Market Scorecard

An FT article from last night pointed out that the technology part of the S&P 500 index is up 40% since the Christmas Eve bounce! Apple for example is up around 60% since then. It just shows you how far things fell in the last few weeks of 2018. Looking back, it was probably a good thing that the majority of our client base was on holiday and not paying attention to their accounts. By the time people came back from the beach or skiing in Europe, the market had already staged a proper come back, meaning there was no longer a need for panic selling.

Yesterday the

JSE All-share closed up 0.81%, the

S&P 500 closed down 0.16%, and the

Nasdaq closed down 0.44%.

Our 10c Worth

One thing, from Paul

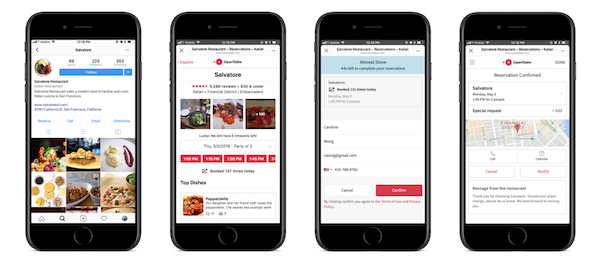

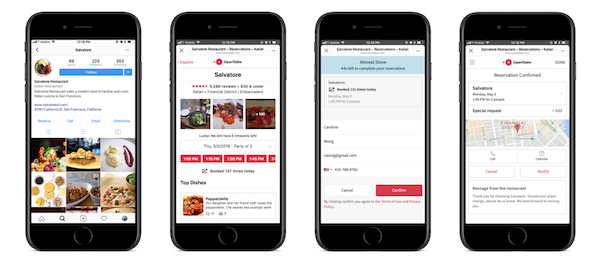

Did you know that

OpenTable belongs to Booking.com? The online travel service giant is another Vestact recommended stock in New York. It is owned by 172 clients, and the aggregate holding is worth $5,8 million.

OpenTable is the world's biggest online restaurant reservation service. It was started by Chuck Templeton in 1998 in San Francisco. It has expanded to 30 000 restaurants in most US states and several major international cities. Booking.com bought them in 2014 for $2.6 billion, in an all-cash deal.

OpenTable has an interesting business model. The service is free to diners, and the restaurants pay them $249 per month plus $1 per seated customer who booked through their app. According to the company, they seat 123 million customers each month. Not bad!

According to this Associated Press story,

OpenTable is now partnering with three companies - Caviar, GrubHub and Uber Eats - to offer food delivery through 8 000 restaurants on its app. Food delivery is the fastest growing part of the restaurant business. People want good food, but can't tear themselves away from Netflix at home?

More here, from AP

Dining reservation app OpenTable moves into delivery.

Byron's Beats

2019 has been an exciting IPO year so far. Uber in particular for us here at Vestact, as it made the very lucrative Vestact recommended list.

2020 may be just as exciting, lead by a potential Airbnb listing.

The articles have already

started covering the business like this one from Forbes. Good article, awful headline. Calling the Lyft and Uber IPO's a collapse is very unprofessional, in my opinion. Moving on.

Airbnb ticks a lot of Vestact boxes. It has low capital costs, has already achieved scale and services a thriving sector of the global economy, that of experiences.

Like Uber, Airbnb has become an adjective.

Being a service that was non-existent 10 years ago, it is also facing regulatory pressure, but that comes with the package, the growth base is still huge.

It will be interesting to see the numbers behind this business. That is why IPO's are so fun, we get to see what is under the hood.

Stay tuned for more on this one.

Michael's Musings

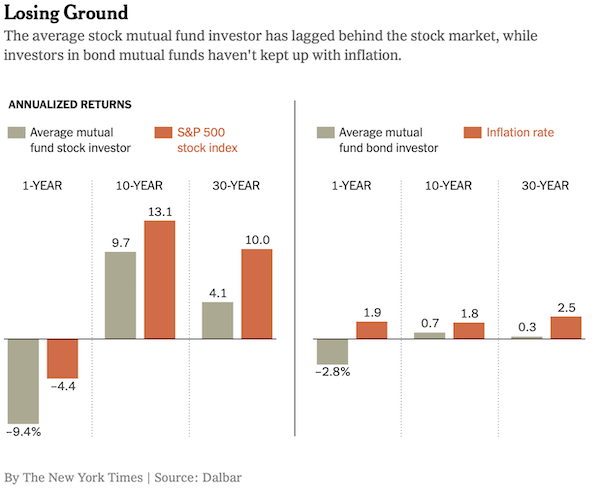

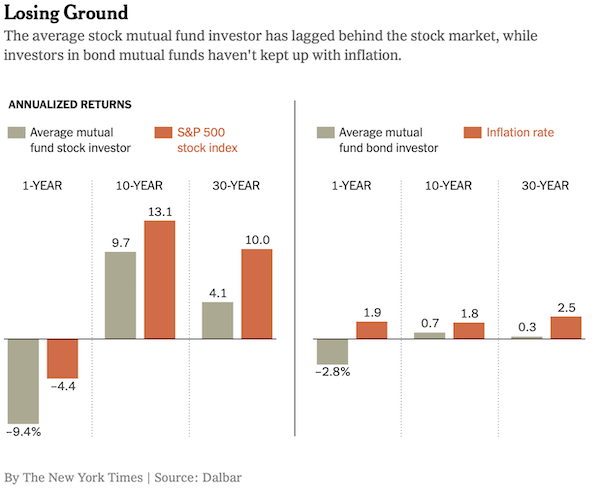

I'm a recent subscriber to The New York Times, at $1 a week I think it is a bargain. That subscription is already paying dividends where I stumbled across this article over the weekend -

Investors Are Usually Wrong. I'm One of Them.

The main theme of the article is that

investors try to be too smart by timing the market, with the end result being that people underperform. Normally people sell the 'underperformers' to buy the 'outperformers'. Basically, selling low to buy high.

In the case of Vestact, a number of clients wanted to sell Starbucks because

'it has done nothing' and

'buy something that goes up' like Amazon. Between October 2015 and October 2018, you would have lost money on Starbucks. Since then though the share price has almost doubled.

Two sentences stood out for me:

"the long-term money, stay invested in the market. Don't do anything fancy with it, and just keep it there." and

"You really need to put the money in a lockbox, of some sort," he said, "and not give in to the temptation to do something that you think is smart - that will probably turn out to be stupid."

Another point made, was that

products that penalised clients for taking their money out early tended to outperform, even though their annual costs were higher. The conclusion was that the penalty fees kept people invested during the tough times. Maybe Vestact should introduce something like this?

Don't overthink your investments.

Put long term money away regularly and then trust the process. Over time you will be rewarded.

Bright's Banter

US GDP grew by "only" 2.1% in the second quarter of 2019 (better than the expected 2%) as the orange man's tariffs and global slowdown start to take their toll on the US economy. Don't get me wrong, 2.1% is amazing growth if you can get it, but it is a bit disappointing after showing growth of 3.1% in the previous quarter.

The issue here is that we were told tax cuts were going to fuel investments into America, which should continue to give the economy an extra boost. I guess policy wonks couldn't forecast human nature. In order for any country to grow, economic policies need to be much friendlier.

Consumer spending was up 4.4%, both gross investment and government investment slumped. Net exports were weak, not what Trump had expected. The good news here is that the Fed is expected to come to the party and lower federal fund rates and be more accommodative to aid growth.

As my colleague Mike wrote yesterday,

the Fed is now expected to cut rates for the first time since the Great Recession. The graph below shows how the US has been growing its GDP over the years.

You will find more infographics at

Statista

Linkfest, Lap it Up

Here is the indirect route that is required if you want to sidestep sanctions and get a luxury car into North Korea I'm sure that Mercedes is unimpressed to see Kim in one of their cars -

From the Netherlands to North Korea, Kim Jong Un's Mercedes Takes a Long Trip.

Streaming is something that is changing society

Streaming is something that is changing society, where companies point out that their main competitor is sleep. As it stands there seems to be enough space for more than one main player -

The Great Race to Rule Streaming TV.

Vestact Out and About

Vestact Out and About

Signing off

Signing off

It will be another busy earnings day in the US, with Under Armour reporting before the market opens. Apple and Amgen are reporting after the market closes. On the data front, there is a South African Unemployment reading coming out mid-morning.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista