Market Scorecard

South African markets had a rough day yesterday. The reason? Yes, you guessed it, a change in the trade war landscape.

Trump signed the Hong Kong human rights act, which effectively is a show of support to the current anti-government protestors. The new law will require the US to annually confirm that Hong Kong's special freedoms are being maintained by Beijing. The law forces China to stick to the one country, two systems principle, which was negotiated between the UK and China in the 1980's. As you can imagine, China is unhappy that the US is getting involved in their domestic politics. The concern from the market is that this will now hamper any short term resolution to the trade war.

Yesterday the

JSE All-share closed down 0.84%, and the US markets were closed.

Our 10c Worth

One thing, from Paul

The

UK election on 12 December will be an interesting one to watch. While Brexit was probably never a good idea economically, it seems that a slender majority of people in that country want to be independent of the European Union. Many of those who voted no in the 2016 referendum are now in support of leaving, if it will bring an end to political uncertainty.

According to an influential and very thorough YouGov poll, Jeremy Corbyn's Labour party could well lose 51 seats, returning 211 MPs which would be its second worst defeat since World War Two.

Boris Johnson's Conservative Party are predicted to win 359 seats, up from 317 seats at the previous election in 2017.

The Financial Times (FT) noted that "Mr Corbyn's team has showered people with pledges like confetti at a wedding. By contrast Mr Johnson has been defined by ruthless message discipline: Get Brexit Done".

From a stock market point of view, it would be good to finalise the matter, and move on to the next phase of negotiating trade deals. The UK is the world's fifth largest economy, so it does help if they can get back onto a more stable footing.

More here in the FT.

Poll forecasts Commons majority for Boris Johnson.

This week on Blunders: Things to Avoid - SAA, Cars, Cancer and Bumhole Tanning (

Blunders 166)

Byron's Beats

Since we started investing in Remgro I have been following the South African fibre story closely. At the beginning of the week Bloomberg

released a piece suggesting that Remgro were looking to sell their 54.4% stake in CIV which owns stakes in Vumatel and Dark Fibre. That was disappointing!

However, this rumour was squashed when Business Insider

announced that the Vodacom Chief of Technology, Andries Delport had resigned and was moving to CIV. The article also quoted Pieter Uys, the chair of CIV and former Vodacom CEO, stating that Remgro were not looking to sell the stake. They are however looking to raise some equity with an empowerment partner.

I think this sector has huge potential. The roll-out of 5G requires fibre to connect even more towers around our cities. Remgro is the best listed option to get access to the growth story.

Michael's Musings

Globally the number of installed 5G networks is growing rapidly. In South Africa Rain has already launched its 5G network.

To use the super fast network though will require a special cellphone or router, so your current iPhone won't cut it.

Thanks partly to the demand for a phone that can use 5G, Apple is forecasting sales of 100 million iPhones next year! If 5G is available in your area, people will want a cellphone that can access all that speed.

The graph below shows the forecasted adoption of the 5G network around the world. Look at how quickly the number climbs.

Each person joining will require a new smartphone, meaning that in the short run we should see a big increase in smartphone sales. Good news for us as Apple shareholders!

Read more about Apple here -

Apple expects a surge in shipments for the next-generation 5G iPhones.

You will find more infographics at

Statista

Bright's Banter

At the end of October, I wrote about LVMH looking to buy Tiffany's for $14.5 billion. You can read what I wrote in that Banter here -

LVMH Makes a Move for Tiffany's. At the beginning of this week, it was announced that a price had been reached, $16.2 billion.

Wow. That makes it the biggest deal ever in the luxury goods space. The sale should be completed in early to mid 2020.

The graph below shows the breadth of LVMH's luxury empire.

You will find more infographics at

Statista

Linkfest, Lap it Up

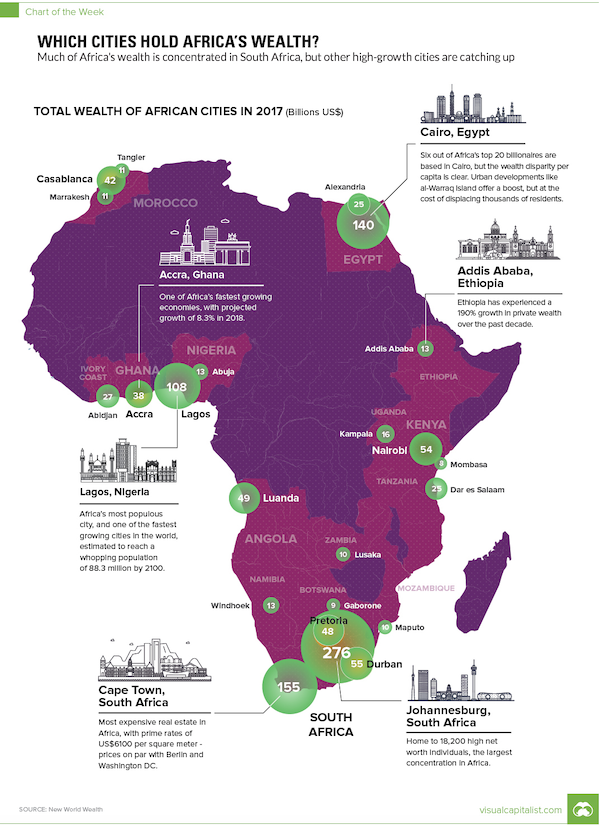

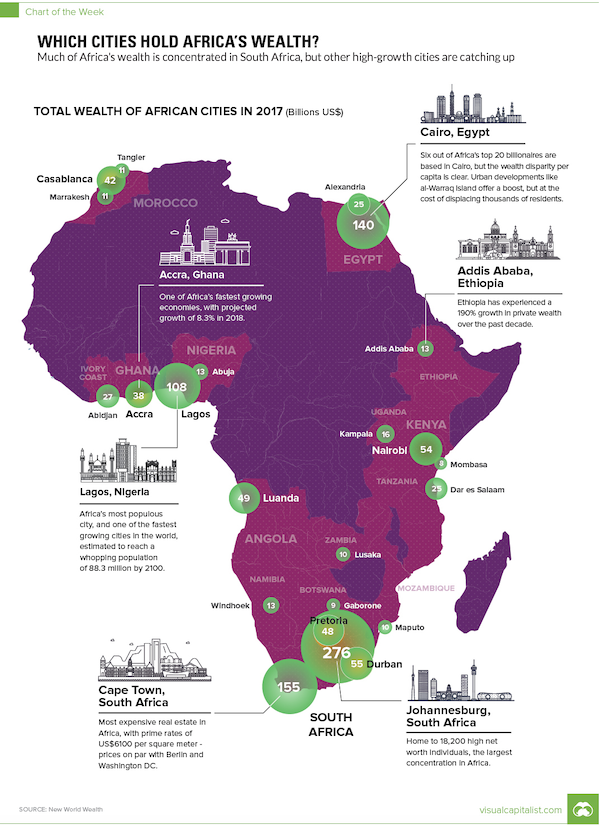

This infographic shows how rich Joburg is in comparison to the rest of the continent -

Which Cities Hold Africa's Wealth.

We are all going to die one day

We are all going to die one day. Instead of going through an energy-intensive cremation, how about going through a "natural organic reduction" where your body will be turned into usable soil within 30 days -

The world's first human composting facility will let us recycle ourselves.

Signing off

Signing off

Happy Black Friday. Is that even a thing? Don't waste your money buying things that you don't need, rather use it to buy shares and create generational wealth! On the data front, there is French GDP, German unemployment and EU CPI data out today. Locally, we get a read on our trade balance status, which can have an impact on the currency. The JSE All-share is lower this morning. Enjoy the last two days of November.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista