Market Scorecard

Unfortunately, the Rand took another knock on Friday as another rating agency warned about the level of South African national debt. If we don't see growth from the economy soon, it is almost certain that we get downgraded to junk status. There are two silver linings for us. The first is that the globe is moving back to a low interest rate environment. Meaning that even as our bonds (debt) become poorer quality, we probably won't pay higher interest than we are paying at the moment.

The second positive, and this is a big one, is that most of South African debt is Rand based. Many developing nations have debt dominated in Euro's and Dollars, so when their currency weakens their debt burden increases, which makes the currency weaken further. Then the cycle repeats itself.

Strong earnings from US companies coming through at the end of last week means that US indexes had a strong Friday and another record high close. The week ahead will probably be a volatile one due to all the data that is coming out. Bloomberg ran an article over the weekend saying '

Get Ready for the World Economy's Biggest Week of 2019.

The most significant event that basically everyone is watching, is the US Fed deciding interest rates on Wednesday. Most economists expect an interest rate cut, the first in a decade. A drop in rates will solidify the complete u-turn of global monetary policy this year. Other news this week is that the US and China are meeting again, there is US jobs data on Friday, and both Brazil and Japan's central banks meet to decide on their interest rates. In South Africa, there is unemployment data out on Tuesday, local manufacturing data and vehicle sales data out on Thursday.

On Friday the

JSE All-share closed down 0.16%, the

S&P 500 closed up 0.74%, and the

Nasdaq closed up 1.11%.

Company Corner

One thing, from Paul

Seattle-based

coffee giant Starbucks is another core recommended stock in Vestact New York portfolios. On Thursday night last week they published their second quarter numbers. They were very good, lifting the outlook for annual revenues and profits.

Starbucks stock rose 9% on Friday, coming to within a whisker of $100 a share. Wow!

Like-for-like sales (that excludes new stores) in the 13 weeks to the end of June rose 6% from a year ago, the highest quarterly figure since 2016. Growth was 5% in China. This

stock has literally doubled in the last 13 months. Before that, it was flat for three years. What's the moral of the story? Buy quality companies and wait.

If you want to see how holding a stock for a long time looks, visit our Vestact website and look at

the long string of reports that we wrote about Starbucks during those quiet years.

Every single report ends with words like, "buy this quality company and hold".

But how could that sudden share price shift higher have happened? It's the same product, sold from the same stores?

Growth expectations have changed, that's how. On Thursday the company said it now expected to deliver earnings per share for the full year of between $2.86 and $2.88, up from a previous range of between $2.40 and $2.44.

CEO Kevin Johnson has cut costs and accelerated the expansion into China, trying to capitalise on the country's growing taste for coffee and expanding middle class. He has also reinvigorated its US business with better menu offerings, more fancy cold drinks, better digital loyalty and payment systems and a coffee delivery partnership with Uber Eats. The partnership with Nestle to sell beans and other coffee consumables outside of stores is also going very well.

Our advice remains the same. New investors can continue to accumulate this stock, at current prices. I'm off to have another cup of coffee.

Byron's Beats

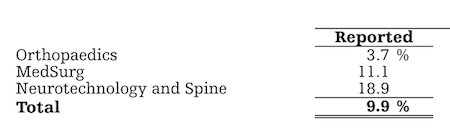

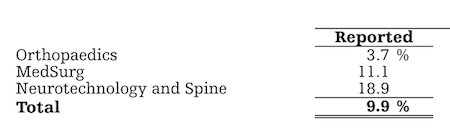

On Thursday night Stryker released second quarter results which impressed the market. Sales increased by 9.9%. Take a look below at their three divisions and where that growth came from.

Of the $3.7bn in sales, Orthopaedics contributed $1.3bn, MedSurg (Medical Surgery) $1.6bn and Neurotechnology and Spine $0.8bn. As you can see, this is an exceptionally well rounded medical devices business. The picture below is of a Robotic Arm Assisted Surgery Device known as Mako.

Acquisitions contributed to 3% of their sales growth

Acquisitions contributed to 3% of their sales growth. This is important to note because part of their strategy is to implement strategic bolt on acquisitions. There is a lot of innovation in this sector, Stryker has the size and scale to scoop up exciting new products and add them to their distribution networks.

The good sales growth resulted in adjusted earnings per share increasing by 12.5% to $1.98, well ahead of consensus. The overall earnings outlook was also increased nicely to $8.15-$8.25 from $8.05-$8.20.

This is a well run company operating in a growing sector. Medical devices is a lot less scrutinised by regulators than the drug companies.

Stryker is a solid entry to the healthcare sector and should be held in all accounts.

Our 10c Worth

Michael's Musings

A key component of a safe self-driving car system is lidar, which uses lasers to measure distance. Unlike cameras, lidar works just as well at night as during the day. At the moment lidar is rather pricey, and the system is known to be unreliable. Some of you might remember the self-driving Uber that collided with a pedestrian a few years ago. In that case, the lidar sensor had been turned off, meaning that the car only picked up the walker when the camera could 'see' her.

For self-driving to go mainstream, making a system as bulletproof as possible will be needed, which means lidar will be an integral part. That means the technology needs to advance to a point where lidar is cheap to produce and have improved reliability. This company is well on the way to make that happen -

This Lidar is so Cheap it Could Make Self-Driving a Reality

Bright's Banter

Synergy Research released some new data on the Cloud industries market share. The overall Cloud market size jumped by 39% from the second quarter of 2018, in line with expectations as it reflects the massive scale of the market.

The top five Cloud service providers control over three quarters of the market.

Amazon growth kept pace with the market and it maintained its 33% worldwide market share. A group of four cloud players namely, Microsoft, Google, Alibaba and Tencent continued to outpace the market and to grow their market share. However, in aggregate AWS is still bigger than those four combined.

My favourite line from the report

"In early 2016 Microsoft was less than a quarter the size of Amazon in this market, while today it is getting close to being half the size." What a remarkable story! The infographic below shows Amazon's and Microsoft's dominance in the worldwide cloud infrastructure market.

You will find more infographics at

Statista

Linkfest, Lap it Up

The apps on the Apple App Store are a big part of the reason why people buy iPhones. Having a greater selection of apps in the Chinese app store will be important for future growth, not only of the iPhone but also of services revenue -

Apple starts China app development program in services business push.

It is good to see South Africa on the list.

It is good to see South Africa on the list. Hopefully in years to come we will see significantly more South African's employed in this sector.

You will find more infographics at

Statista

Vestact Out and About

Get your weekly dose of market happenings where Bright joins the BD TV team -

The Week That Was.

Signing off

Signing off

It will be a busy week ahead with global economic data, coupled with that is US earning season that continues at full steam. On Tuesday there are figures from Apple and Illumina, and on Wednesday we have Amgen. Surprisingly there is no significant data out today. The Rand has found a new level at $/R 14.30.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista