Market Scorecard

If you are a short term trader, the next two weeks are going to be tricky. There is the Fed interest rate decision tomorrow and then the G20 meeting next week. You can be sure that the Fed's statement tomorrow will move markets; will it be dovish or will it be too hawkish? Then depending on how Trump's meeting with Xi goes, that will also have further ramifications for the market. The outcomes of both events seems too hard to call. That is why we are not short term traders.

We would rather have your money ride out the turbulent waves and take advantage of the rising tide from a growing global middle class.

On Friday the

JSE All-share closed down 0.86%. Yesterday the

S&P 500 closed up 0.09%, and the

Nasdaq closed up 0.62%.

Our 10c Worth

One thing, from Paul

I've just returned from a trip to the USA which included a side jaunt to the island of

Bermuda. It's a British Overseas Territory and the capital is Hamilton (pictured below). The island has a population of about 70 000 people, many of whom are expats and tax-exiles. It has a

large offshore insurance and asset management industry. There are no personal or corporate income taxes, but high taxes on all imported goods.

Bermuda's

tourism industry is based on its lovely sandy beaches, light blue ocean waters, watersports and sub-tropical golf courses. It has a big dockyard at the western end of the island, built by the British Navy in the 1800s, that now serves as a cruise boat terminal. At the eastern end of the island is a massive airport, built by the Americans during the second world war for use by the US Air Force and the Royal Air Force.

Bermuda is wonderful. A great place to visit for an island holiday.

Byron's Beats

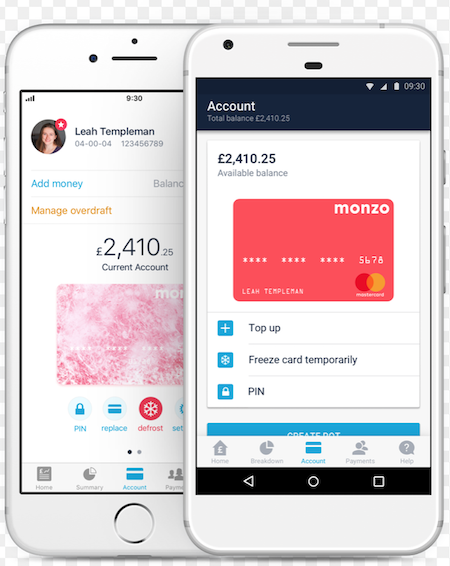

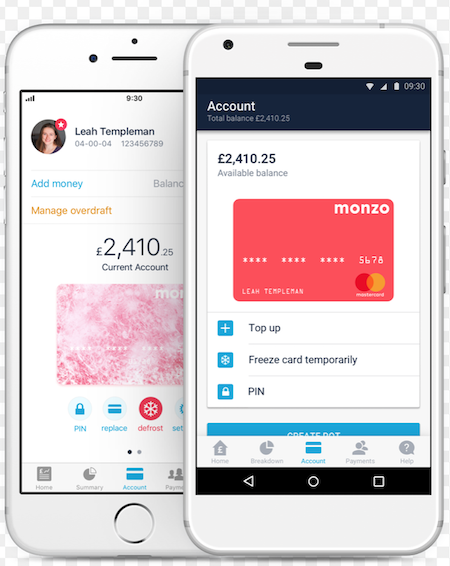

The Battle of the Banks in SA has been well publicised with the likes of Bank Zero, Tyme Bank and Discovery Bank joining the ranks. What you may not know is that the very old school world of banking in the UK, has already been disrupted by some very nifty online alternatives. This Verge article titled

Meet the British Mobile Banks Showing the US How it's Done talks about how Monzo and Starling took on the status quo.

Monzo already has 2 million customers and is adding 200 000 a month. Wow! Most of this was just through word of mouth. It is enjoyable watching retail banking evolve so fast. It is an industry that has been too expensive for too long. At the end of the day, the consumer will be the winner.

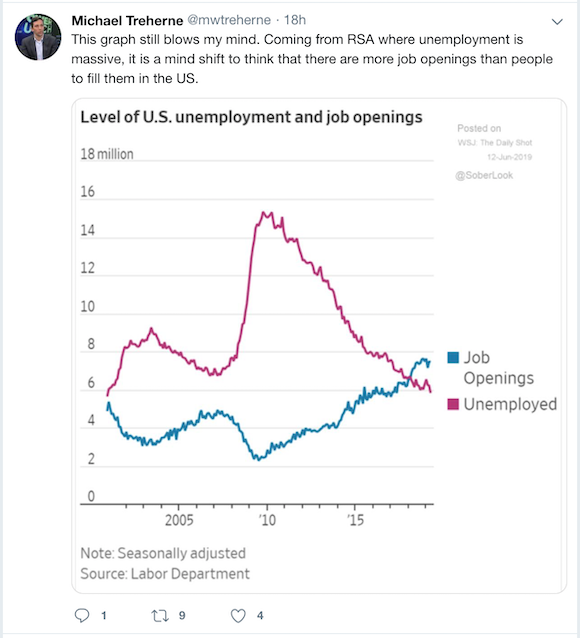

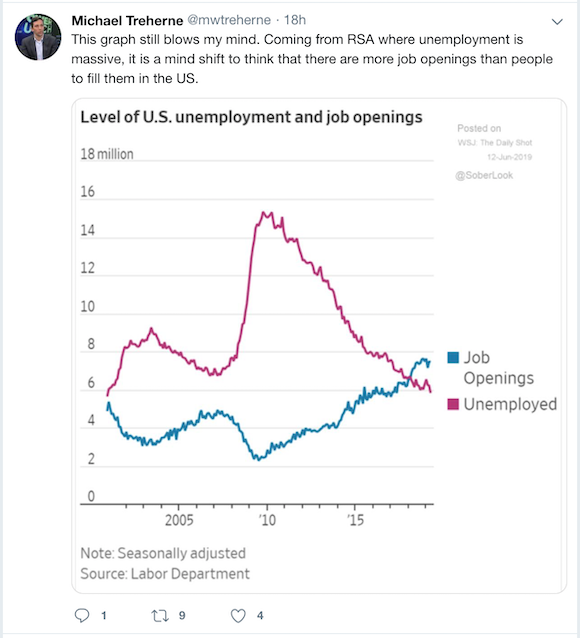

Michael's Musings

One of the balances that a city needs to manage, is how to reinvigorate old parts of the city but still have housing that is affordable for a wide spectrum of the population.

Joburg is currently going through the process of gentrification, which is good for a city, but with a downside because many people are no longer able to afford to live in these newly renovated areas.

One way that governments try to curb the problem of rent being too expensive is to implement rent controls, where rent limits are placed on specific areas. Like in most cases of the economy, I am always weary when governments get too involved.

The government is a slow bureaucratic machine. There is always a struggle to stay up to date with what the is happening in the economy.

Here is a look at how rent control hit parts of Mumbai -

Rent Control in Mumbai. If you have 8 minutes, give it a watch, it is very interesting.

Bright's Banter

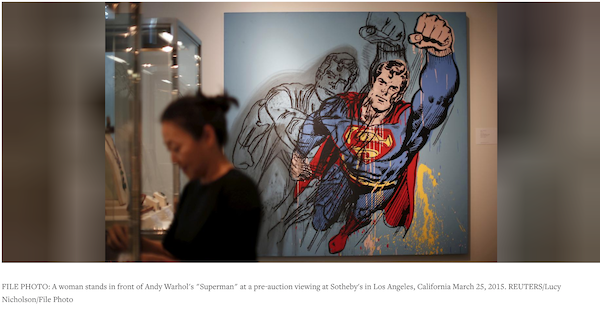

Auction house Sotheby's was sold to Franco-Israeli media and telecom magnate Patrick Drahi for a mouthwatering $3.7 billion, taking the auction house private after 31 years of being a listed entity. Drahi paid a 61% premium from the last traded price which gave the company a market capitalisation of $2.6 billion.

According to Reuters, the big premium and the appetite for auction houses is due to low interest rates which have made the high end art market an appealing alternative for big investors. Taking Sotheby's private will help the company compete with rival Christie's, which is majority owned by a French billionaire and art collector Francois Pinault.

Famous items sold by Sotheby's include the collections of the late Duchess of Windsor, the personal collection of artist Andy Warhol and Edvard Munch's famous painting "The Scream".

The biggest winner in all of this is hedge fund manager Dan Loeb and his investors. He's been in the stock for longer than five years, has been involved in the management shake up, and was instrumental in the hiring of the current CEO.

Linkfest, Lap it Up

Linkfest, Lap it Up

Videos of people eating, are driving views on Youtube and are making their authors online stars! Not to mention rich too. Apparently it is soothing to watch someone slurp shellfish? -

Let's keep this going

The trend toward more people wanting a socialist

The trend toward more people wanting a socialist government is worrying. Having said that, if you had to ask most people what socialism is, they would all have different answers.

You will find more infographics at

Statista

Vestact Out and About

Byron gets a mention in this Business Day editorial. His 'Beats' last week seems to have inspired this article -

Tough times expose the corporate rot

Signing off

Signing off

The Fed kicks off their two day interest rate meeting today, more than likely they will leave rates as is. On Wednesday there is South African CPI, if it is below 4.5% there is a good chance that on the 18 July we will get a rate cut. Then Friday, Naspers releases their full-year results at 15:00 and it is the June Solstice that night. For today though, there is EU CPI and then the next round of voting for who will lead the Tories. The JSE All-share is higher this morning.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista