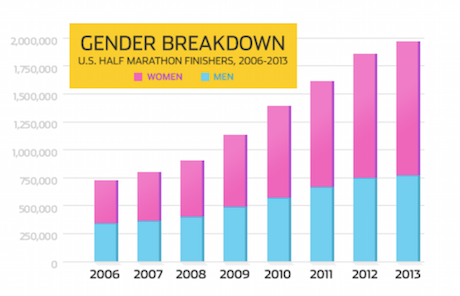

"As you can see, phenomenal growth regardless of macro trends. And that second image which shows the dominance in women runners is very interesting and encouraging. Whether it be indoor soccer, running, touch rugby, cross fit or pushing weights, people are getting more active and Nike are the brand leaders."

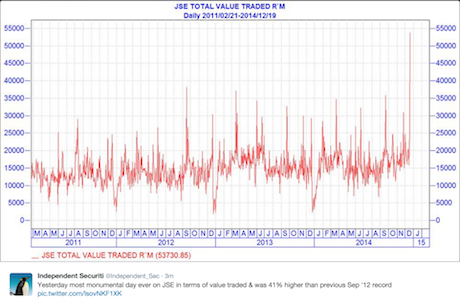

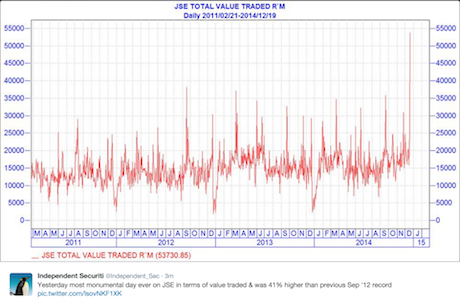

To market, to market to buy a fat pig. Saying that yesterday was huge doesn't quite capture how big it was, the All share was up 4.25% and the Top 40 was up 4.79%!!! The media tells me that the Top 40's gain is the biggest since 2009, on a points basis it was the biggest day ever! The All Share is now up 6.56% for the year so the market is now just beating inflation, if you assume that there are no costs involved. On a value basis I found this image on twitter; thank you Independent securities.

"Yesterday most monumental day ever on JSE in terms of value traded & was 41% higher than previous Sep '12 record". So yesterday was huge from any angle that you look at it.

I watched an interview with Warren Buffett

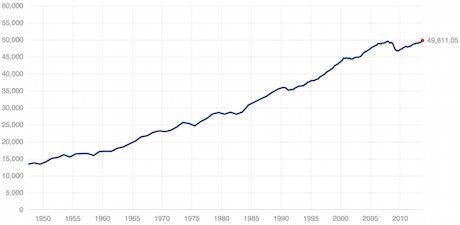

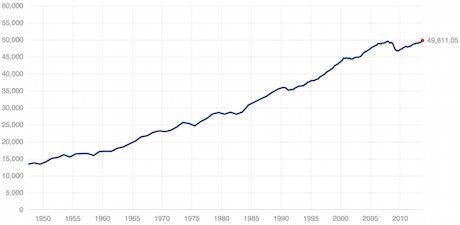

I watched an interview with Warren Buffett yesterday, he had a number of things to say but the big thing that stood out to me was the incredible wealth created in the US. In the interview Buffett said that real GDP per capita in the US has gone up by a factor of six since he was born! Breaking down the jargon, it basically means that it is the GDP number for the US, taking out inflation and then divided by the population number of that year. I went out and found a graph of the real GDP per capita growth:

Now most people might think, well that is normal. Aren't all good graphs meant to start in the bottom left and end on the top right? Going back into history, I would say that the average over the last couple thousand years has been for it to take a generation just for the wealth meter to move let alone quadruple in a generation. I think that this highlights the golden age that we are living in and the power that a free country and market has. I'm not quite sure what my conclusion is from this information but I do know that it is a very impressive stat.

Another thing that the oracle of Omaha had to say was that he didn't think stocks were overvalued. He said in his life time stocks have not been fairly valued about 5 or 6 times and the last time that was the case was at the end of 2008 when they were severely undervalued. So all in all, stocks are not over valued and the US is blazing a trail in creating wealth for its citizens, which creates wealth for other countries all over the world.

Byron beats the streets, Nike still doing it

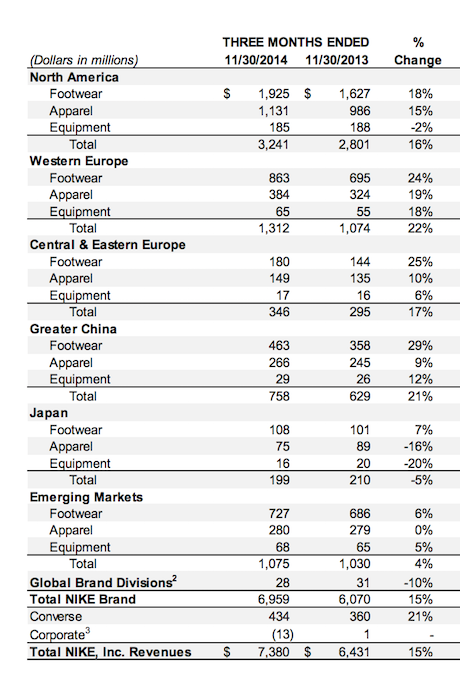

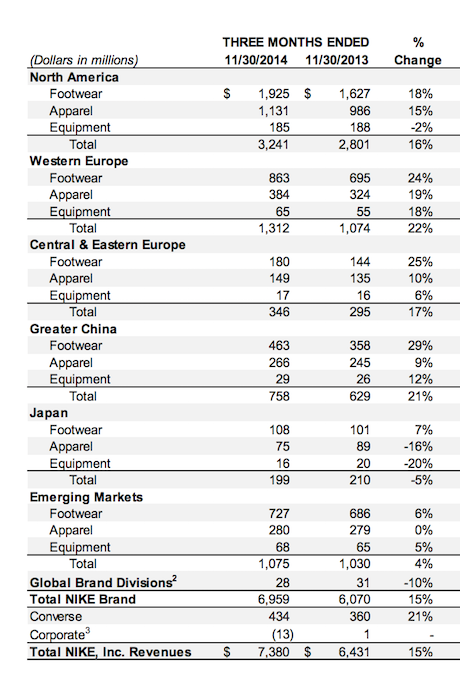

Last night after the close we received second quarter results from Nike. An odd time to release results but it certainly kept us busy and excited in the quiet office. Lets delve into the numbers straight away.

Revenues increased 15 percent to $7.4bn while headline earnings increased 25 percent. This was thanks to increasing margins (they pushed their high margin products successfully) and share buy backs. The group was very proud to announce solid growth in all geographic regions while Converse grew sales 24% to $434 million (6.2% of sales). The only disappointment was golf where sales were flat. This has been an ongoing trend for a while now, Golf has slowed down in general. It is not a Nike issue.

Below I have hacked a divisional break up of their revenues to paint a better picture of where Nike sell their goods and what they are selling. As you can see, very solid growth in the developed markets, no wonder we have seen money shifting back in that direction. Footwear is still dominant whether it be for fashion or sport. Their are Nike fashion shoes which sell for over 1 thousand British Pounds!

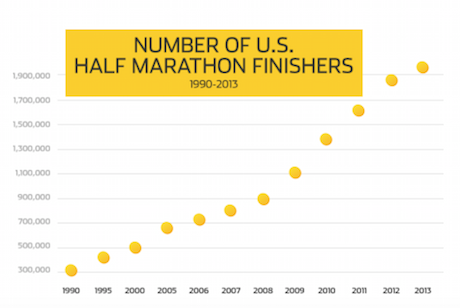

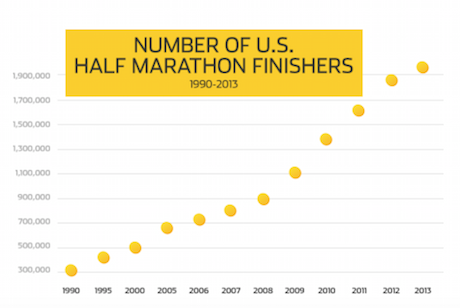

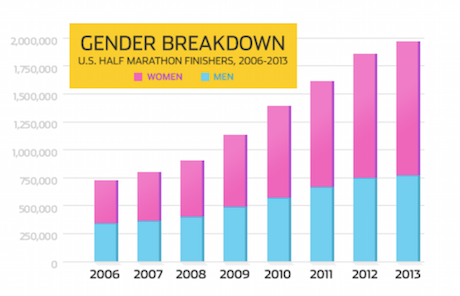

But the sporting aspect excites me the most. Being a recent runner myself I now read and follow running media. I came across this article in the RunnersWorld titled

The Half Marathon's amazing growth in 3 charts. I am going to hack a couple of images from the article.

As you can see, phenomenal growth regardless of macro trends. And that second image which shows the dominance in women runners is very interesting and encouraging. Whether it be indoor soccer, running, touch rugby, cross fit or pushing weights, people are getting more active and Nike are the brand leaders.

The market of course knows this. The share trades at $94.27 (it's down 2.5% on the back of lower than expected future orders) and is expected to make $3.61 this year and $4.16 next year. Year end is May. Trading at 23 times next years earnings the stock is priced for growth. But if a company is growing earnings between 15 and 20 percent then that is to be expected.

We are of the opinion that sales will exceed high expectations. The take up of sport and activity is contagious and if your peers are all doing it, its very hard to not get involved. The Nike brand has never been stronger and the shift in Nike apparel as a fashion statement is also very exciting. We are adding to this stock.

Company corner snippets

British American Tobacco announced that it Reached Agreement on an issue that goes back to 1986. Wow, that is a long time for something to be unresolved.

Ellies had their Unaudited Interim Results For The Six Months Ended 31 October 2014 come out late yesterday afternoon. They were not pretty looking numbers but the market is of the view that they could have been worse, the stock is up 5% today on low volume.

Things we are reading, we think that you should read them too

The future of medicine and an inspirational storey at the same time - Beyond blood: Theranos' billionaire founder talks growth. The technology developed by Theranos will make it more mainstream to wear a patch and have real time data sent to your phone and then onto your doctor, allowing for early detection of disease and probably the more basic function, to monitor your diet.

Activist investors see ways that companies can make better returns for their shareholders, they swoop in and try influence management to do things better - The Activist Investor Scorecard. I suppose that you can look at them as a mechanism that makes markets/ companies more efficient.

Having a look at how technology has changed the market - Is Technology Speeding Up Market Cycles?.

The power of economic freedom, a liquid capital market and a world changing technology - Google Is Now Worth More Than the Entire Russian Stock Market. The irony is that Google has closed its Russian office due to increased restrictions imposed on it from the authorities.

What we search for on the internet gives some insight into who we are - Google top searches for 2014. Change the country and the year to see how the trends change. Then to finish off - Google video of top searches for 2014

Home again, home again, jiggety-jog. From another strong start this morning, up around 1%, we are now sitting in the red. The Rand has also started weakening again and is sitting around the R11.60 level. The last few days have highlighted how emotional markets can be and why it is important to ignore short term moves, focus on the fundamentals and batten down the hatches for the long term. Today is the last message for the year, so the team here wishes everyone a relaxing festive season and hopefully a christmas rally to end the year off. If you need to contact us, give us a call on our cells or via email, we will be back with your daily dose of markets on the 5th Jan.

Sasha Naryshkine, Byron Lotter and Michael Treherne