Last night after the South African market closed, RMB Holdings (share code RMH) announced that they plan to spin out their FistRand stake and then delist. RMH is effectively just a holding company for 34% of FirstRand; a legacy structure. Due to changing corporate governance standards and increased pressure from shareholders, these types of holding structures are being dismantled. Remember in 2016 Pick'n Pay restructured their holding setup?

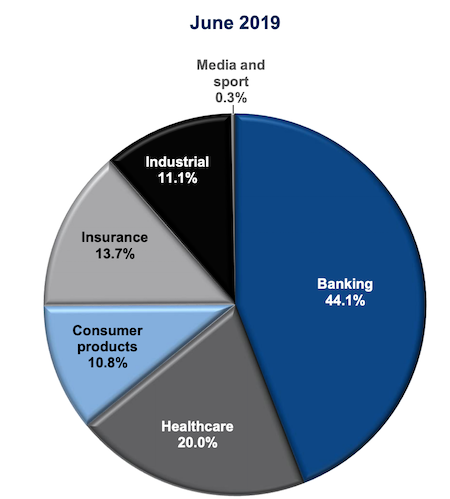

As shareholders, it makes sense to remove this extra layer of costs and management. In the case of RMH, their stake in FirstRand is worth around R130 billion but their market cap is only around R117 billion. Where things get interesting is that Remgro owns 28% of RMH. Shortly after the RMH announcement, Remgro announced that they would also consider distributing all or some of their FirstRand shares. In the case of Remgro they will get shares from their stake in RMH, plus they own 4% of FirstRand directly. Giving them an effective holding of 13.5% of FirstRand. Here is a graph showing where Remgro makes their money.

As you can see, FirstRand is their biggest income generator. Management will probably be loathed to lose the whole stake of their biggest money-spinner. If you own Remgro shares, it is because of the diversification that the company offers. So as a shareholder, you would want to see Remgro holding onto some of their banking assets. We will find out early next year about the exact plans and timetables from both Remgro and RMH. Remgro is up 7% on the news.