Market Scorecard

Popping into Vestact email boxes this morning was a research note from a US investment bank on Naspers.

They expect the Naspers share price to be around R4 450 in the next 12-months. Viva! It is worth noting that this is just a forecast and that these analyst notes are wrong all the time. What is worth considering are their reasons for thinking a price surge is coming. One of the key drivers of the Naspers share price is forecast to come from an expected 27% increase in Tencent's share price over the next year. Added to that,

Naspers currently trades on a 36% discount to NAV. The discount is expected to narrow with the listing of NewCo next month. Good news for shareholders.

If you are a Vestact client, expect an email about what to do with Naspers and NewCo by the end of the week.

It was a good day for markets yesterday.

Looking North to the EU, Super Mario (Mario Draghi) openly spoke about potential interest rate cuts coming for the EU area. Shortly after Draghi's press conference, Trump was waking up in the US and started tweeting about how the EU are currency manipulators. Dropping rates in the EU, means that fewer people want to hold EU debt, which makes their currency weaker. A weaker euro makes their exports more competitive. Who knew economics could be this exciting? Then during the afternoon,

Trump and Xi both confirmed that they are meeting next week at the G20.

Yesterday the

JSE All-share closed up 0.75%, the

S&P 500 closed up 0.97%, and the

Nasdaq closed up 1.39%.

Company Corner

Michael's Musings

Yesterday

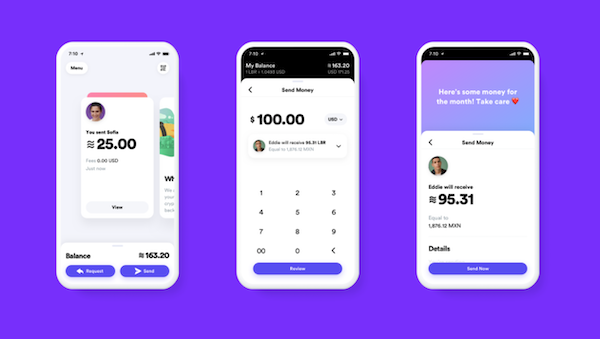

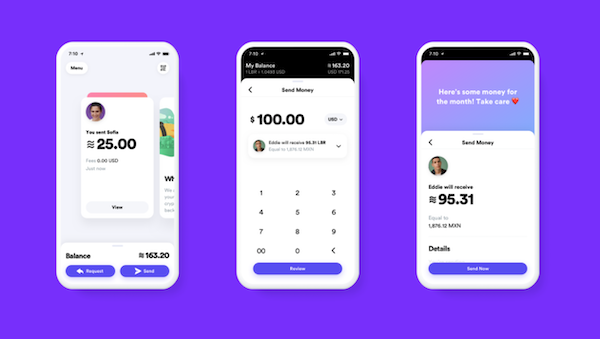

Facebook released details of their new cryptocurrency, Libra. The currency is only partly Facebook's because there are other founding partners, who also have a say in how things will be run. The founder group includes Visa, Mastercard, Uber, PayPal, Vodafone, PayU (Naspers) and eBay. It's expected to launch early next year.

The new platform has huge potential. If you are a US client of ours, you will know how painful and expensive it was to send money overseas.

With Libra you will be able to send money over Whatsapp, Facebook Messenger or Instagram. Practically, you will buy Libra in South Africa using Rands, probably using your credit card. Then once you have Libra coins, you can send it to anyone in the world. Once that person receives the Libra coins, they will be able to cash it into their home country or they can go onto Facebook market place and spend it.

The new currency won't need to be only used for international payments, it can also be used for domestic payments. Imagine tipping your Uber driver with Libra. I suspect it will get a big online adoption. Unlike current cryptocurrencies, the goal is to try to keep its value stable, which will enhance its value as a currency. Think of Mpesa in East Africa or WeChat Wallet in China, both systems have almost replaced cash in some places.

The new cryptocurrency will be run by the Libra Association who is based in Geneva, Switzerland.

The new cryptocurrency will be run by the Libra Association who is based in Geneva, Switzerland. The country was chosen for its neutral status and strong support for financial innovation, including blockchain technology. Having an independent organisation control Libra is essential for its legitimacy. Facebook has assured users that their Libra transactions are not linked to their Facebook user data.

This has the potential to become a truly global online currency. The current founding companies will make money from running the network and from interest earned on money that you deposit to buy Libra coins.

Here is a more in-depth read if you want -

Facebook announces Libra cryptocurrency: All you need to know

One thing, from Paul

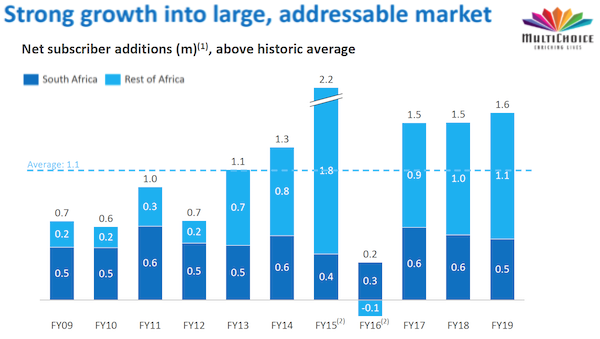

MultiChoice released results yesterday for the year ended 31 March 2019. Holders of Naspers received Multichoice shares earlier this year by way of a share unbundling. We wrote to Vestact customers in February, advising you to

keep these shares, as they were likely to do well.

As we noted then, "

Multichoice is the leading video entertainment operator in Africa, with over 13.5 million household subscribers (at the end of March 2018) in 50 countries across multiple platforms, including digital satellite, digital terrestrial and online. Of those users, 6.9 million were DStv subscribers in South Africa and 6.6 million subscribers were elsewhere in Africa."

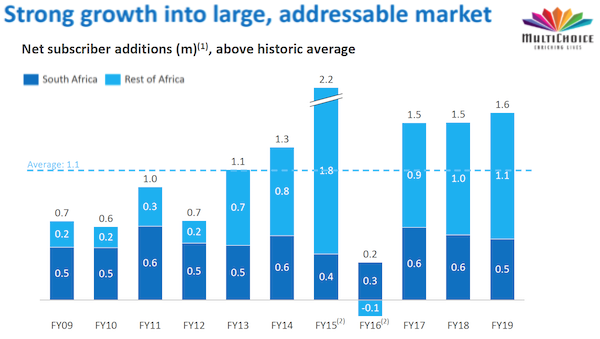

We pointed out that "Multichoice also has lots of growth potential in Africa outside of South Africa. There are at least 40 million addressable households across its 50 markets. Some of these operations are new and currently loss-making, but scale is everything."

In yesterday's results, this growth was in evidence. They

increased the subscriber base by 12% to 15.1 million active households. Of that, 1.1 million net additions were in Africa outside of South Africa, which was up 17% compared to last year.

Sign-ups for digital delivery services, like

Showmax and DStvNow are growing fast. Local content production is up, and the sports offering is still amazing.

The group has a

very strong financial position. Revenue was up 6% to over R50 billion and core headline earnings rose 10%. In line with the plan communicated at the time of the listing, there was no dividend declared this time, but they plan to pay out

R2.5 billion in the financial year 2020 (that should be about R6 per share).

The stock has done well since making its market debut, rising from a low of around R93 per share shortly after coming onto the market to R130 per share now.

Hold on to this one, or even buy some more.

Our 10c Worth

Bright's Banter

Yoga-inspired, technical apparel company for men and women, Lululemon, reported its first-quarter numbers. The

company beat management and analysts aggressive earnings target for the fifth consecutive quarter. This was thanks to growth from online sales of leggings and joggers.

Revenues were up 20% to $782.3 million, beating $755 million market expectation and they raised the full-year revenue guidance to $3.73 billion and $3.77 billion for the 2019 financial year-end. Net income came in at $96.6 million from $75.2 million thanks to same store growth of 14% driven by a 33% increase in online sales.

Lululemon's share price is up 51% year-to-date valuing the business at $23.88 billion. I'm guessing Chip Wilson's (The company's controversial founder) departure, and lack of snarky comments was the catalyst to these good numbers or maybe I am fooled by randomness? The company has done very well to fend off competition from Nike and Under Armour.

The infographic below shows the ten year share price growth of Lululemon shares. So far the company has gone up more than 40-times from around $4/share in January 2009 (fresh out the financial crisis) to $183 at market close on Tuesday.

"If the company was a yoga-post, it would certainly be the upward-facing stock."

You will find more infographics at

Statista

Linkfest, Lap it Up

What could go wrong? Mixing alcohol, emotions and money? Well the London Metal Exchange is no longer taking the chance -

No More Daytime Drinking for Metals Traders as LME Bans Alcohol

If Bitcoin mining is causing

If Bitcoin mining is causing damage to the environment, lets hope it is not for nothing -

Bitcoin mining may be pumping out as much CO2per year as Kansas City

Vestact Out and About

Vestact Out and About

Signing off

Signing off

It is Fed decision day and CPI day locally, both will have a ripple impact on the South African economy. There is also CPI data coming out in the UK, and US crude inventories. The Rand has responded well to the talk of developed markets dropping interest rates, currently we are around $/R14.50, can we be below $/R 14.00 by the end of the month? The JSE All-share is poised to open higher this morning.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista