforms would not take place. Greece decides this weekend, we will see what transpires, no need to try and make any early predictions based on early polls. Alexis Tsipras, a former communist (yes, this is true) and rabble rouser could "win" the election with his lefty party Syriza.

By win, I mean get the most votes and then get the extra seats, the system is not too different to Italy. 250 seats up for grabs, you need at least 3 percent of the votes to get into parliament, the winner gets an extra 50 seats, that is the simple way of explaining Greek politics. In order to rule, you need at least 151 seats, there is nobody that would get there. I think what you must remember is that Syriza is a badly cobbled together coalition itself of the far left, a splinter group of the Communist party, workers party, active citizens and so on. It is very different when you are in power from being an opposition with one aim, to unseat the incumbents. It is very different to govern, you need to be more conservative and actually show leadership skills. Being a rabble rouser is all fine, being in charge is very different.

Anyhow, Greece must make up their own mind.

The upshot for global markets was a positive spin, as you can imagine, this met and beat the expectations (if there is such a thing), the quantum of the program. Markets ended around one and a half percent higher, tech stocks surged even further, over a percent and three quarters higher on the day, it has been an excellent shortened week for stocks across the globe, including here. Of course there have been company results, companies at the end of the day are the most important factor in determining where share prices will go and by extension where the index will end up. Companies, their prospects and results, not central banks set the index price ultimately.

Company corner snippets

C'mon Harry, let us go some place warm, let's go to Aspen is what Lloyd said to his pal in that classic from 1994, Dumb and Dumber. OK, it is not a classic, it was exceptionally funny slapstick humour that I enjoyed. What has been a great investment and a wonderful company has been

Aspen Pharmacare. Stephen Saad and Gus Attridge never sit still, they are the founders of this business. The company listed in 1999, there were 367 million shares in issue, the turnover was 522 million Rand. At last June, 15 years on, turnover was 29.5 billion Rands, number of shares in issue 455.9 million. OK, that aside, the company has bought numbers of businesses over the years, businesses from majors that they could sweat harder and "do better" than the big cumbersome majors. The company has announced this morning a transaction in which Aspen International will acquire the rights of a therapy called Mono-Embolex from Novartis, which as per the release is

"an injectable anti-coagulant, for a consideration of US$142.3 million." At the ruling exchange rate, that amounts to 1.623 billion Rand.

The therapy (which sounds like a one trick druid from the Asterix series), is an anti-coagulant and compliments their recent acquisitions in this space. It is currently only available in Germany, Switzerland and Austria. Subject to approval from the German competitions authorities, they will fork out that fairly sizeable sum. The product is pretty small for now, having revenues of only 68 million Euros. So the therapy is small, if you require further reading material, be my guest, Wikipedia ->

Certoparin sodium and this page ->

Certoparin Sodium:

Sodium salt of depolymerized heparin obtained by isoamyl nitrite degradation of heparin from pork intestinal mucosa. Pig stomach mucous, to manufacture anticoagulants, which treat blood clotting. That is the simplest way of explaining it. As Byron said from across the table, all you need to know is that the guys at Aspen know exactly what is going on. The stock is up on the news and is in fact, if it closes here, will be at an all time high.

AVI stuck out a trading update this morning. All divisions did pretty well, other than their smallest, the personal care division, as per the release:

"revenue declined following the revision of trading terms with Coty". Sales for the six months to end December topped 6 billion Rand, an increase of 11.1 percent. Consolidated headline earnings per share is expected to show an increase of between 8 to 11 percent, 249 to 256 cents per share for the six months. AVI results are expected on the 9th of March. The stock is down over one and one quarter of a percent, relative to a market which is marginally higher.

Whoa, can you read the Anglo American Platinum trading statement? It actually was not posted on the Amplats website, believe it or not, it was nowhere online, only on the SENS service. The first part is pretty basic and self explanatory:

headline earnings and headline earnings per share ("HEPS") for the period are likely to decrease to be between R650 million and R875 million and 250 cents and 335 cents per share respectively. The prior year it was 1.451 billion Rand, 556 cents per share. Basic EPS is

"likely to increase to be between R495 million and R705 million and 190 cents and 270 cents per share respectively." The upshot of it all is that the stock is down 3.3 percent, not good. I am interested to see in the results (9 February) the further action taken with regards to the unprofitable mines to reflect the reality of lower platinum prices. Phew, we still continue to avoid single commodity stocks, the prospects still look patchy at best.

Byron beats the streets

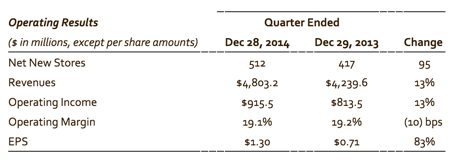

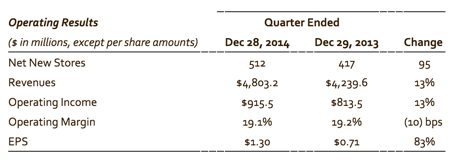

Last night after hours we received earnings from Starbucks for their first quarter of the financial year. The numbers look good and the share price shot up 5% after hours. Lets look at the numbers.

Revenues increased by 13% but remember this now includes Starbucks Japan which was recently acquired. Global comparable sales increased 5%. Earnings per share increased 83% to $1.30 per share, this also includes Japan for the first time. Highlights for the quarter included, 9 million more customer transactions in the US over the comparable period; the opening of 512 new stores including the first Starbucks Reserve Roastery and Tasting Room (

Sasha wrote about this last year); $1.6bn now loaded on Starbucks Cards; 1 in 7 Americans received a Starbucks gift card in Q1 (WOW!); 896 000 new Rewards members in the quarter.

As you can see, its been a busy quarter for a company that never sits still. In fact I was reminded of an Onion headline the other day which gave me a good chuckle. "New Starbucks Opens in Restroom of Existing Starbucks." I've hacked a table from the presentation which sums up the quarter. The decrease on Margins actually comes from the Japanese business. If you exclude that, margins in fact increased by 70 basis points.

From what I read and see in daily life, coffee is growing everywhere.

From what I read and see in daily life, coffee is growing everywhere. Research has shown (in moderation of course) that it is actually good for you and it's allure as a gourmet product has spiralled it up the list for anyone who claims to be cool. Whats more exciting for Starbucks is that 70% of their sales come from the US. A recent study from Statista suggests that the US is still quite low on the list of coffee drinking nations.

Global leading 20 coffee consuming countries in 2013 (average per capita cups per day). Which means there is still plenty room to grow in its country of origin. Other studies I have read suggest that within the US, minority groups are the fastest growing coffee consumers. Thats always a good sign.

The room for expansion outside the US is also huge. Paul said that the presence of Starbucks in China was huge. The brand is strong and the Chinese sure love strong brands (sorry for the generalisation).

Fundamentals? The stock is expensive, it always has been. Earnings expectations for the year are $3.17, trading at $86.26 we have forward earnings of 27 times. But these earnings are expected to grow by 24% in 2016 to $3.93. As far as PEG ratios are concerned, the market is right.

We expect Starbucks to beat these lofty expectations and continue to add.

Things we are reading, we think that you should read them too

The one trick pony, Google, keeps adding small but new revenue streams -

Google allegedly close to launching its own wireless service using Sprint and T-Mobile. The long term goal here I think is to control the infrastructure linking everyone and everything.

This article highlights how quickly the world changes and by extension how companies have the opportunity to grow (or die if they don't adapt) -

3 ways to fix our broken training system. 65 percent of today's school kids will end up doing jobs that haven't even been invented yet.

Looking at ways of being more efficient and helping feed more people -

The Drought Fighter

Home again, home again, jiggety-jog. Markets were higher, now they are lower. Gold, platinum and resource stocks are lower on the whole, the copper price is lower. It is still wall to wall coverage of Davos, I am paying attention to who is there and what is going on, I am not too sure that it is relevant for our business. It is fun however to see journalists from Sandton interviewing business leaders from Sandton in the Snow, what did that all cost? Talking of that, one of my favourite market presenters, Nozipho Mbanjwa asked Telkom CEO, Sipho Maseko why he had to be there, at Davos. He replied that Telkom were always looking for partners, business partners. The last time I remember Telkom talking to someone else, government as the main shareholder rebuffed the advances from a South Korean business, KT Corp. I guess the Davos experience still means that face to face is still the way, millennials must have been absent, they prefer to "hang out".

Sasha Naryshkine, Byron Lotter and Michael Treherne