Market Scorecard

Over the weekend, there was tragic news of the Ethiopian Airlines plane crash. Similar to the Lion Air crash late last year, it was a Boeing 737-8 Max, which was only a couple of months old and the plane crashed shortly after takeoff. In the Lion Air crash, there was a faulty sensor which triggered anti-stall software, pushing the nose of the plane down. Given that the Ethiopian crash looks very similar to the Lion Air crash, there are concerns that there is a fundamental problem with this new model of Boeing.

As a precautionary move,

China has grounded all 737-8 Max planes. Bloomberg reported this morning that this aircraft was forecast to contribute towards 1/3 of Boeings profits this year. If airlines are not allowed to fly this model, or if passengers won't fly on it, Boeing has a massive problem on their hands. The Boeing shares have not started to trade in pre-market, but

Dow futures are trading down 0.8% at the moment. Boeing has the biggest weighting in the Dow.

On Friday the

JSE All-share closed down 0.66%, the

S&P 500 closed down 0.21%, and the

Nasdaq closed down 0.18%.

Company Corner

Michael's Musings

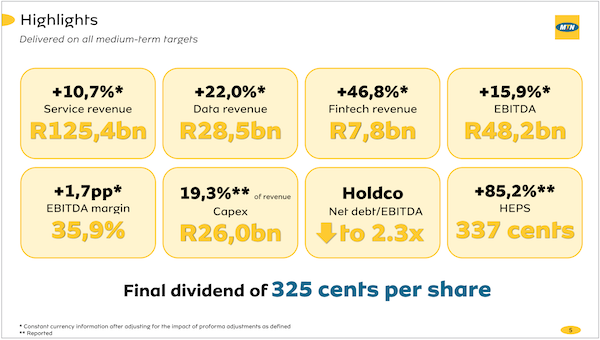

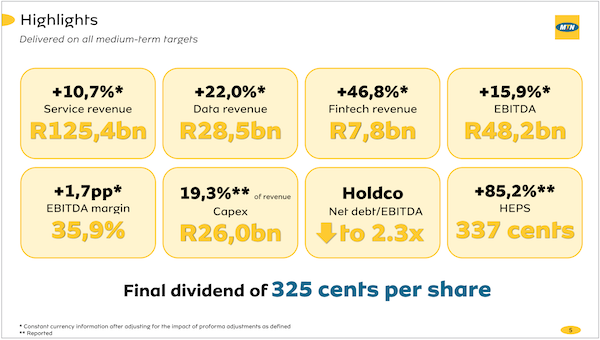

Last week MTN released their full-year numbers, shooting the stock up 15%. Going into these results, the market wasn't expecting much from the group, especially given that the stock fell significantly a few days earlier when they released their trading update. Here is the first slide from the results presentation, showing the numbers that the group is most proud of.

Two key positive areas that I think the market focused on from the presentation were,

the progressive dividend policy from the company and their drive to pay down debt. For 2018, the full year dividend was R5 a share, down from 2017's R7 a share, but the company has committed to increasing the dividend payment by between 10%-20% each year. That is a very positive sign from management. Then over the next three years, the company plans to sell off non-core assets, which includes their towers and fin-tech companies that they are invested in, like

listing Jumia. With the cash raised from these sales, MTN plans to pay down debt.

Between Nigeria and South Africa, they account for roughly 70% of MTN Groups profits. Swapping from last year, Nigeria is now more profitable for MTN than South Africa is. Which means the current rally in oil prices is good news for the group. Both regions saw an increase in their total subscriber numbers, 1.7 million to 31.2 million for South Africa and 5.9 million to 58.2 million for Nigeria.

The group has a

few key growth areas that they are focusing on to increase the profit figure. The

first is the increased usage of data as more people get access to smartphones. In the case of Nigeria, only 70% of the country has access to 3G, so simply improving access to mobile internet will see data usage rise.

Next is the potential of Mobile Money, particularly in Nigeria where they have applied for a license. For the

long term there is the potential from the internet of things. Imagine your car having a sim card in it, and then communicating with other cars on the road.

In South Africa, there is the potential to see a jump in margins as more spectrum is released. To be cautious and prudent, MTN management says that they have not included this scenario in their forecast for the business going forward. If it happens, it will be a nice boost for the group, but if it doesn't, they will still be fine.

It looks like MTN has now turned a corner and hopefully it is only higher from here. Given the markets that they operate in though, even the best laid plans can go awry.

Byron's Beats

Nvidia and Intel have been bidding for an Israeli chipmaker named Mellanox. Insiders suggest that Nvidia have won the bid and a deal could be announced today. Mellanox's technology specialises in transferring information from one component to another, within and between computers. This will help Nvidia maintain its lead in data centre technology, an area that I feel has the most potential for the company.

The deal is said to be worth $7bn

The deal is said to be worth $7bn which is, of course, is a lot of money but very manageable for the $91bn market cap company. In fact, I double checked their balance sheet, and they have cash of $7.4bn and long term debt of $2bn. They certainly have the firepower.

Let's wait and see if the deal is concluded. If it is, could we see more consolidation in the sector? In a fast moving sector like this, I like to see the companies we own make bolt on acquisitions in order to keep up with the technological changes.

Our 10c Worth

One thing, from Paul

What should investors do when stocks just won't go up? Or worse still, they go down? Remember, stock prices are supposed to rise in the long run, because as prices for goods and services rise, and healthy companies grow their earnings, the price that new investors are prepared to pay per share rises. Of course, it's not a smooth process, because sentiment shifts and company earnings may stumble, even if they pick up over time. But

if you look at long term charts of stock indices, they go up and outperform all other asset classes.

In cases like

JP Morgan or

Richemont at the moment, company earnings have risen quite nicely, but share prices have stayed stagnant because investors have cooled on the whole sector, and only feel like paying a multiple of 12 times earnings, whereas 18 times was fine in the past.

In other cases, like

MTN,

Mediclinic or

Aspen at the moment, company earnings have either declined or slowed badly; plus the sector in which the company operates has fallen out of favour; and the macroeconomic environment in their key markets has deteriorated. That's a triple whammy and share prices are down by more than half. Very painful!

In general

the best thing to do when a portfolio holding is performing badly is to wait. Ride it out. The

secret to long term wealth formation is to accumulate quality assets and hold them for many years. There are exceptions, and sometimes our investment thesis is just wrong, but in general, patience is rewarded in the end.

Bright's Banter

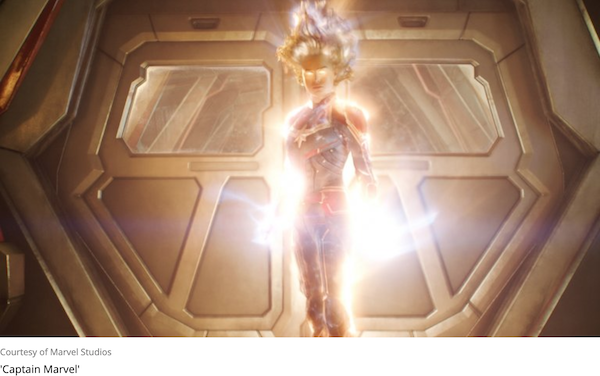

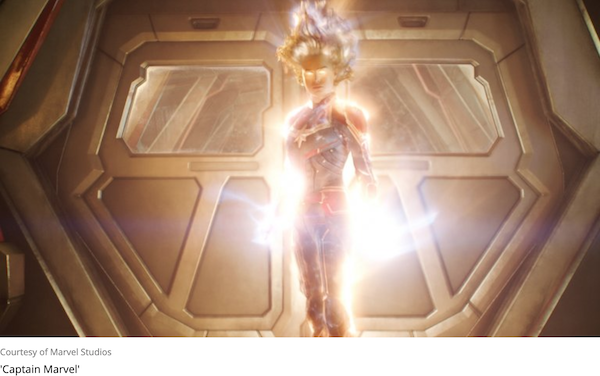

According to the Hollywood Reporter,

Disney's Captain Marvel movie raked in over $455 million in ticket sales globally and over $153 million in the US alone. This is the latest edition in the Marvel Cinematic Universe, and the largest-ever global box office debut for a female led film.

This tops the $357 million debut of "Beauty and the Beast" and easily leapfrogs the $103 million made by DC's "Wonder Woman", Sorry Gal Gadot; I still love you though.

Captain Marvel is the second-largest worldwide premiere for any superhero film behind only "Avengers: Infinity War", a movie that grossed a staggering $640.5 million.

Captain Marvel is also the seventh biggest debut for the Marvel franchise in the US, following the three Avengers movies: Black Panther, Captain America: Civil War, and Iron Man 3.

According to The Guardian, a recent study showed that out of the 350 highest grossing movies between 2014 and 2017, female-led movies outperformed ones with male leads at every budget level.

I'm starting to understand why my colleague Michael likes Disney as a long-term investment.

Linkfest, Lap it Up

It is good to see these companies spreading the wealth they are creating -

Uber and Lyft will grant top drivers stock in their highly anticipated IPOs.

Contrary to what many think

Contrary to what many think, the world's forests increased last year.

You will find more infographics at

Statista

Vestact Out and About

Signing off

Signing off

There is another Brexit vote in the UK parliament tomorrow, which is expected to fail dismally. With 18 days till the divorce date, the risk of a no deal Brexit is growing. After the implosion from Aspen on Friday, the stock is flat this morning. We will have more detail on the stock and its earnings tomorrow. The JSE All-share is higher this morning, being lead by Naspers. Later today there is US retail sales figures.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista