Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

As you may know, having access to the New York Stock Exchange gives you the ability to invest in many exciting companies around the world. One of those companies which we have initiated coverage of over the last couple of months is the Italian sunglass manufacturer, Luxottica.

First let's look at what the company does.

"Luxottica produces and distributes sun and prescription eyewear of high technical and stylistic quality to improve the well-being and satisfaction of its customers and at the same time create value for employees and the communities in which the Group operates."

Ok that sounds interesting, but this will blow your mind, here is the list of their brands. (These are just the ones I know)

Arnette, Brooks Brothers, Burberry, BVLGARI, Chanel, Coach, DKNY, Dolce & Gabbana, Donna Karan, Emporio Armani, Giorgio Armani, Oakley, Paul Smith, Polo Ralph Lauren, Prada, Ray-Ban, Tiffany, Versace and Vogue. So basically you think sunglasses, think Luxottica.

That is their branded goods portfolio which they sell through both wholesale and retail (heard of Sunglass hut?). But 50% of this business falls under prescription glasses. So it actually covers two of our favourite themes, Luxury retail and healthcare. There are also lots of synergies where you can mix the luxury brands with the prescription glasses. Even nerds want to look cool.

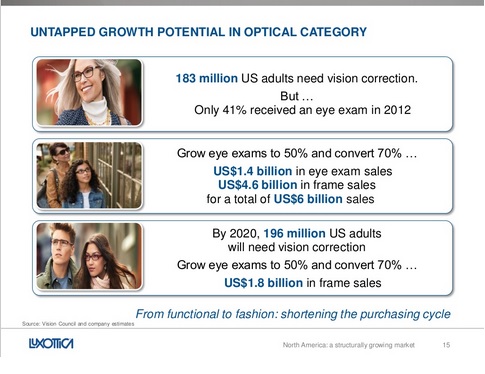

That prescription business brings a whole new dynamic. They recently did a study on the US market and found the following information. The potential is huge.

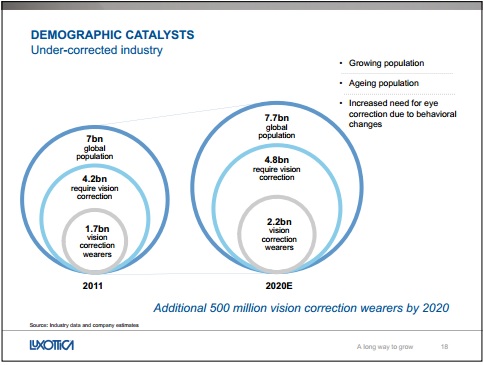

The potential on a global basis is even bigger (see below). You can just imagine how many people in developing markets are walking around with terrible eyesight.

There are concerns about eyesight operations and contact lenses creating extra competition but in my opinion these people will still be branded sunglass clients more so than most.

Their financials are strong. In the 3rd quarter of 2013 they managed grow sales by 7.4%. This consisted of 3% growth from the US, 11% from Europe and 20% growth was seen in developing markets. With gross profit margins of 66.7% and net income margins of 9.2% the company made 522 million Euro for the quarter. However with a forward earnings ratio of 23 it is certainly not cheap.

One concern is the ownership structure. 61.35% of the business is still owned by founder and second richest man in Italy, Leonardo Del Vecchio. His family is complicated with 3 wives (not at the same time) and 6 children and that can always pose a risk. His interests and the family's are certainly aligned with shareholders though. Hopefully they will start selling shares in the future.

Having had a long look at this one and weighing the pros and cons, I find it a compelling investment according to the Vestact criteria. Luxury retail, sports apparel and healthcare are all covered here and its position in emerging markets is also very exciting, both for sunglasses and prescription eyewear. Let us know if you would like to add these to your portfolio.