Market Scorecard

The day we have been eagerly waiting for has finally arrived. It is the 29 March, which means that it is

Moody's Rate decision the listing of Lyft. Originally the company planned to list at a price of between $62 and $68 a share, but

due to very high demand they will be listing at $72 a share. At that price, Lyft is worth just over $24 billion. Not bad for a company with

only $2 billion in revenue and making a loss of $1 billion. The market clearly has high growth expectations for the company.

One company watching closely is Uber, who after seeing all the demand for Lyft shares will be licking their lips to get to market. Another company who is

making money on both IPO's is Alphabet. The search giant owns about $1 billion worth of Lyft shares and possibly $10 billion worth of Uber. In 2013 Google Ventures first took a stake in Uber when it was only worth $4 billion, Uber could be worth $120 billion when it lists this year. Not bad, a 30 bagger in six years.

Yesterday the

JSE All-share closed down 0.16%, the

S&P 500 closed up 0.36%, and the

Nasdaq closed up 0.34%.

Our 10c Worth

Byron's Beats

We are very good at moaning about what government has been doing wrong or not doing at all. But every now and then they do something that actually makes sense. This week Cyril Ramaphosa launched a R1.4bn venture capital fund that will help small businesses take the next step in their growth phase.

The initiative is headed by Ketso Gordhan who has a very good CV for such an endeavour, and the funds will come from the PIC as well as 50 other companies.

The fund has a clear transformation target with 50% earmarked for black entrepreneurs. We need everyone to participate in this economy, so this makes sense to me. So many private venture deals are done through networks established over many years. The point of this fund is to give access to finance to those that would struggle to get it.

Small and medium businesses are the backbone of all the globes successful economies. This is the kind of thing we need to see more of.

The below fin24 article goes through it in more detail.

Ramaphosa launches R1.4bn venture capital fund.

Michael's Musings

Economic growth and wealth are created when humanity finds more efficient ways to do things. This Business Insider article is a perfect example of this in action -

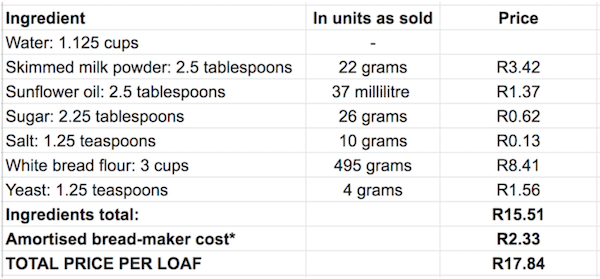

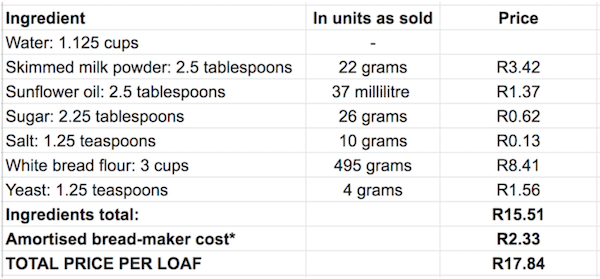

This is how much more it costs to bake your own bread at home

A key figure missing from the above calculation is the cost of labour. How much is an hour of your time worth?

A key figure missing from the above calculation is the cost of labour. How much is an hour of your time worth? Also, running the bread machine uses electricity, which is not factored into the calculation. Effectively, you can buy bread for cheaper than you can make it, plus it frees you up to do other economic activities where you contribute to economic growth.

Bright's Banter

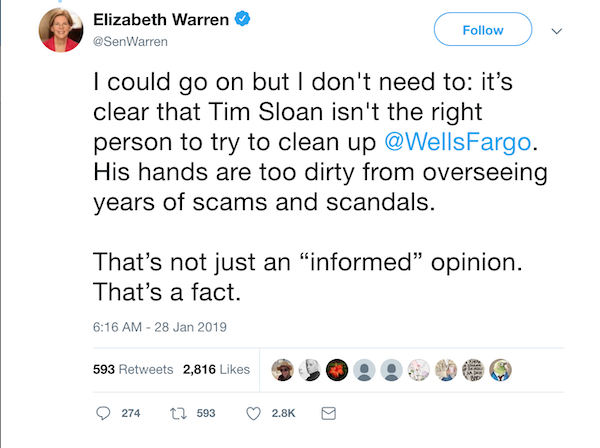

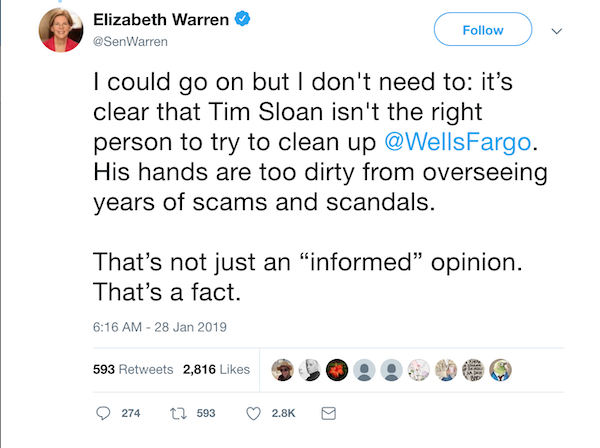

Wells Fargo's ailing CEO Tim Sloan is stepping down effective immediately. This is after he struggled to lead the bank in light of a series of scandals that the bank encountered.

In a previous Banter I wrote:

If you remember, Wells Fargo is still in the dog box with the US financial regulators for multiple scandals. The staff opened 3.5 million fake accounts in order to meet sales targets, signing customers up for credit and debit cards, without their consent, charging them for insurance they didn't need, and overcharging for mortgage refinancing.

The bigger problem I think is that maybe Sloan wasn't fit for the job. After all he was the CFO when the fake customer scandal was in progress, but somehow only his CEO then was the one shown the door with a boot stuck in his backside. But Sloan survived the chopping block? That whole board needs serious medical attention from the neck up!

The most probable reason why Sloan is stepping down is because of presidential candidate Elizabeth Warren's pressure exerted against Wells Fargo and Tim Sloan, as she was demanding answers and legal action against the perpetrators.

The stock is up 3% on the news! Hopefully, the board hires someone who isn't tainted this time around!

Linkfest, Lap it Up

Linkfest, Lap it Up

This is great to see! -

A Kenyan teacher just won the $1 million Global Teacher Prize

One of the advantages of making pot legal

One of the advantages of making pot legal is that governments can tax it. Maybe a solution to help ease our local debt burden?

You will find more infographics at

Statista

Vestact Out and About

Signing off

Signing off

Today is the last trading day of Q1 2019, three more quarters and 2019 will be over. The JSE All-share is higher this morning, and the Rand strengthened slightly over night. Today there is German unemployment data, UK GDP data and EU CPI. Then of course the Moody's rate decision tonight. The expectation is for a change from stable to a negative outlook, but not for the actual debt rating to change.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista