"OK, that is all nice, how does the company make money? Advertising on your timeline, I am sure as a user you have seen them. Promoted adverts. International revenue was 33 percent of total revenue in the last quarter, mobile advertising revenue was 81 percent of total revenue, 211 million of the 271 million monthly active users are mobile users. Average revenue per 1000 timeline views is a mere 1.60 Dollars."

To market, to market to buy a fat pig. Markets reached all time highs here in Jozi yesterday, fabulous news for all and sundry. I suspect that the tired old bears are feeling a little worse for wear, Marc Faber (you know, the gloom-boom-doom guy) suggested that equities were going to fall 20 to 30 percent. Thanks Marc for that.

My word, it must be so tiresome to be so bearish all the time and then suggest when equity markets went down that you called it.

Byron will deal with whether the markets are over or undervalued and whether that really matters in the long run, I suspect long run means different things to different people. If you are in the equity markets trying to trade around non farm payrolls, or weekly jobless claims, good luck with that, rather you than me. I found this fabulous graph, via Barry Ritholtz, which led me to Catherine Mulbrandon and her website page titled:

STOCK EXPONENTIAL GROWTH RATES.

You can see many wars and events trying to derail the trajectory of equity prices, to no avail, companies always find a way. That is why I will continue to advocate investing in businesses and not trying to worry about absolute market levels. The best investment is owning companies stock over the long term, as you can see from another graph on her website:

RETURN ON GOLD, STOCKS, BONDS, AND BILLS SINCE 1928

That one line struck me though, below the graph if you follow the link:

"if we look at the annualized return for 1928-2012: gold's return of 5.3% beats t-bills at 3.6% and bonds at 5.1% but still underperforms stock's return of 9.3%." The short answer is to stay long quality businesses, nobody ever knows what is going to happen and where it is going to happen next. Byron hopefully will flesh out the valuations side for you.

Twitter reported numbers for their second quarter last evening and they absolutely crushed it. Revenues against the comparable quarter grew an astonishing 124 percent, but yet is only 312 million Dollars. Only, why do I say only? This is relatively new to investors and users and as such the average spend per user is going to be lower until everyone adopts the handset as their primary news outlet. We have the internet to read flat pages, Youtube to watch all sorts of videos, TV is still huge, print media is struggling. I am still amused when radio stations look at newspapers in the morning, even some of the stories are ancient in this modern world we live in.

Trends are important. New technologies require time until they become mainstream. Twitter is on the cusp of being the number one news platform. It is customisable to each and every single user. Follow and unfollow becomes easy. If you do not like your friends on Facebook that is your problem, on Twitter it is so easy, it is business. Twitter is for the big issues and as such it will attract people who are interested in broader global issues as well as feeling they need to know what is going on.

The fear of missing out, FOMO is real people!!

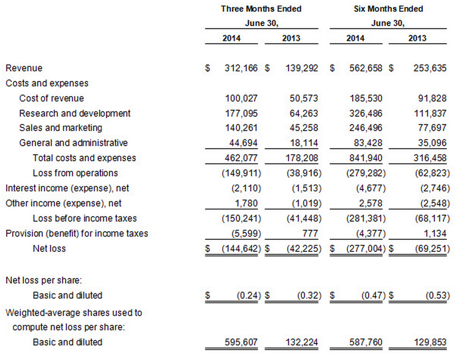

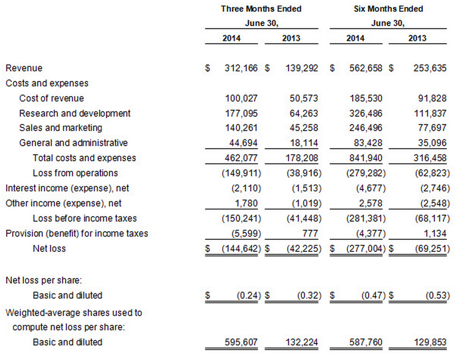

Now that we have tried our best to understand new technologies and how humans adapt (there must be thousands of entries on that) over time, let us do what we do, look at the business and their prospects. Rather than use the quarterly numbers, let us use the half year comparable numbers, it is something that we are more used to around these parts. OK, let us compromise and do both, here is a snapshot of the business:

The company is spending a bomb on sales and research and development. Twitter spent a whopping 58 percent of revenue on R&D in the first half. In addition to that 43.7 percent of revenues were spent on sales and marketing. That is of course why the company made an operating loss of 279 million Dollars for the first half. If you reinvest a large portion of your profits back into your business, this can be seen as a business expense and therefore tax deductible, that is the simplest way I think to explain it.

OK, that is all nice, how does the company make money? Advertising on your timeline, I am sure as a user you have seen them. Promoted adverts. International revenue was 33 percent of total revenue in the last quarter, mobile advertising revenue was 81 percent of total revenue, 211 million of the 271 million monthly active users are mobile users. Average revenue per 1000 timeline views is a mere 1.60 Dollars. Wow. Or 16 cents per 100. 0.16 cents (US) per timeline view. That is almost laughably low. In that I think lies the opportunity. Advertising revenues on traditional platforms are not nearly as pointed as they are on social media, there is so much data available, specific data.

So whilst these results with a marginal non-GAAP profit (14.5 million Dollars for the quarter), which translated to a marginal Non-GAAP EPS of 2 cents for the quarter, the excitement is that the business is there, it is enabled, the users now need to spend more, more advertisers need to move to the platform. That will happen. More exciting for shareholders that have felt left out of the rally is that the stock surged an incredible 28 plus percent after hours trade, now at 49.61 Dollars a share. Even opening at that level the stock would be down year to date.

Is this investable, this company? It clearly depends on whether you think all the advertising platforms will move quickly to the device that you use more than anything else, the device in your pocket. Twitter are starting to monetize their very pointed base. There are according to the company, millions of users who do not have an account and engage with the platform, that is why you might have noticed the subtle web changes.

If the company is not that committed to profitability whilst ramping up in the short run (as Amazon are in the errrr.... long run?),

then you have to buy the company on the basis that revenues are going to continue to explode higher, as they did here. We like it, it is a buy, perhaps wait for a while to see where the price settles if you are thinking of adding after the heroic rally.

Byron's beats: Are markets expensive?

There is so much talk out there that the market is overvalued. Firstly what is meant by "The Market" and secondly is there merit in the statement?

Lets cover the first question and then deal with the relevance of the second question. When talking about "The Market" I am mostly referring to the JSE All share index. That is because this message is geared towards South Africans whose interest would be predominantly geared towards the JSE. But the JSE is directly linked to global markets so in essence we have to look at the NYSE which is accountable for more than 35% of listed assets. But even the S&P 500 gets nearly 50% of its earnings from outside the US.

This means essentially that markets are almost completely globalised. Especially a liquid one like ours where the biggest constituents listed on the JSE are not South African companies. Naspers, SAB, British American Tobacco, Richemont, Glencore and Billiton are all global businesses and they make up 45% of the ALSI. This means that the South African economy in fact has very little impact on the JSE. Global sentiment towards equities as an investment is what is most important.

So is the market overvalued? I came across a very interesting article by investment legend Byron Wien (great first name) titled

Byron Wien Makes the Case for Another Huge Rally in Stocks. From the title I am sure you can see where this article is going but the fundamental arguments he makes make a lot of sense.

"One of the problems limiting investor enthusiasm may be valuation. If the S&P 500 earns $115 in 2014, it is selling at 17.1x earnings. Market peaks have occurred historically at 25x–30x times earnings. On that basis, the market is fairly valued but not exceedingly expensive. The average trailing 12-month price-earnings ratio when the inflation rate is 0%–4% is 17... If the economy grows at a rate of 3% real during the remainder of the year and inflation is 2%, then nominal growth should be 5%.

With productivity increases continuing and share buybacks, the S&P 500 should be able to show improvement of 7% over the $108 in operating earnings of 2013 and that would put us at $115. With considerable cash on corporate balance sheets, share buybacks should continue. Therefore, if earnings reach my target and the S&P 500 sells at 20x, we could reach 2300, which is 17% above the present level or more than 20% above the index price at the start of 2014."

In my opinion this is a good argument in favour of a fairly valued market and that we are far from bubble territory. Growing margins, a growing economy and manageable inflation rates should eventually result in growing sales which will be even more earnings enhancing. I'm talking about the S&P here.

But what about the JSE? A friend of mine sent me an interesting graph this morning which suggested that the JSE all share has recently reached a high in dollars previously reached in 2007 and then again in 2011 when the Rand was much stronger. Essentially this means that in dollar terms the JSE ALSI has done nothing for nearly seven years. My immediate reaction was that this is a buying opportunity. Another graph was then forwarded on to me which suggested that the growth was only due to PE expansion. The average PE of 19 was also back to the highs reached in 2007.

Referring back to Byron Wien's article along with my explanation of markets being globalised, it makes complete sense that the JSE has seen a PE expansion. Don't be fooled by negative economic data coming from South Africa, in fact the ALSI is a natural Rand and inflation hedge which is exactly what you want in this low interest rate environment. And according to the article above we could easily see more PE expansion which will filter across to the ALSI.

I don't like to get too absorbed in macro sentiment debates but for clients who are still looking to get into the market and are worried about timing, it is important to explain these types of factors. What is important from our perspective is that we pick companies that are growing regardless of short term macro factors.

If we buy the quality, ride the sentiment wave and consistently add cash to these existing positions, these types of arguments are less relevant.

Home again, home again, jiggety-jog. Janet Yellen and the FOMC tapering further is apparently the biggest thing happening today, in equity markets that is. There is also ADP data. Another look at GDP for the second quarter in the US. Company results too continue to stream in. That is all that matters.

Sasha Naryshkine, Byron Lotter and Michael Treherne