Market Scorecard

Chinese stocks are on an eight-day green streak. That has meant a strong Tencent and by extension, a strong Naspers. Also helping the JSE has been the momentum from gold miners as the gold price crosses $1 800 for the first time since 2011. If you are a regular reader of this newsletter, you will know that we are not fans of gold. It costs money to take out of the ground, it then costs you money to store, and it doesn't even pay you a dividend! No thanks. Lets rather invest in growing companies that are changing the world.

Yesterday the

JSE All-share closed up 1.13%, the

S&P 500 closed up 0.78%, and the

Nasdaq closed up 1.44%.

Our 10c Worth

One thing, from Paul

I'm a graduate engineer, with an MSc (Eng) from the University of Cape Town. That was back in 1991, and I never actually worked as one, but I've always enjoyed trying to understand how things work, and was naturally drawn to investing in technology companies.

That has worked out well. This year alone, our focus on large-cap tech stocks has resulted in some very solid market outperformance.

For the first six months of 2020 the Vestact model account in New York was up by 12.3% in US Dollars, after fees and a stock swap from Booking.com to Microsoft. The S&P500 lost -3.1% over the same period. So a very good start to the year!

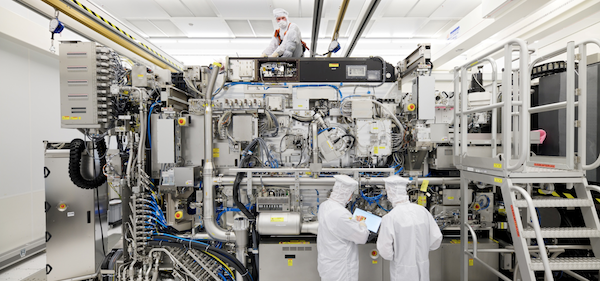

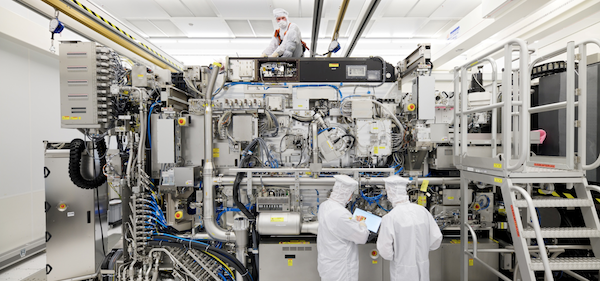

Speaking of how things work, I enjoyed this article about the machines that make semiconductor chips for computers. This is how they work, which is really impressive.

"An extreme ultraviolet lithography machine is a technological marvel. A generator ejects 50 000 tiny droplets of molten tin per second. A high-powered laser blasts each droplet twice. The first shapes the tiny tin, so the second can vaporize it into plasma. The plasma emits extreme ultraviolet (EUV) radiation that is focused into a beam and bounced through a series of mirrors. The mirrors are so smooth that if expanded to the size of Germany they would not have a bump higher than a millimeter. Finally, the EUV beam hits a silicon wafer - itself a marvel of materials science - with a precision equivalent to shooting an arrow from Earth to hit an apple placed on the moon. This allows the EUV machine to draw transistors into the wafer with features measuring only five nanometers - approximately the length your fingernail grows in five seconds. This wafer with billions or trillions of transistors is eventually made into computer chips."

In this sector we own chipmaker

Nvidia, which just bypassed IBM in market capitalisation.

Other tech nerds might want to read this.

The chip-making machine at the center of Chinese dual-use concerns.

Byron's Beats

I am very excited about the prospects for Google Cloud. We have seen how well it has done for Amazon and Microsoft. The cloud business is still in its early stages and I believe there is room for a third big player. That is why I was excited when I saw the following headline

Google, Deutsche Bank Agree to 10-Year Cloud Partnership.

It is believed that the partnership could save Deutsche as much as $1bn in costs over the 10 years, thanks to the efficiencies of cloud services. What is great for Google is that it gives them a track record in financial services, a sector that is fast moving online.

According to the article, Google already has HSBC as a cloud client.

If Google can make financial services a niche they can sign up a lot more banks. The more banks they have, the more data they can process and the better their service becomes. Such is the nature of cloud services. It learns what is best for the client over time.

AWS (Amazon) and Azure (Microsoft) both have their own niches. But as I said earlier, there are plenty of sectors that still need to move online and will be looking for a happy cloud home.

Michael's Musings

A term that you might have started hearing recently is MMT or Modern Monetary Theory.

Roughly speaking, the idea is that governments with their own currency should not worry about budget deficits and should just spend as they need to. The only time a government should cut back on spending is when inflation levels start to rise.

You can understand why this theory is starting to gain traction among politicians.

Who doesn't want a blank cheque? With our current Covid crisis, and the need for huge amounts of stimulus, MMT is starting to be spoken about in more mainstream circles.

At the core of any currency is trust. It is a trust that someone else also thinks my money is worth something. It is a trust that the government will be good custodians of their nation's currency. As long as there is trust in a nation's currency, and there is a demand for the currency, a government can have as big a budget deficit as they like. As that trust starts to weaken, then that currency value decreases.

If the trust is broken, that is when you see hyperinflation and money become worthless.

The world trusts the USD. Rightly or wrongly, the USD is a global currency. Thanks to this level of trust, their government is able to print a few trillion dollars to stimulate the economy, and no-one bats an eyelid.

Unfortunately, there is not the same level of trust in the Rand. Due to the lack of trust, our interest rate is much higher than other developed nations who have much higher levels of debt. It means that our government is not able to spend as freely as MMT says they should be able to.

Anyway, so as not to go on too much, you can read more here -

What if the federal deficit didn't actually matter? Modern Monetary Theory explained.

Bright's Banter

As mentioned on Monday, I have a new podcast titled

"The Art of Randomness" where we deep dive into the minds of the most influential, savvy, and successful people in the world of business, finance, and investing. The podcast explores how these industry heavyweights became the professionals they are today: what motivates them, who their mentors are, what books do they read, what their daily routines look like, and the process that goes into running their businesses.

In this podcast we are joined by fintech entrepreneur Charles Savage, the founder of GT47, EasyEquities and Purple Group.

Charles started out as a handyman across the world, back-packing and experiencing the globe. He then became an internal auditor at the Health and Racket Club and this led to him encountering the internet, where he went on to launch one of South Africa's first e-commerce business.

In this podcast we discuss his background and upbringing; how he was introduced to Fintech and building trading platforms. He discusses the difficulty of being an entrepreneur and building a reputable business in the South African context where there's little venture capital funding to go around.

Charles describes his journey regarding building a successful business and losing it and pivoting his career path to build EasyEquities. He also shares his passion for adventure sports and how he lives his life embracing failure. This was a masterclass of a podcast and we hope you enjoy it.

Don't forget to hit the subscribe button and rate the podcast on

iTunes,

Spotify,

Google Podcasts,

PocketCast, and wherever you consume your podcasts.

Linkfest, Lap it Up

Linkfest, Lap it Up

Even before the current crisis, mall owners were under pressure due to department stores closing. The theory was that the space would be converted into offices. But with Covid, companies are looking to use less office space. Maybe the malls can become housing developments? Anyway, the property sector is a tough place to be in -

With Department Stores Disappearing, Malls Could Be Next.

Europe is positioning itself to be a leader in the emerging hydrogen powered industry. The goal is to set up an environment conducive for the creation of the entire value chain -

European Clean Hydrogen Alliance is ready for take-off.

Signing off

US earnings season has some early reporting today, with some small companies like Helen of Troy and Barns & Noble reporting. There is mining and manufacturing data out of South Africa, and the weekly initial jobless claims figure out of the US. The JSE All-share is higher, the Rand is stronger at $/R16.90 and the US futures are pointing to a higher open.

Sent to you by Team Vestact