"The business, Bidvest is not even 30 years old, the business was founded in 1988. It employs, according to their website 137 thousand people, the results release says 143,828 people worldwide. That is astonishing and in this country we are always at pains to talk about who is going to be the creator of jobs, look no further than private enterprise and unleashing human potential. Brian Joffe is smart, he is street smart, he has done exceptionally well for his shareholders."

To market, to market to buy a fat pig. It is a holiday in the US today, Labor Day. What that normally means is that the seasons are changing, you can see that all around you, the buds are there, the flowers are too. It is certainly a *nice* time of the year, it could of course be warmer for us. We certainly cannot complain about the weather here, less so in Harare. The Zim economy might be on its knees again, the cricket team however is on top of the world, having beaten the mighty Australia for only the second time ever.

Other records include a new closing high for the S&P 500 Friday, of course that will hold until tomorrow, the futures market reflects a modest drop when the market does eventually open. Locally we were dented by all of the resource companies, the iron ore price as discussed last week weighed heavily on all of the major producers. As such we are around 1000 points, or two percent away from our all time highs. Quiet today as a result of the holiday weekend, news is "slow", locally we have results from one of the businesses that we follow closely.

Bidvest have released their full year numbers to end June 2014 this morning. We often say that this company is very close to us and this is true, they are right next door, their back stairwell is ten metres from our offices here. So we are close in proximity to a man that sometimes we term the Magician of Melrose Arch, using the similar reference to the Oracle of Omaha (Warren Buffet). Brian Joffe, the man that runs Bidvest has been called the Warren Buffet of South Africa, his ability to continue to bolt on businesses into the Bidvest stable using existing cash flows is compared to Buffet going elephant hunting from time to time.

The business, Bidvest is not even 30 years old, the business was founded in 1988. It employs, according to their website 137 thousand people, the results release says 143,828 people worldwide. That is astonishing and in this country we are always at pains to talk about who is going to be the creator of jobs, look no further than private enterprise and unleashing human potential. Brian Joffe is smart, he is street smart, he has done exceptionally well for his shareholders.

Who are they? The shareholders that is. Well, in order, the Government Employees Pension Fund own 15.07 percent of Bidvest. BB Investment company (insiders) owns 4.06 percent, Lazard owns 3.08 percent whilst the Government Singapore Investment Corporation (or GIC, the Singapore government's sovereign wealth fund) owns just over two percent. You can see that this is a very widely held company. The market cap of Bidvest as at Friday close, 93.183 billion Rand.

Bigger than Shoprite, close enough to that 100 billion mark! Nearly 30 thousand shareholders in total, as at the last financial year (12 months ago) with 52 percent of the shares held by South Africans and nearly one quarter North Americans.

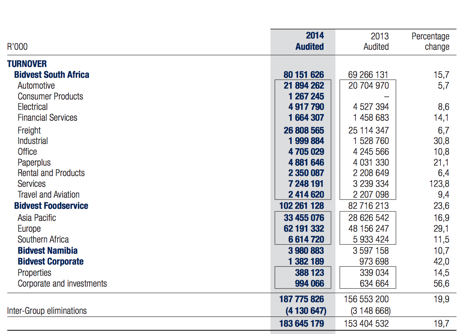

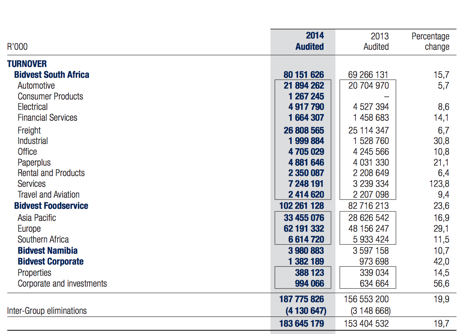

The results? Turnover up to 183.6 billion Rand, HEPS up 11.1 percent to 1733.9 cents per share, distributions of 834.1 cents per share for the full year (up 15.8 percent), 398.1 cents in the first half, 436 in the second half. In terms of the revenue and profits split, here goes, two separate images from their

2014 results booklet. First things first, here is the revenue mix,

notice that European and Asia Pacific foodservice's collectively are more than half of group revenue.

It is fair then to say that half of this businesses revenues come from South Africa and Namibia and the rest from Europe and Asia Pacific. To put that into perspective, of how that has changed over a five year period, those two divisions contributed roughly 35.5 percent to group revenue, now it is more than half. That tells you what you need to know, about the company's strategy, they will continue to buy bolt on businesses and bulk those up in Asia Pacific (Aussie, New Zealand and a more meaningful push into China) as well as Europe.

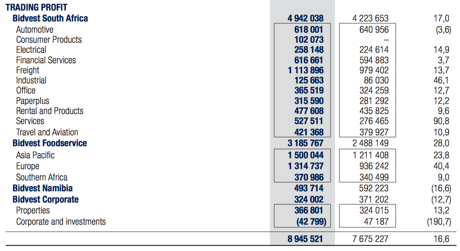

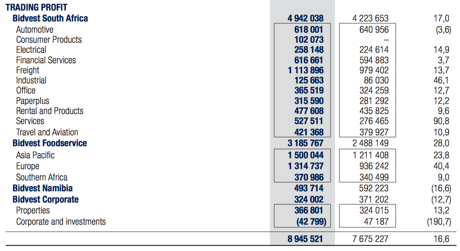

It is all very "nice" to have revenue, profits count for everything, Visa and Mastercard are very profitable businesses with low revenues. So how do those businesses compare to the local business, the core part of the Bidvest group? Well, here is the graphic of the trading profits of the various parts of the business, you can see that the South African business is still the king, contributing roughly 55.2 percent of the profits, whilst those two separate foodservice's businesses represent 31.5 percent of trading profits.

So whilst it is good to see that the business is more international in their focus, in this case it is clear that the margins in South Africa are better as a result of less competition. Reading through the separate divisional and geographical businesses you get a good sense that Europe, whilst in recovery mode, is still tough, the UK is much better than anticipated. Notwithstanding tough operating conditions here in South Africa, I like the fact that the company is still able to comfortably be more profitable than I guess some of their peers. The automotive part of the business is a tough old place to do business, all local operators are struggling.

In the foodservice's part of their business, a few acquisitions have strengthened their foothold in Italy and the UK, more promisingly in Chile where they are now number 2 in that market. A small acquisition in Brazil has signalled intentions of being a more serious operator in South America in the coming years. Equally the mainland China growth, although small for now, is a clear sign that Bidvest foodservice's are ready to deliver stronger revenue growth from the number 2 economy on the planet. Foodservices go hand in hand with stronger tourism and better business operating environments, both of which have grown significantly, as we tried to put forward in those aviation (bums on seats) numbers last week.

To end off, why would you want to own a business like Bidvest? There is nothing revolutionary in terms of their services and nothing earth shattering in terms of how they will continue to grow their business. There is however a lot to be said with consistency and the compounding growth achieved over time by picking the right businesses, as the investment team do over there at Bidvest. There is a case to be made for people to own Bidvest rather than any unit trust, it will certainly be cheaper!

For us here at Vestact, the reason why we own them in portfolios is for stability and reliability and consistent outperformance, the team has been able to show superior investment skills. The share price has followed, we continue to buy and add to what is a quality company. There could also be the potential in time of an international unbundling, or pure global foodservice business that incorporates all their respective businesses.

Things that we are reading, that we think you should be too

What is your real return on your investment? -

Understanding Your Real, Real Returns. The unseen costs that we sometimes forget about have a significant impact on our returns.

Farming without soil, using no soil and in our cities -

How to feed the cities of the future. How we grow our food impacts everyone's lives from the cost of food to the quantity that we can grow and the land required.

Making it easier to pay for things will lead to increased sales -

Apple Said to Team With Visa, MasterCard on iPhone Wallet. If successful Apple will lock people into their ecosystem for another cycle and Visa will process more payments. Great for both companies and the consumer who can now part with their money that much easier.

Social Media impacts on just about every aspect of our lives -

Top ten trends in social media. Americans spend an average of 4.3 hours a day on social media compared to the world average of 2.8 hours.

Another call for a market crash and gold to soar -

About David Tice's 60% Crash Call . . . Even a broken clock is right twice a day.

A scary stat -

More Than Half of the Upper Middle Class Saves Nothing. This might be an American stat but you could probably transpose it to most of the world.

Home again, home again, jiggety-jog. We are up marginally here. The Russians and the Ukrainians are still fighting. Sigh.

Sasha Naryshkine, Byron Lotter and Michael Treherne