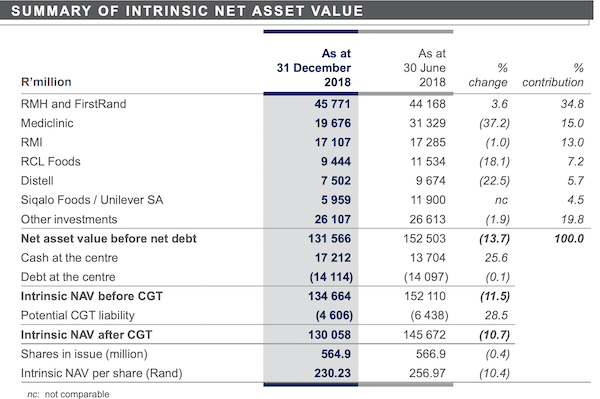

Last week Remgro released their 6-month numbers, for the period ending 31 December 2018. Like most other South Africa focused companies, the lack of economic growth has hurt them. Given that they are an investment holding company, the figure that counts is NAV.

Mediclinic was the biggest drawdown on their NAV; we have spoken about Mediclinic's woes in previous posts. The only division that did well was banking, which is very impressive given the current environment locally. If you are positive on the future of South Africa, all these asset prices will recover in time.

The number that we really like is the 25% increase in their cash holdings. Having cash in the current environment means that management are now able to go on a shopping spree. Having more cash than debt means that their balance sheet is much stronger than many other firms, allowing them to ride out any political or economic speed bumps.

Currently Remgro trades at an 18% discount to their NAV, which is calculated after taking into consideration potential CGT impacts. Most investment holding companies don't break out the potential CGT impact, having the figure is very useful. The stock looks cheap at these levels, especially if you are positive on the future of South Africa.